How can you withdraw your EPF funds online?

Employee Provident Fund (EPF) is one of the most popular and trusted scheme for securing a long-term retirement fund. It is managed by Employees’ Provident Fund Organization under the Employees’ Provident Fund and Misc. Provisions Act, 1952. Both the employer as well as the employee contribute to the EPF account and one can withdraw the…

Is PAN required for EPF withdrawal?

हिन्दी में पढें PAN is required during EPF withdrawal/settlement if you do not want some excess tax to be deducted from your EPF account. If you fail to submit PAN, the tax deducted at source (TDS) can be as high as 34.6%. Is EPF withdrawal taxable? EPF or Employee’s Provident Fund is taxable if withdrawn…

How Aadhaar Helps the Government and the Citizens

Union Cabinet Passes the Aadhaar Ordinance for Voluntary KYC Use

The Cabinet approved the Aadhaar ordinance that allows people to voluntarily furnish their 12-digit biometric identification number to open a bank account or buy a new mobile SIM. Currently, private entities are not allowed to use Aadhaar details for providing different services as per the Supreme Court’s judgement on Aadhaar on 26th September 2018. The…

All You Need to Know about EDLI if You are an EPF Member

Do you know that the Employee Provident Fund Organization (EPFO) has increased the minimum assurance (life insurance) benefits under its Employee Deposit Linked Insurance (EDLI)? Now, the assurance benefits for the eligible employee will stand at a minimum of Rs. 2.5 lakhs and maximum of Rs. 7 lakhs. So this could be a good time…

Everything you Need to Know about the Aadhaar Data Vault

The Unique Identification Authority of India, under the Aadhaar Act and Regulations, 2016 has made it compulsory for the centralized storage (collected by AUAs/KUAs/ Sub-AUAs/ or any other agency) of all the Aadhaar number in a different repository which is known an as ‘Aadhaar Data Vault’. The Aadhaar Act 2016 states an Aadhaar Number which…

Lost Your Aadhaar? Here’s How to Get Aadhaar PVC Card

How to Link PAN with Bank Account

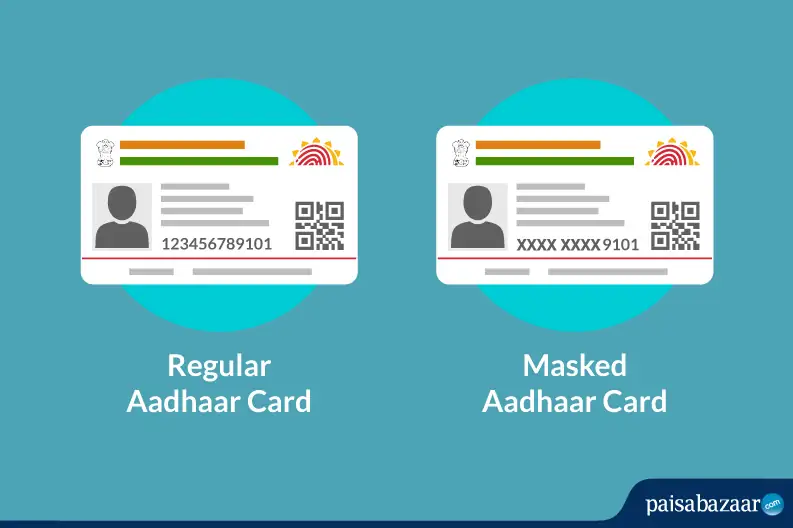

What makes an Aadhaar Card different from Masked Aadhaar

The Unique Identification Authority of India issues a 12-digit unique Aadhaar Number to all the individuals for availing various government schemes such as LPG subsidies, Pradhan Mantri Yojna and many more. The Aadhaar is also considered as one of the most important documents for the proof of identification and the proof of residence for all…