Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Compare and choose from trusted banks and NBFCs

Manage all FDs in one place

No Bank A/c Required

Investments of up to Rs. 5L insured by DICGC

Invest in FD and Get Lifetime FREE Step Up Credit Card

Apply NowOne of the many advantages of investing in a fixed deposit is loan against FD. Oriental Bank of Commerce offers this benefit over its fixed deposits. This facility is offered to fixed deposit holders to help them attend to their emergencies without having to break FD.

A loan against FD is simply taking a loan by keeping your FD as alien so as to meet financial requirements. The loan is offered at lower interest rates as compared to high rates charged by unsecured loans.

To meet the financial requirements, taking a loan against FD is comparatively better than liquidating FD for two reasons:

Manage all FDs in one place

Manage all FDs in one place

No Bank A/C Required

No Bank A/C Required

Oriental Bank of Commerce has set eligibility criteria to offer loans against FD, which include:

OBC offers loans against FD as per the limits tabulated below:

| Time/Type of Loan | Limit (% of deposit amount) |

| Against self-deposit of tenure less than 6 months | 95 |

| Against self-deposit of tenure 6 months and above | 90 |

| Against third-party deposits | 85 |

Since the bank extends two types of loans against fixed deposit, interest rates vary accordingly, viz.:

Apart from the features stated above, the below-mentioned points are added benefits:

Follow the steps mentioned here to successfully apply for a loan against FD with OBC:

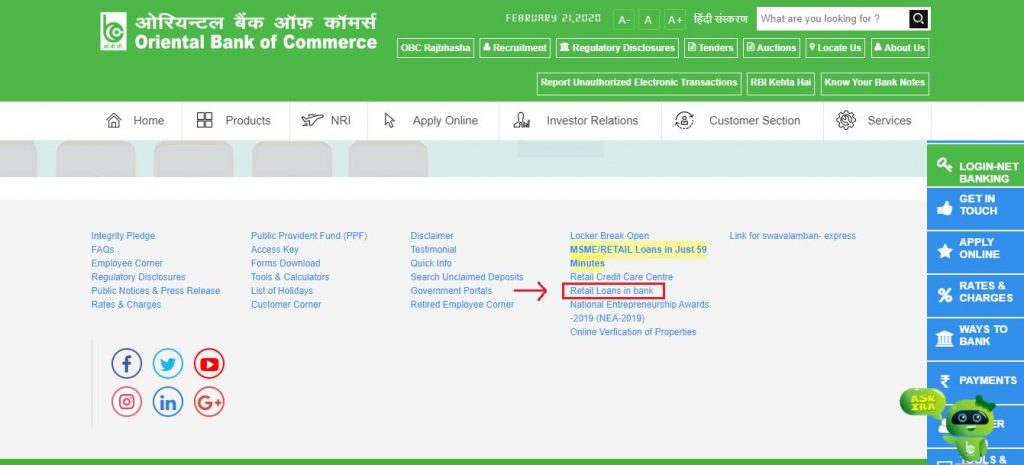

Step 1: Visit the official website of the Oriental Bank of Commerce and scroll to the bottom of the homepage

Step 2: Click on ‘Retail Loans in the bank’

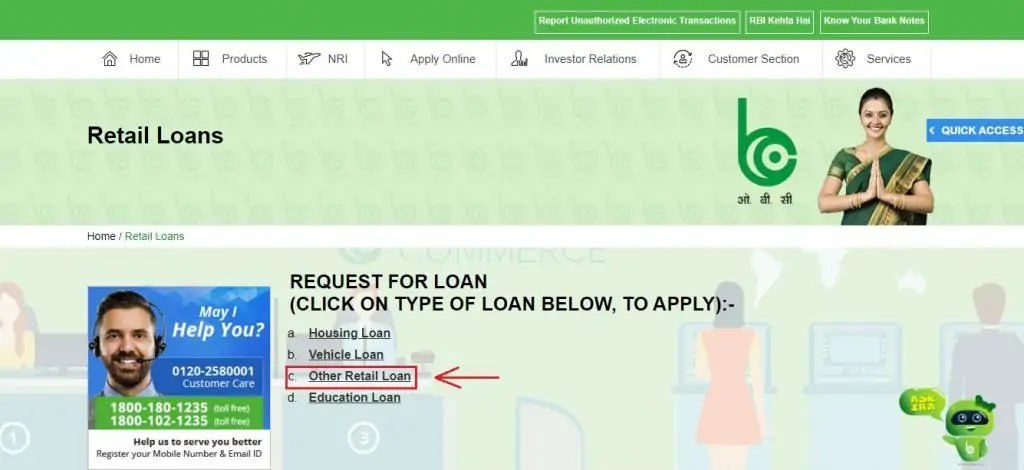

Step 3: Click on ‘Other Retail Loan’

Get Lifetime FREE Step UP Credit Card With No Annual Fees Know More

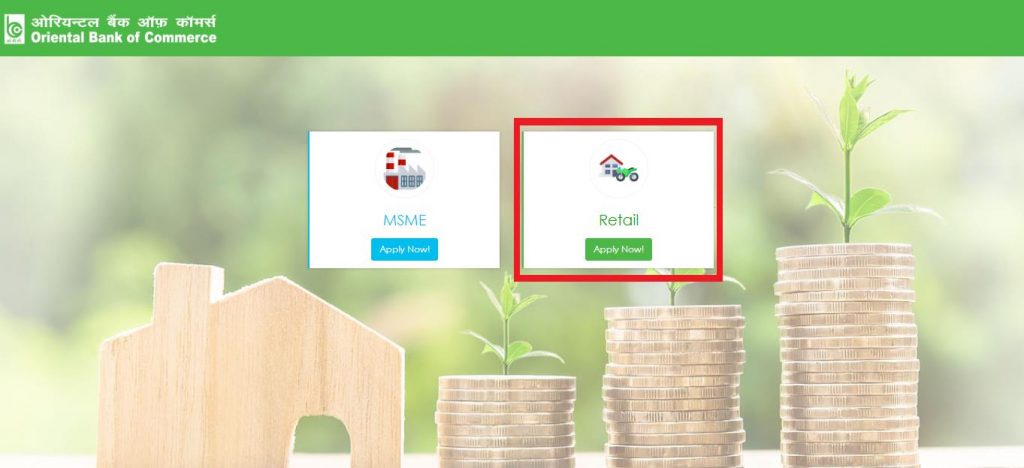

Step 4: Choose the ‘Retail’ option

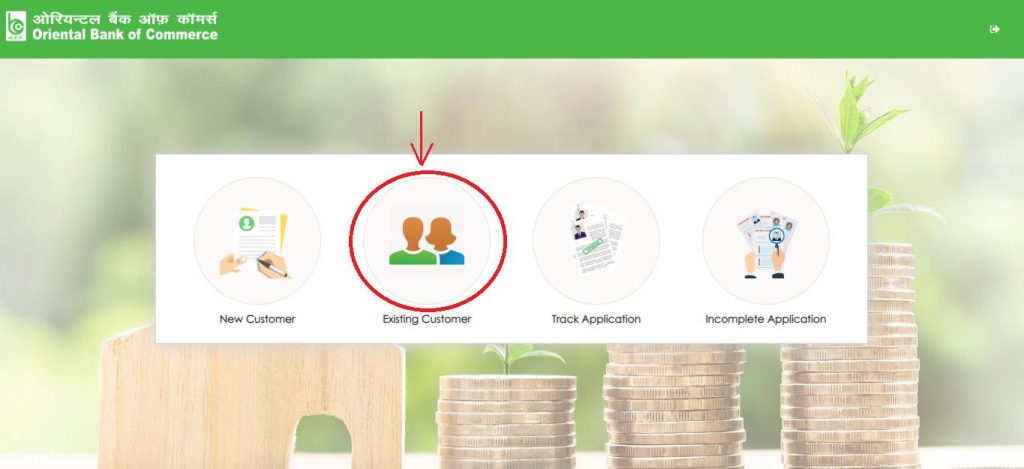

Step 5: Click on the ‘Existing Customer’ icon since loan against FD is available for existing customers only

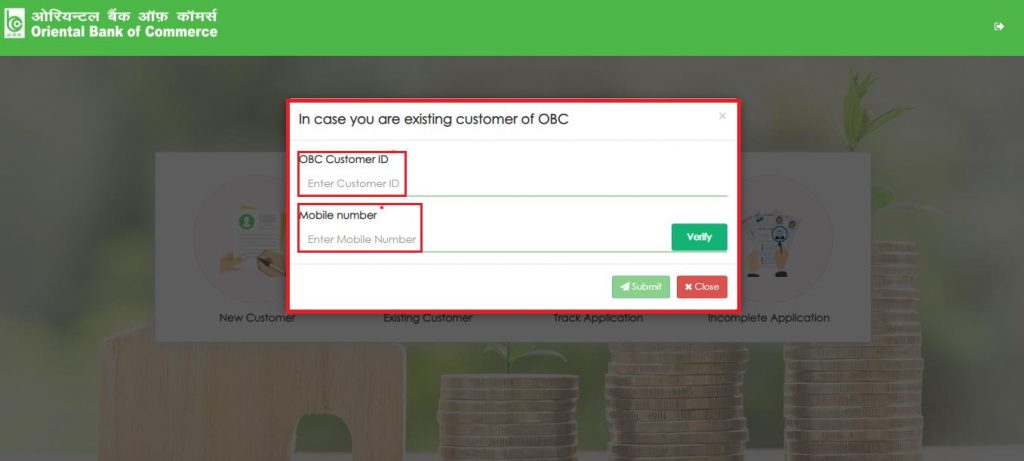

Step 6: Enter the OBC Customer ID and registered mobile number and click on ‘Verify’

Once the details entered are successfully verified, the applicant shall be redirected to the application portal.

The following documents must be checked with when applying for an OBC loan against deposits facility:

Q. Who can apply for an OBC loan against FD?

The loan against FD with the Oriental Bank of Commerce is extended to all adult Indian nationals, HUFs, firms & companies, trusts, societies, clubs, associations of persons, etc.

Q. What is the maximum amount of loan against FD that one can take from OBC?

A maximum of 95% of the deposit amount can be taken as a loan against FD.

Q. What is the OBC overdraft limit?

The bank has set a limit of Rs. 500 lakh beyond which it does not provide an overdraft facility.

Q. Can I take a loan against an FD booked with another bank?

No. The oriental Bank of Commerce does not provide such facility.