Over the years, it has been widely noticed that investors have often confused Systematic Investment Plan (SIP) and Mutual Fund as two mutually exclusive financial products, or assumed Mutual Funds to be a second name for lump sum investments. Many have googled the difference between SIP and Mutual Funds, only to find that, in essence, the former is a mode of investment into the latter.

In this article we will explain the different concepts to rid you of any further confusions.

Table of Contents :

What is a Mutual Fund?

A mutual fund is an investment instrument where investors pool in their assets which are later invested in equity, debt and other money market securities, by the professional fund manager. They are further classified into equity funds, debt funds and hybrid funds, based on the asset allocation.

The returns generated from the mutual fund investment are distributed proportionally among the investors. A professional and competent manager who has a sound knowledge of the financial market manages the fund, thus bridging the gap of layman’s knowledge of the financial world and that of an expert.

How do I Invest in Mutual Funds?

While investing in Mutual Funds, you can either go for a Lump Sum investment or opt for a Systematic Investment Plan (SIP). Yes! You read that right. SIP is a mode of investment in Mutual Funds, and not an altogether different product to be compared with Mutual Funds. Hence, the point of comparing SIP with Mutual Funds becomes redundant. What it needs to be compared with is the other mode of investment, i.e. the lump sum mode.

Lump Sum investment refers to a one-time investment than an individual makes in a mutual fund scheme. Investors with a large sum of disposable income in hand, coupled with a good risk appetite, go for lump sum investment. Whereas, through SIP, you make regular investment of small amounts of money in a mutual fund, at predefined intervals. One can invest as low as Rs. 100 (in some schemes) or Rs 500 in a mutual fund scheme via SIP. This option is not available in the lump sum mode, where the minimum investment is much higher, mostly around Rs 5,000.

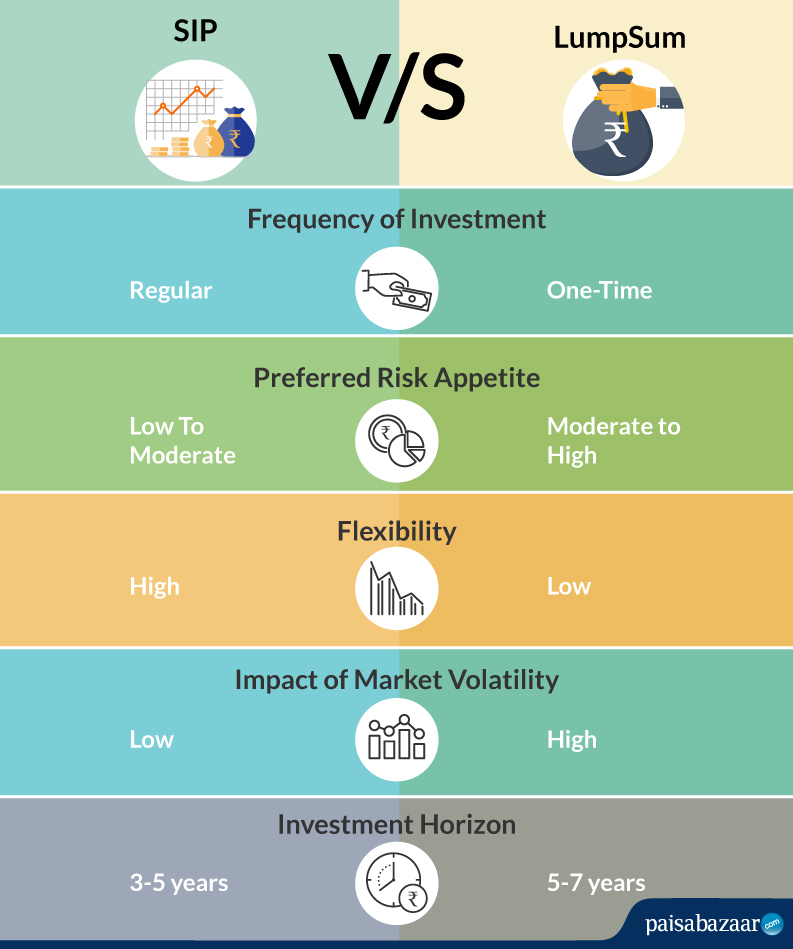

The two modes of investment have been compared on the following parameters:

- Risk Appetite: SIP mode of investment is highly recommended to investors who have low to moderate risk appetite, as the investment is spread over a long time span, the inherent risk gets spread out. Whereas, lump sum investment is for investors with a high risk appetite, as the investor may need to time the market before the purchase, and if s/he invests the money at a wrong time, the possibility of capital loss becomes high.

- Flexibility: Since lump sum mode of investment involves one time investment in a mutual fund scheme, it has a very low flexibility. You need to have a bulk of money for this investment, which might hamper your financial budget.

On the other hand, SIP allows you to have flexibility in terms of investment, where you can invest small amounts of money on a regular basis (either weekly, fortnightly, monthly, etc.) as per your convenience. This doesn’t disturb your expenditure pattern and paves way to disciplined investment.

- Impact of Market Volatility: In lump sum mode of investment, an investor needs to time the purchase of fund units in order to factor in market volatility, and use it to the best of his/her advantage. This leads to a high impact of market volatility.However, in SIP, since the investment is on a regular basis, the impact of market volatility gets toned down. You don’t need to time the market, as you’re buying the fund units during every market cycle, whether bullish or bearish.

- Investment Horizon: The advisable investment horizon for SIP mode of investment is 3 to 5 years, as this mode is recommended for equity funds, which are highly susceptible to market fluctuations. For the lump sum mode of investment, the suitable investment horizon is 5 -7 years, if you’re investing in equity funds. However, if you wish to invest in short term debt funds through lump sum, the recommended investment horizon reduces to 1-3 years.

Benefits of investing via SIP in Mutual Funds?

- Low Risk: New investors often face problems such as lack of knowledge of financial markets or finding the ideal time to monitor the market. An investor may lose a huge amount if it is invested through lump sum and the market crashes.

SIPs prevent investors from such losses and ensure decent returns as your investment is managed by a team of market experts. Through regular, disciplined investment, one can mitigate the risk of a potential market crash and need not worry about when and how to invest.

- Convenience: SIP allows investors to put in smaller amounts every month without any hassle. In fact, one can also give Standing Instructions (SI) to the fund house for auto debit from your bank account. This is a great way to pay every installment without any default or delay or efforts!

Additionally, SIP enables investors to increase their investment amount as per their wishes. There are several fund houses that allow investors to increase the SIP amount.

- Rupee Cost Averaging (RCA): Rupee Cost Averaging refers to an investment strategy which eliminates the need to time the market. Through SIP one invests a pre-decided amount in the fund. This ensures that one buys fewer units of shares when the markets are expensive, and more units of shares when the markets are cheap. This practice reduces the cost per unit and is called ‘Rupee Cost Averaging’ (RCA).Ultimately, investors end up with better returns at a lower risk. RCA is one of the major reasons people invest in Equity Mutual Funds through the SIP route.

- Benefits of Compounding: When investing in mutual funds through SIP, returns are magnified through the compounding effect. Because of compounding, you not only earn interest on your principal amount but also on the interest accrued on that amount.

Suppose you invest Rs.500 in a mutual fund at a 10% rate of return. After a year, interest earned would be Rs.50. From the next year, you’ll earn interest on Rs. 550. Thus, in the long run, one can significantly benefit from the compounding effect.

Best Mutual Funds For SIP

Here is a list of top 10 mutual fund schemes that have delivered impressive SIP returns over the years. It should be noted that the 5 -Year Returns of the following funds, might not look attractive as of now, owing to the recent economic slowdown. However, the returns are expected to jump back, once the market conditions normalise.

| Fund Name | AUM (cr.) | 5- Year Returns |

| Axis Bluechip | Rs. 11,824 | 6.75% |

| Axis Midcap | Rs. 5,193 | 4.54% |

| Axis Long Term Equity | Rs. 21,659 | 3.22% |

| Canara Robeco Bluechip | Rs. 353 | 2.98% |

| SBI Focused Equity | Rs. 8,264 | 2.93% |

| Mirae Asset Emerging Bluechip | Rs. 9,614 | 1.63% |

| JM Multicap | Rs. 139 | 1.59% |

| Axis Small Cap | Rs. 2,507 | 1.41% |

| SBI Small Cap | Rs. 3,476 | -0.39% |

| DSP Tax Saver | Rs. 6,096 | -2.50% |

{Data as on March 27, 2020; Source: Value Research}

{Funds have been ranked based on the 5 -Year Returns}