Abu Dhabi Commercial Bank (ADCB) IFSC Code is an 11-digit alphanumeric code that helps in uniquely identifying all the banks and their respective branches. IFSC or Indian Financial System Code is allocated by the Reserve Bank of India to all the banks and their respective branches. The code also helps in the facilitation of online funds transfer using NEFT, RTGS or IMPS.

Format of Abu Dhabi Commercial Bank IFSC Code

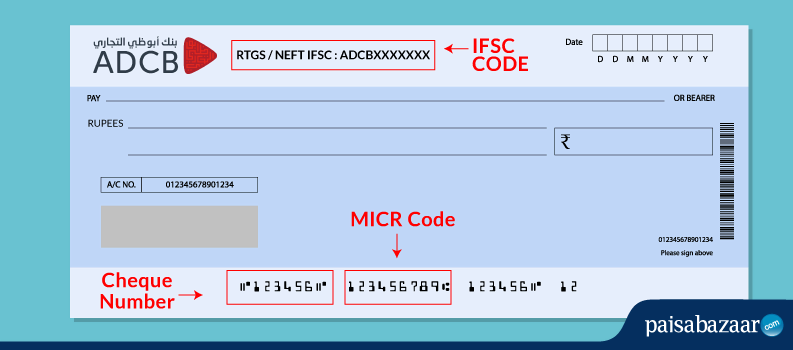

In the 11-digit IFSC Code, the first 4 digits signify the bank code, the 5th character is always ‘0’ and the last 6 characters indicate the branch code. Have a look at the below-given example of Abu Dhabi Commercial Bank IFSC Code, Bangalore, Karnataka.

| Abu Dhabi Commercial Bank Code | Zero | Abu Dhabi Commercial Bank ’s Branch Code | ||||||||

| A | D | C | B | 0 | 0 | 0 | 0 | 0 | 0 | 2 |

Here in the above-mentioned example of Abu Dhabi Commercial Bank IFSC Code (ADCB0000002):

- The first 4 characters ‘ADCB’ indicate the bank code

- The 5th character is a ‘0’

- The last characters ‘000002’ represent the branch code of Bangalore, Karnataka

Where to find Abu Dhabi Commercial Bank IFSC and MICR Code?

The users can find Abu Dhabi Commercial Bank IFSC Code online as well as offline. Below mentioned are some of the ways:

Online

- IFSC Code search tool by Paisabazaar: The users can visit the IFSC Code search tool page provided by Paisabazaar. Enter the required details like the bank name, state, city, and branch. The IFSC Code along with MICR Code and other details will be displayed on the right-hand side of the page.

- The Reserve Bank of India (RBI): The IFSC and MICR codes can also be found on the official website of RBI. RBI provides a separate list for both IFSC and MICR code, for user’s convenience.

- Net Banking / Mobile Banking: The users can look for the IFSC Code of Abu Dhabi Commercial Bank by logging into the net banking portal or via the bank’s official mobile application.

Offline

- Cheque Book: The IFSC Code can be seen printed on the top left corner of the cheque leaf, while the MICR Code is printed at the bottom.

- Passbook: Both the IFSC and MICR codes can be found on the first page of the passbook provided by the respective bank.

Importance of IFSC Code

- IFSC Code helps in uniquely identifying a particular bank branch hassle-free

- The code is used by the RBI to keep a track of all the online banking transactions performed by an individual, hence minimizing the fraudulent activities

- The code helps in facilitating electronic or online fund transfer via NEFT, RTGS or IMPS

- The code can be used to pay online bills. The transactions can be performed using a mobile phone, tablet or laptop

How to do fund transfer using Abu Dhabi Commercial Bank IFSC Code?

The role of IFSC Code is vital in the facilitation of electronic or online funds transfer using NEFT, RTGS or IMPS. Below mentioned are the different ways to transfer money online using IFSC Code:

- Funds Transfer via NEFT: National Electronic Fund Transfer (NEFT) helps users to transfer funds from one bank to another. The NEFT process is based on a deferred settlement through which the transactions are carried out in settlements. Funds transfer via NEFT settles in 23 half-hourly batches.

- Maximum transfer limit: No limit

- Minimum transfer limit: Re.1

- Operational Timings: Available 24x7 throughout the year

- Inward Transaction Charges: No charges

- Funds Transfer via RTGS: Real-Time Gross Settlement (RTGS) is the process by which the funds transfer takes place instantaneously and on a real-time and gross basis. RTGS is ideal for large-value transactions on a regular basis. It is to be noted that the remitter needs to provide the basic bank account details for the transfer process to take place.

- Maximum transfer limit: No limit

- Minimum transfer limit: Rs.2 lakh

- Operational Timings: 8 am to 6 pm Monday to Saturday (except 2nd & 4th Saturday)

- Inward Transaction Charges: No charges

- Funds Transfer via IMPS: Fund transfer via IMPS can be carried out 24x7, throughout the year. In comparison to NEFT and RTGS, IMPS is considered a secure and faster mode of fund transfer. The money transfer via IMPS can be initiated by providing the beneficiary’s account number and IFSC code.

- Maximum transfer limit: Rs.2 lakh

- Minimum transfer limit: Re.1

- Operational Timings: Available 365 days (24x7)

- Inward Transaction Charges: Decided by the individual member banks and PPIs

About Abu Dhabi Commercial Bank

Abu Dhabi Commercial Bank or ADCB is located in the United Arab Emirates. Incorporated in the year 1985, the bank was initially formed as a public shareholding company with limited liability. It is the 3rd largest bank in the UAE and provides a wide range of commercial and retail banking services to its customers. The bank holds a network of 48 branches in the UAE and abroad (2 branches in India and 1 in the UK).