Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Fixed deposits and mutual funds are two of the popular investment choices. Both options provide investors with promising returns to help them realize their goals well within time.

Where fixed deposits offer guaranteed returns at pre-fixed interest rates, mutual fund investments provide variable returns depending upon how the market performs.

In this article, we shall highlight the primary differences between FD and MF as well as the returns in both these avenues. Also, we shall be looking at the after-effects of COVID-19 on fixed deposits and investment in mutual funds.

Fixed deposit is an investment option in which the rate of interest is fixed at the time of booking and interest is calculated on this interest rate throughout the tenure. Returns are decent while the risk is limited, often negligible.

To know more: What is Fixed Deposit?

Manage all FDs in one place

Manage all FDs in one place

No Bank A/C Required

No Bank A/C Required

A mutual fund is another type of investment instrument where many investors put in their money to reach a common goal. Once the income is generated, it is proportionately distributed among the mutual fund investors based on their initial deposits made.

This is more like a pool of money and is market-linked. This attracts both – higher returns and higher risk.

To know more: What is Mutual Funds?

Now, let’s understand the difference between fixed deposits and mutual funds by drawing a comparison between both.

| Parameter | Fixed Deposit (FD) | Mutual Fund (MF) |

| Returns | Fixed | Variable |

| Risk | Negligible | Significant |

| Investment via | Directly with the bank/company | Directly with fund houses or indirectly via distributors/brokers |

| Withdrawal | The penalty is imposed on premature withdrawal which constitutes lowering of the interest rate at which due returns are to be paid

(Some banks may not charge any penalty) |

MF is an open-ended investment and can be withdrawn anytime without penalty

(Exit loads of 1% or higher may be applicable depending upon the fund.) |

| Insurance | Up to Rs. 5 lakh deposit insurance by DICGC | No insurance provided |

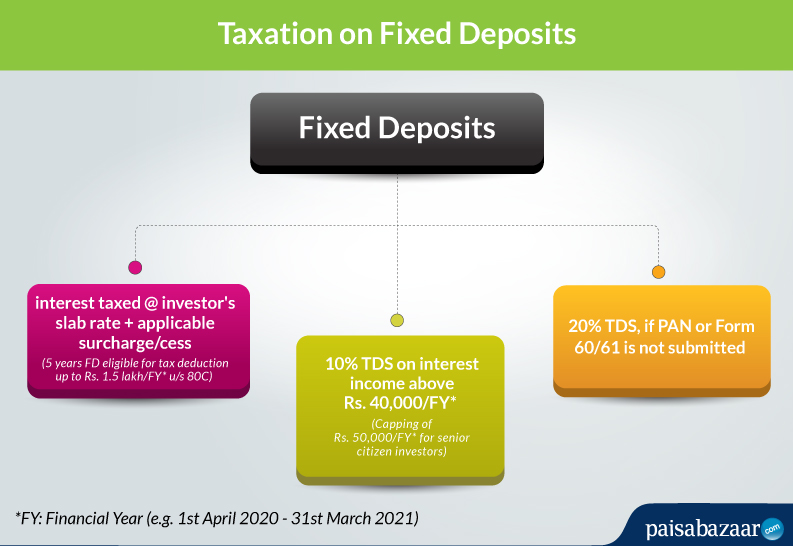

Fixed Deposits

Check how to fill Form 15G/H

Mutual Funds

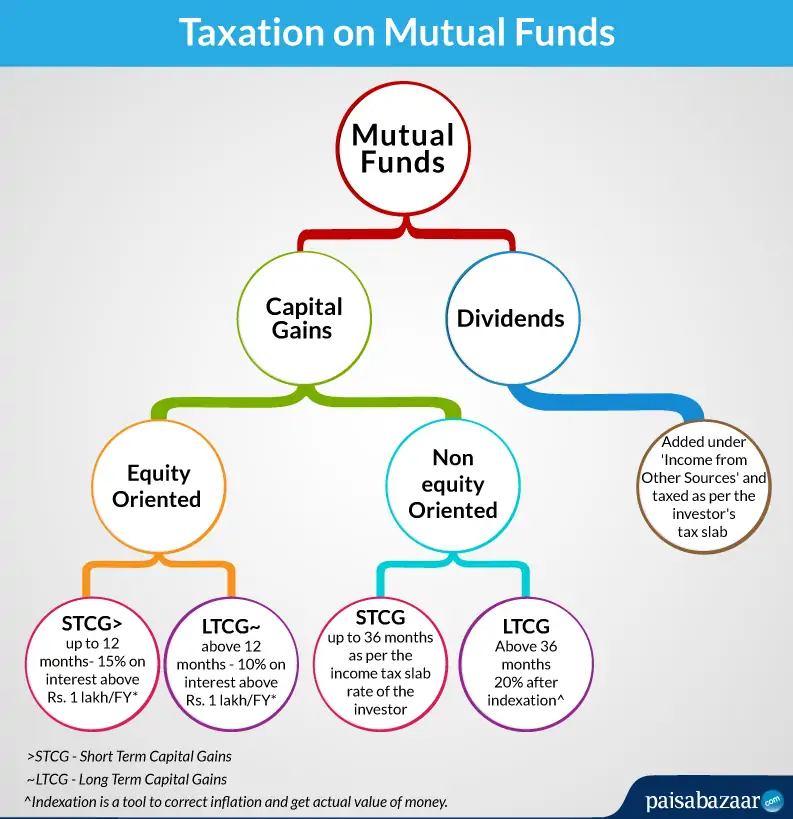

Returns earned from MF are subject to short-term or long-term capital gains, whichever is applicable.

Equity-based Funds:

STCG: 15% on interest above Rs. 1 lakh

LTCG: 10% on interest above Rs. 1 lakh

Debt Funds:

STCG: As per income tax slab if redeemed within 3 years from the date of unit allocation

LTCG: 20% of returns with indexation benefit, if redeemed after 3 years from the date of unit allocation

*STCG – Short Term Capital Gains; LTCG – Long Term Capital Gains

There are two ways of investing in a mutual fund, viz. directly with the AMC (Asset Management Company) or via an authorized intermediary like a banker, broker, and platforms like Paytm Money.

The market is hit very badly and returns are falling down sharply. However, ironically MF values are so low, it is by far the best time to invest since demonetization. A simple principle applies here; lower the prices – best to buy, higher the prices – the best time to sell.

Generally, the rate of return in mutual funds is higher than it is in fixed deposits. It is because mutual funds give exposure to market-linked investments such as equity and debt instruments. Funds in a mutual fund are effectively managed by professional fund managers and they keep on allocating funds where the returns can be optimum. This leads to better returns.

Some of the best mutual funds to invest in today’s time are tabulated below:

| Fund Name | Category | 3- Year Returns (%) | 5- Year Returns (%) |

| ICICI Prudential Long Term Bond Fund | Debt- Long Duration | 10.16 | 10.56 |

| SBI Magnum Medium Duration Fund | Debt- Medium Duration | 9.37 | 10.16 |

| Axis Bluechip Fund | Equity- Large Cap | 8.35 | 8.45 |

| Kotak Debt Hybrid Fund | Hybrid- Conservative | 5.72 | 8.23 |

| Motilal Oswal Long Term Equity Fund | ELSS (Tax Saver) | -1.69 | 7.41 |

| Axis Long Term Equity Fund | ELSS (Tax Saver) | 5.10 | 7.01 |

| IDFC Dynamic Equity Fund | Hybrid- Dynamic Asset Allocation | 4.84 | 5.48 |

| ICICI Prudential Bluechip Fund | Equity- Large Cap | 0.61 | 5.11 |

(Data as on 29th May 2020; Source- Value Research)

Note: The aforementioned funds (all being direct funds) have been arranged in descending order according to their 5-year trailing returns.

Fixed deposits, as the name clarifies, come with a seal of guaranteed returns. Deposits made in scheduled banks come with Rs. 5 lakh insurance by DICGC. In any FD scheme, the FD rates are decided at the time of booking the FD and remain the same till the end of FD tenure.

It is the first time in a long time that large banks like SBI have lowered their FD rates to a sharp low of 2.90%. This is lower than what a basic savings account offers. Other banks are also following the lead and interest rates are nowhere expected to recover soon. However, when it comes to mid-term or long-term FDs, depositors can still benefit with up to 9% returns by booking FD in banks like Fincare Small Finance Bank and Suryodaya Small Finance Banks.

Some of the banks/NBFCs* offering the best FD interest rates are stated below:

| Bank Name | Returns (% p.a.) | Tenure | |

| Regular Individuals | Senior Citizens | ||

| Fincare Small Finance Bank | 8.00% | 8.50% | 1000 days |

| Suryodaya Small Finance Bank | 8.51% | 8.76% | 999 days |

| Utkarsh Small Finance Bank | 8.00% | 8.75% | 700 days |

| Equitas Small Finance Bank | 8.00% | 8.50% | 888 Days |

| DCB Bank | 7.85% | 8.35% | more than 700 days to 3 years |

| IDFC First Bank | 7.50% | 8.00% | 18 months 1 day to 3 years |

| RBL Bank | 7.55% | 7.75% | 15 months to 725 days |

| IndusInd Bank | 7.25% | 7.85% | 2 years up to 2 years 1 month |

*Non-Banking Financial Companies

(Data as on 27th Dec 2022. Source: Official websites of respective banks)

To calculate the maturity amount as well as total interest expected from fixed deposit investment, you can use Paisabazaar’s FD calculator, an online tool available for free. This way you can easily predict your returns on FD.

Choosing between these two options requires thorough analysis, moreover, understanding of one’s risk-return appetite.

While mutual funds come with a good mix of risk-return, FDs help strike the right balance in one’s portfolio since these do not have any significant risk label attached to them.

For Senior Citizens

Senior citizens are advised to safeguard their money in special senior citizen FD schemes like SBI We Care, HDFC Senior Citizen Care, and ICICI Bank Golden Years. These schemes are offering up to 0.80% higher interest on the standard FD interest rates.

| Scheme | Offer | Rate of Interest | Tenure |

| SBI We Care | 0.80% extra | 7.55% | 5 years – 10 years |

| HDFC Senior Citizen Care | 0.75% extra | 7.75% | 5 years 1 day – 10 years |

| ICICI Golden Years | 0.60% extra | 7.60% | 5 years 1 day – 10 years |

Know more about Special Senior Citizen Fixed Deposit Schemes.

If senior citizens wish to invest in mutual funds, they should go for debt mutual funds and not equity-based funds. Debt funds provide better stability and have decent performance.

For others (i.e. non-senior citizens)

For those looking to invest in the market, it’s a good time since the MF values are low. However, the returns should take around 3 years at least to tilt towards the positive mark. Do not expect significant returns sooner.

Also, as we have learned, any moment can turn into a black swan situation, like the current novel coronavirus. With market-linked investments, there is no guarantee of returns coming back to pre-COVID crisis levels in the short term. Hence, if you continue investing in mutual funds during this period, consider staying invested for a period of 3 years or longer for maximized returns.