Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

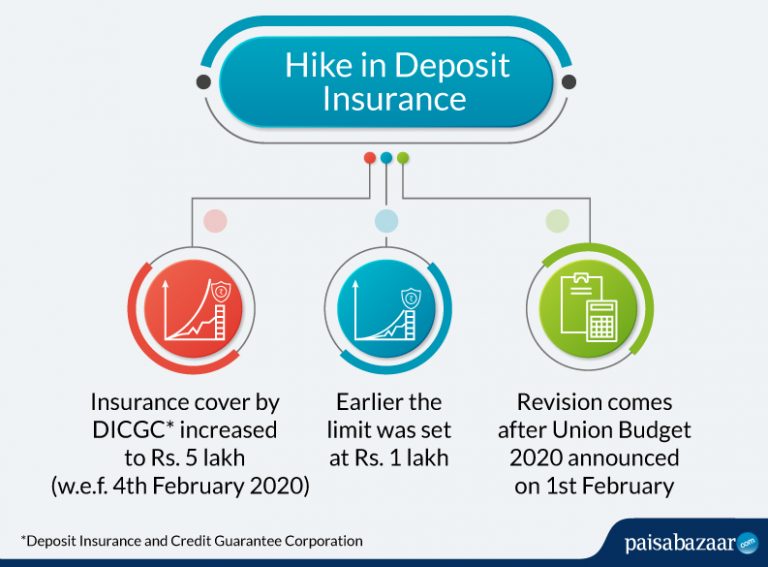

On the 1st of February 2020, Finance Minister Nirmala Sitharaman presented the Union Budget 2020 in the Parliament. In it, an increase in deposit insurance to Rs. 5 lakh was proposed which was earlier set at Rs. 1 lakh for the bank account holders. This revision in the insurance cover came into effect from the 4th of February, 2020.

Deposit insurance is insurance for deposits held by customers in a bank. It is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC). It includes commercial public banks and small finance banks. Company deposits are not included in the deposit insurance

Manage all FDs in one place

Manage all FDs in one place

No Bank A/C Required

No Bank A/C Required

DICGC or Deposit Insurance and Credit Guarantee Corporation is a wholly-owned subsidiary of the Reserve Bank of India. This corporation was built to provide insurance of deposits and also, to solidify the credit facilities in India.

You are insured for up to Rs. 5 lakh (principal + interest) in a scheduled bank. It can be a commercial bank like SBI or HDFC Bank or it can be a small finance bank like Fincare or Suryodaya.

Case 1: You have Rs. 4.5 lakh in a bank and have earned an interest of Rs. 15,000 on it. The bank defaults. DICGC will pay you a total of Rs. 4.65 lakh.

Case 2: You have Rs. 5 lakh in a bank. You earned an interest of Rs. 25,000 on it. The bank defaults. DICGC will pay you a total of Rs. 5 lakh.

Case 3: You have Rs. 6 lakh in a bank. You earn an interest of Rs. 50,000 on it. The bank goes insolvent. DICGC will pay you a total of Rs. 5 lakh.

Money kept in the following is insured by DICGC:

(This is not an exhaustive list)

The following types of deposits are not insured by DICGC:

No. DICGC deposit insurance is solely for banks. Non-banking financial companies (NBFCs) do not come under its umbrella.

Read More: Company/Corporate Fixed Deposits

All your deposits in a bank are covered for up to Rs. 5 lakh. Similarly, if you simultaneously invest in another bank, that amount will also be covered separately.

Let’s understand this with an example:

You have 3 FDs in 3 different banks, say, SBI (Rs. 1 lakh), Yes Bank (Rs. 4.5 lakh) and Kotak Mahindra Bank (Rs. 5 lakh). Now, Yes Bank and Kotak Mahindra Bank all go into liquidation (which is very unlikely). DICGC will pay you Rs. 4.5 lakh for your deposits in Yes Bank and Rs. 5 lakh for your deposits in Kotak Mahindra Bank.

What if there is more than one account in the same bank?

In case of more than one account in the same bank, whether it’s a combination of savings and fixed deposit account or the same type of accounts, the insurance coverage will be paid a total of Rs. 5 lakh and not separately per account. This coverage is provided per bank and not per account type.

In case of Joint Accounts

In case of a person holding two accounts in a bank, one individually and the other as a joint account, then DICGC shall be paying the compensation of Rs. 5 – 5 lakh separately to each depositor. Here, these accounts shall be held in different capacities and different rights.

Suppose, Mrs Arya has three accounts in, let’s say, DBS Bank, viz. a salary account (balance of Rs. 2.5 lakh), an FD account (Rs. 5 lakh) and a joint account, with her husband being the prime holder (balanced at Rs. 2.5 lakh). Now, unfortunately, the bank goes into liquidation. Mrs Arya’s salary account and FD account shall be treated as one, i.e. in the same capacity and right. Thus, DICGC shall be paying Rs. 5 lakh to Mrs Arya and Rs. 2.5 lakh to her husband, separately.

Does the interest accrued on a deposit also covered by the deposit insurance?

Yes. DICGC covers both the principal as well as the interest accrued. However, the total of the principal and interest cannot cross Rs. 5 lakh. If the principal itself is Rs. 5 lakh, the interest on it will not be covered.

Do I have to pay for the deposit insurance?

No. the cost of deposit insurance is borne solely by the insured bank.

When does DICGC come into the picture?

DICGC becomes liable to pay when an insured bank goes into liquidation. The bank provides the DICGC the claim list. Within 2 months of receipt of this claim list, the DICGC pays the total insurance amount to the liquidator. After this, it becomes the responsibility of the liquidator to proportionately disburse this amount to each insured depositor.

Can my bank withdraw from the DICGC coverage?

DICGC coverage is not a choice. It is compulsory. Therefore, no bank can withdraw from it.

How would I know if my bank deposit is insured by the DICGC?

Although it is established that all the commercial banks and cooperative banks are insured by the DICGC, in case of doubt, you must enquire about it with the bank’s official. Also, most of the times, in case of a fixed deposit, it will be clearly mentioned on your Fixed Deposit Receipt or FDR.