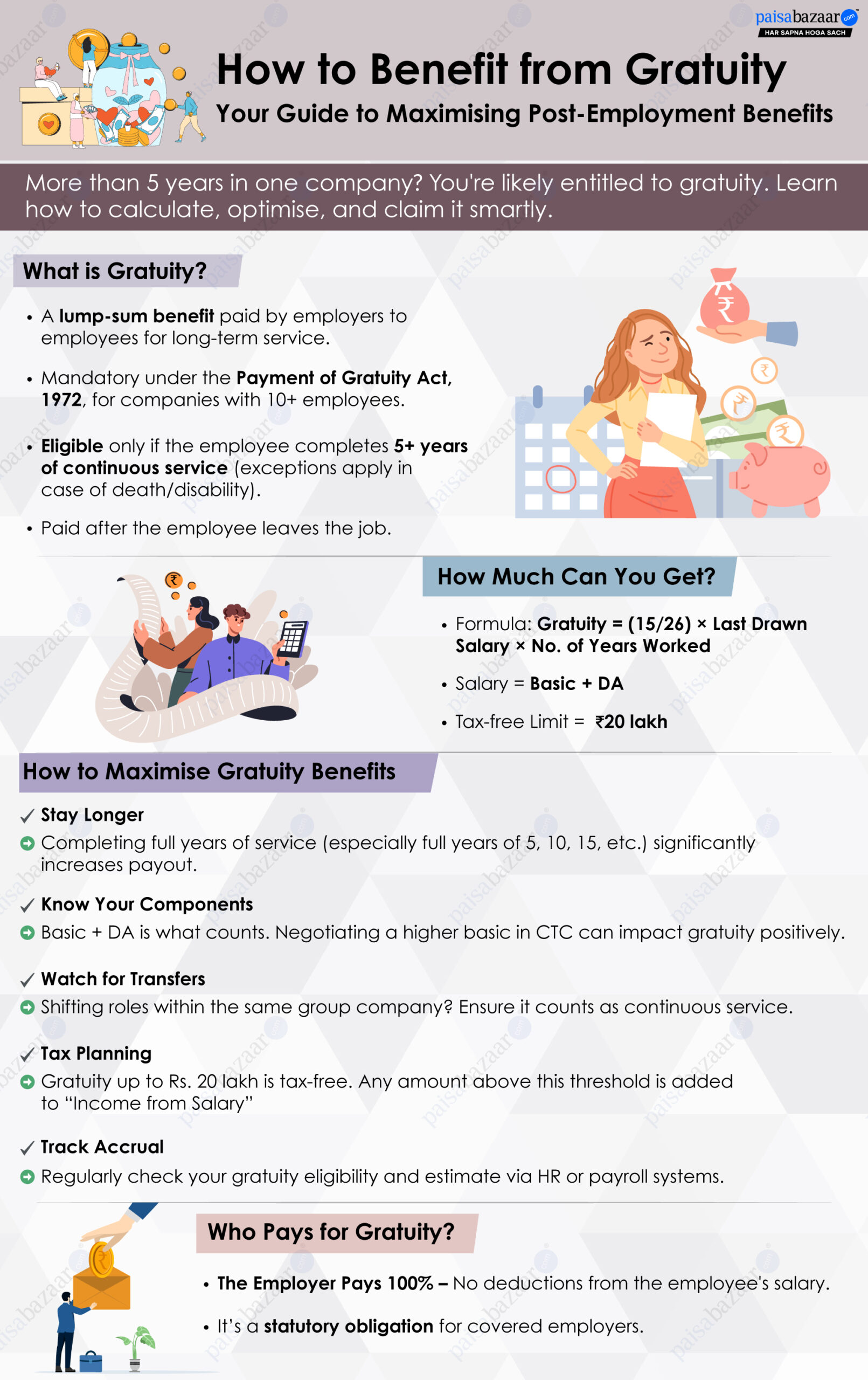

Gratuity is a monetary benefit provided by an employer to an employee for the services rendered to the organisation. It is paid at the time of retirement or resignation, provided the employee has completed at least 5 years of continuous service before leaving the organisation.

In certain circumstances, such as death or disablement, the rule of continuous 5-year service is relaxed. Let us understand about the Gratuity Act, eligibility criteria, gratuity formula, calculation, and taxation rules on gratuity in detail.