Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

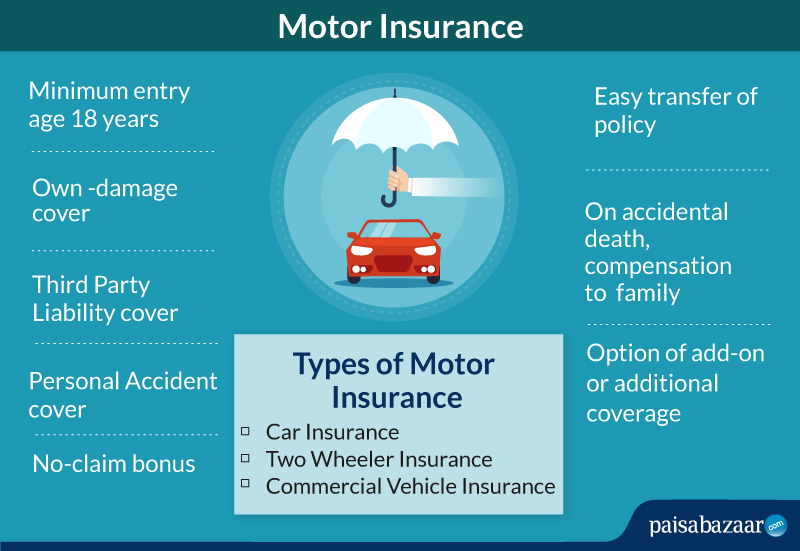

Most of the deaths in India occur because of road accidents, says a report recently published in a daily. To manage the consequences and effects of these accidents, a motor insurance is necessary, as it gives financial support to take care of any loss or damage to own vehicle or of a third party.

A motor insurance includes insurance for all types of vehicles, including private cars, two wheeler and commercial vehicles. It provides financial protection against damage related to any accident, theft or loss of the car. It also takes care of any bodily injury arising due to accidents or theft.

It makes sense to get protection from the loss incurred by a vehicle owner due to accident or theft of the vehicle. There are three types of motor insurance on the basis of the vehicle that is insured.

Car insurance : This insurance is valid for all privately owned cars and not for cars used for commercial purpose. This is a comprehensive private vehicle insurance to overcome the financial losses incurred due to risks associated with the car.

Two wheeler insurance: This insurance covers bikes, scooters, scooty, etc. It helps the owner get coverage for any risks associated with the two wheeler.

Commercial vehicle insurance: Commercial vehicles are those vehicles that are not used for personal use. They are used to transport goods or passengers from one place to another. This insurance protects businessmen from the losses incurred due to theft or damage to the commercial vehicle. Also, the insured will get protection from third-party liabilities and accident coverage for the driver of the vehicle with this type of insurance.

Third Party Insurance: This type of automobile insurance covers third-party liabilities. The expenses of any unintentional damage caused to a third party or their property due to your insured vehicle can be covered with third party insurance. According to law, it is mandatory to give compensation to the third- party in case of accidents causing serious injuries, disability or death of the person or damages to their property.

Comprehensive Insurance: Comprehensive motor insurance covers you and your vehicle against any unforeseen damage to your vehicle or a third-party and their property. It also covers death/disability of the driver, owner, and passengers due to an accident by the insured vehicle.

Purchasing a motor insurance helps to get coverage for various requirements. Let us understand the various sections of coverage offered:

Certain documents are required to purchase a motor insurance irrespective of its type. They are:

In India, a motor insurance can be bought for private cars, two wheelers and commercial vehicles. To be eligible to buy a motor insurance, you must own a car, can be old or new, should be above 18 years of age, should be a citizen of India and should possess the RC of the car.

A policyholder usually gets a comprehensive coverage under a motor insurance; however, he/she can get additional benefits or add-ons by paying some extra amount. Following are some add-ons available along with a comprehensive insurance policy:

Zero depreciation cover: An insurance company usually deducts a certain amount as depreciation of your vehicle from the sum insured. But if you opt for zero depreciation cover, the insurance company will pay the original value of your vehicle in case of damage or theft.

Key replacement cover: If you misplace the key of your vehicle, you can claim for reimbursement. With this add-on cover, the insurance company provides a part of the cost incurred for the substitution of the key.

Engine and electronic circuits cover: If your vehicle is damaged due to engine failure or electronic circuits, you can claim for reimbursement with this add-on cover.

Roadside assistance cover: In case your vehicle breaks down while traveling through remote locations, you can call for assistance with roadside assistance cover. Other assistance can be arranging for fuel or mechanic in case of any problem while travelling and you can’t get any help.

In case of an accident or a damage, it is important to intimate the insurance company about the incident on their toll-free number and lodge the complaint. Afterwards, submit the following documents to the insurance company:

A motor insurance offers various kinds of coverage for a peaceful driving experience. However, certain situations and cases are not included in the coverage, also called exclusions. Let is look at some of them:

After the required documents are submitted to the insurance company, the surveyor will be assigned for the inspection. If the garage covered under the network provider is nearby the accident/damage area, then claim process will be cashless, else, the insured can repair it on their own and submit the bill to the insurance company which will be reimbursed within 30 days.

The value of your car when you make a claim in the market is termed as the insured declared value (IDV). This is the highest sum your insurer will have to pay you at the claim of your vehicle insurance policy. You cannot claim money more than the IDV.

The policy term for motor insurance usually varies from one year to three years which the policyholder can renew online by visiting the official webpage of the insurance provider. At the time of renewal, policyholder should know about no claim bonus (NCB). It is the bonus received for every claim-free year. NCB includes discounts in premiums of your policy at the time of renewal as a reward for following the safety measures while driving your vehicle. The rate of discount increases at each renewal which is why it is advised not to claim your insurance money for minor damage.

Some of the general insurance companies providing motor insurance, i.e. Car Insurance and two wheeler insurance policies in India are:

Before purchasing a motor insurance, it is important to check and compare the plans well so that you get the best deal. Let us look at some points to keep in mind while purchasing the policy:

History of the company: Insurance is an indefinite asset and so it is important to stay alert while choosing the insurance policy. Many companies will publicise their service for the wrong reasons. It is your call to investigate the history and previous claim records of the company to choose the right one.

Financial stability of company: There are cases wherein the insurance providers failed to maintain a financial balance resulting into loss of money of their investors. To avoid this, you should check the financial stability of the insurance provider by checking their financial statements and growth rate over recent years.

Cost: Another essential thing to consider is the cost you would bear to buy coverage. As a policy seeker, it is important to compare quotes from different insurance companies and choose the one offering maximum benefits.

Look for key features: There is a general set of features offered by all insurance providers. These features include personal accident cover, third-party cover, etc. Check for these necessary covers before finalising your insurance provider.

Check add-on covers: Different insurance providers offer different add-on covers based on the type and value of the insurance. Check for the available add-on covers, benefits and discounts offered to compare for the right insurance policy and the insurance company. Some of the standard add-on covers include zero depreciation cover, personal accident cover, roadside assistance cover.

Lack of legal enforcement and negligence in following traffic rules are contributing to the increasing number of accidents taking place in India. Following are the benefits one can avail:

Reduces your liabilities: In case the third party is harmed or injured from the insured vehicle, the insurance company will pay off the charges for the injuries/damage if the vehicle is covered under the third party. It also sets you free from any legal liabilities that the policyholder could incur because of the accident.

Damage to vehicle covered: Any damage done to your vehicle as a result of disasters caused by human error can be covered under comprehensive insurance policy. The claim process can be cashless or reimbursement.

Hospital bill payment: If you are injured or get permanently disabled in an accident, the insurance company pays the hospital bills and other medical charges under personal accident coverage.

Reimbursement on death: In case of fatal accidents, the family of the insured gets compensation from the insurance provider.

Some of the factors affecting the premium are age of the insured, occupation of the insured, insured declared value, place of registration of the vehicle.

The insurance premium amount to be paid by the policyholder can be reduced by taking certain steps like installing smart drive system, safety devices, renewing your policy before the due date.

Yes. No matter if your vehicle is new or second-hand, it is compulsory to get a motor insurance for the same.

Yes. NCB can always be transferred as it does not belong to the vehicle but to the owner of the vehicle.

Some of the basic ones are Zero Depreciation Cover, NCB Protection Cover, Roadside Assistance, etc.

Yes. If you live in a city like Delhi or Mumbai, you might have to pay slightly higher than someone who resides in a city like Guwahati or maybe Port Blaire.

Yes. Along with driving license, pollution check certificate and registration certificate of the vehicle, it is mandatory to keep the insurance papers too.

The maximum amount that you are eligible to receive is the Insured Declared Value (IDV). IDV is calculated at the time of purchasing the policy and is payable at the time of total loss or theft of the vehicle.

For any type of motor vehicle, it is mandatory to get at least the third-party liability cover. Without this, you will have to pay fine or may have to face court procedures too.

Yes. For this, you are required to transfer the ownership of the vehicle to the one you wish to transfer the insurance papers. Once the ownership part is taken care of, the insurance company shall start with the transfer of insurance papers once all the documents and related charges are paid in full.