Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Days Past Due or DPD is the most important information on your CIBIL report that can considerably impact the possibility of getting your credit application approved from the lending institution. DPD value signifies the number of days by which the borrower has missed the payments of loan EMIs or credit card bills in the past.

Check Credit Score for FREE Before Applying for Credit

Let’s Get Started

The entered number doesn't seem to be correct

One of the most important factors a CIBIL score depends on is the repayment history. Lenders analyse this section critically at the time of credit approval. They go through every credit product to check for a non-zero DPD in the credit report. Let us understand what a DPD is and how it can impact the credit score.

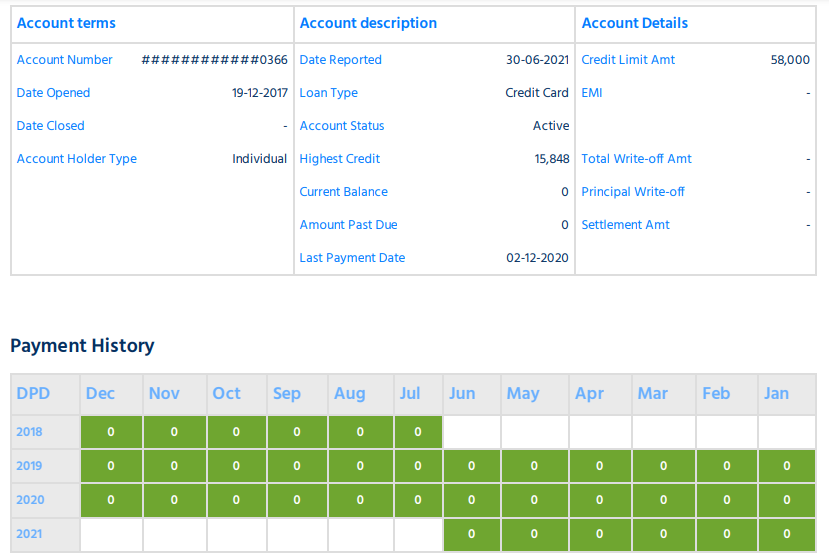

Days Past Due (DPD) indicates the number of days by which a borrower has missed an EMI or credit card payment. DPD is present in the ‘Payment History’ section of your CIBIL report.

The DPD in the CIBIL report is considered one of the determining factors for lenders while approving or rejecting your loan or credit card application.

If you have made timely payments in the past, your DPD (Payment made within 90 days) will be mentioned as ‘000’. In case you have missed your payment by 40 days, your report will show ’40’ against the previous month.

There may be instances where “XXX” is mentioned in the DPD in CIBIL. It means that the lender has not provided the payment history details to the credit bureau. You should not worry, if you find it in your credit report, as it has no negative impact on your credit score or your chances of loan or card approval in the future.

Get your Credit Report and Verify your DPD Data Check Now

DPD shows how disciplined you have been in making EMI payments in the past. It contains your payment timeline for the past 36 months. While assessing your credit application, the lender checks whether you have missed any payments in the past. If your DPD is ‘000’ for all 36 months, it shows that you have prudently paid off all your credit dues on time and pose a lesser risk to the lender.

Occasionally missing the payment deadline also hurts your credit score and creditworthiness but few lenders might approve your credit application. However, frequent misses and non-payment of dues for long pose a higher risk for lenders and they may refrain from approving your loan or credit card applications.

Missed Payments? Check your updated Credit Report Check Now

Every time a lender submits your credit data to the credit bureau, it updates the details in your CIBIL report and evaluates and generates your CIBIL score. Your credit score may not change every month, even if the details are provided regularly by the lender.

In case you miss a deadline by 30 days, the Credit Information Company (CIC) or Credit Bureau updates your DPD for that month as ’30’ in your credit report. Assuming you don’t make the payment and the lender reports it to the bureau the next month again, your DPD would be updated as ’60’.

As per the financial experts, it is recommended not to miss the payments by more than 3 months, as it can have a serious impact on your credit score, as well as your creditworthiness may get hampered.

In case you find that your credit report has DPD errors, wherein you made the payment on time for a specific month but your DPD shows a value other than “000” (it means that the lender has reported that you missed the payment by the number of days mentioned in the DPD), you can report this error to the credit bureau.

CIBIL will request verification with the concerned lender and add an “Under Dispute” tag to your credit account. Once the lender sends the correct data to the bureau, it updates the credit report and removes the “Under Dispute” tag.

TransUnion CIBIL also shares an updated credit report containing your refreshed credit score.

Also Read: How to Raise CIBIL Dispute?

Don’t Know your Credit Score? Check it now – It’s FREE. Check Now

DPD is mentioned against each of your credit products in the “Payment History” section of the CIBIL report. For example, if you have 3 active credit products, such as SBI credit card, ICICI home loan, and HDFC personal loan, DPD for the past 36 months will be mentioned against each of the credit products separately.

Get Your Latest Credit Score in Just 2 mins. Check Now

Below states are the abbreviated asset classifications under DPD for availed loans or credit cards:

It is recommended that you check your CIBIL report regularly for any minor or major errors and get it rectified at the earliest so that your CIBIL score does not fall. Here, you can check free credit reports from multiple credit bureaus and receive monthly updates with no impact on your credit score. It can further help you in keeping track of your DPD and other errors in your credit report, if any.

Ans. Days Past Due (DPD) is a key indicator in your CIBIL report that signifies the period or number of days a loan EMI or credit card due date has been missed or delayed for any reason. It highlights the defaults or delays in the credit payments of a borrower.

Ans. DPD in your CIBIL report stands for Days Past Due, which indicates the number of days by which you have delayed or missed payments of your past or existing loan or credit card, if any.

Ans. DPD in your CIBIL report can be checked under the ‘Payment History’ section of your CIBIL report. It is considered one of the most vital components of your CIBIL report that indicates your creditworthiness and repayment capacity.

Ans. All the Credit Information Companies (CICs) or credit bureaus named TransUnion CIBIL, Experian, Equifax, and CRIF High Mark mention the DPD value. The DPD value is generated by the consumer credit information provided by the banks to the credit bureaus every month.

Ans. Your DPD value is listed under the ‘Payment History’ section of your CIBIL report. It is good not to have any numeric against your DPD in your CIBIL report, as it signifies no delayed or missed payment by your side.

Ans. A borrower needs to pay all his/her credit payments, such as loan EMIs, credit card dues or any borrowed credit payments in time to avoid any negative value against your DPD section in the CIBIL report.

Ans. If you have missed a payment by 30 days, then a DPD will reflect in your credit report, as the credit bureau updates it as ’30’ for a particular month. However, if you have missed your payments by 2 consecutive months, it shall reflect as ’60’.

Ans. As we can not change or edit any details in our credit report, the same way we can not remove or edit DPD from our credit report.

As it is an integral and related component of the credit report, it cannot be altered or removed. However, we can wait until the DPD section shows some stability or improvement within a few months of regular and timely payments.

Ans. There is no such DPD rule as stated in CIBIL or any credit report. DPD indicates the number of days the borrower has missed or delayed the payments.

So, the higher the DPD is, the lower your creditworthiness and vice versa. Try to pay off all loan EMIs and credit card dues in time to avoid any DPD number in your credit report.

Ans. The CIBIL report holds DPD information of a maximum of 90 days which is divided into 3 months, wherein the value reflected is 30, 60, and 90 days.

These values indicate the number of days that passed or were missed after the payment due date of the loan EMI or credit card bill.

Ans. DPD defines the number of days of payment delays and it is reflected in your credit reports generated by Credit Information Companies (CICs) as per the consumer credit data provided by the banks and NBFCs. Therefore, all the credit bureaus mention DPD in their credit reports under the ‘Payment History’ section.

Ans. Under the payments history section of your credit report, the DPD contains your payment timeline for the past 36 months.

Ans. Days Past Due (DPD) summarizes the number of days the borrower has missed or delayed payments like loan EMIs or credit card dues. Whereas, a credit score is a 3 digit-numeric that displays your creditworthiness and payment history resulting in the possibility of loan approval or denial.

Ans. To avoid any adverse DPD number or value, the borrower should start clearing all overdue, as well as paying off all existing loan EMIs and credit card dues in time.

Ans. DPD number is listed below the Credit Account Information Details under the ‘Payment History’ section of each credit product in your CIBIL report.

Ans. Any DPD value that is other than ‘000’ and ‘XXX’ are considered negative which affects your CIBIL report. If your CIBIL report shows ‘000’ under the DPD section, this signifies that there is no outstanding payment left to be paid. Additionally, the STD value in DPD shows that the payment dues are for less than 90 days.

Ans. The date reported and certified in your CIBIL report is the date on which your lending bank or NBFC notified CIBIL regarding your recent loan or credit card.

Other Credit Score Related Articles: