Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

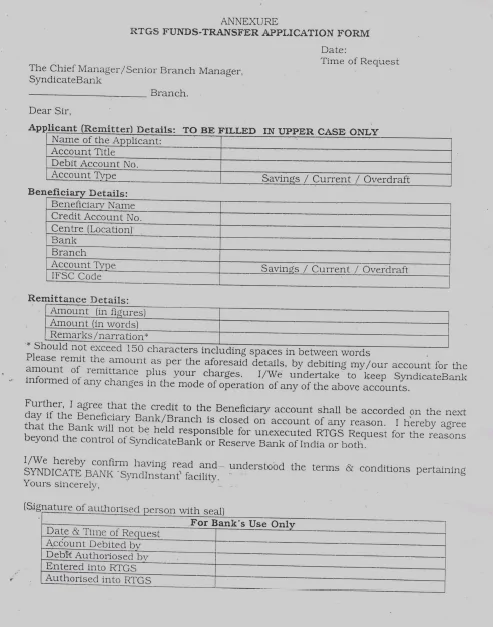

One of the fastest payment facilities to be offered by various banks is the facility of RTGS payment. Such payments can be made via the bank or through online means. You will need to have the bank account details of the beneficiary as well as your bank account details and cheque book when you fill Syndicate Bank RTGS form.

The bank offers RTGS payment facility to all its customers, and the bank charges a fee in place of providing this service.

If you wish to make an RTGS payment from your Syndicate Bank account by visiting the bank, here are the steps to follow:

After filling out the Syndicate Bank RTGS form, you will have to submit it to the official who is going to verify the details and process the payment.

RBI has directed all the banks to not apply any charges on RTGS transactions initiated online via internet banking and/or mobile banking. Intrabank RTGS payments are not chargeable at most of the banks. Additionally, you will also have to make sure that you check the time period for the RTGS payments as well. Some banks have different payment charges for different time slots.

RTGS stands for real-time gross settlement. Such payments are made right away without any waiting period. What’s more is that such payments can be processed for large sums of money. The benefits of opting for an RTGS payment are:

For you to initiate an RTGS payment, all you need to do is go to the bank and find the RTGS form and fill it out, or you could make use of net banking facilities to initiate a payment.