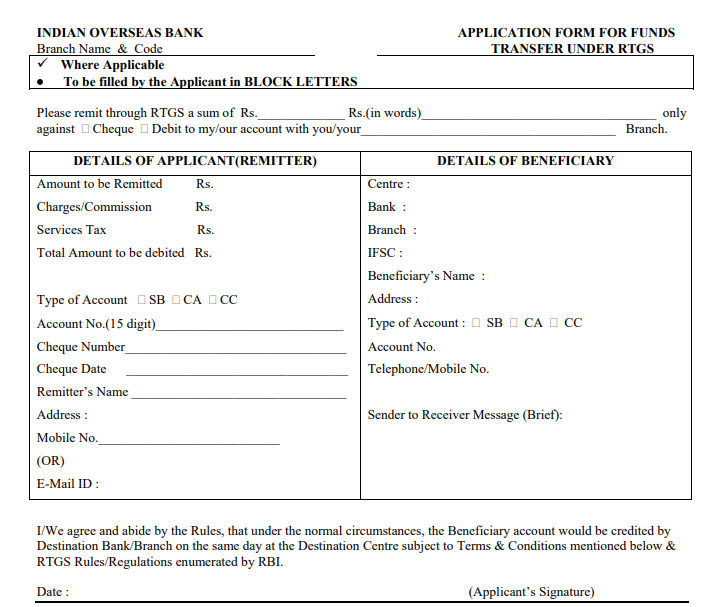

Real Time Gross Settlement (RTGS) is a super fast and hassle-free online money transfer method. While Real Time refers to money transfer taking place to live, “Gross Settlement” refers to the processing of funds on an individual basis and not in hourly slots like that in NEFT. The bank has made RTGS payments simple by enabling a single IOB RTGS form for initiating the payment. An applicant can download the IOB RTGS form from the banking portal as well.

-

Personal Loan

-

Credit Score

-

Credit Cards

-

Business Loan

-

Home Loan

-

Bonds

-

Fixed Deposit

-

Mutual Funds

-

Calculators

-

Other Loans

-

Learn & Resources

(Image Source: Indian Overseas Bank)

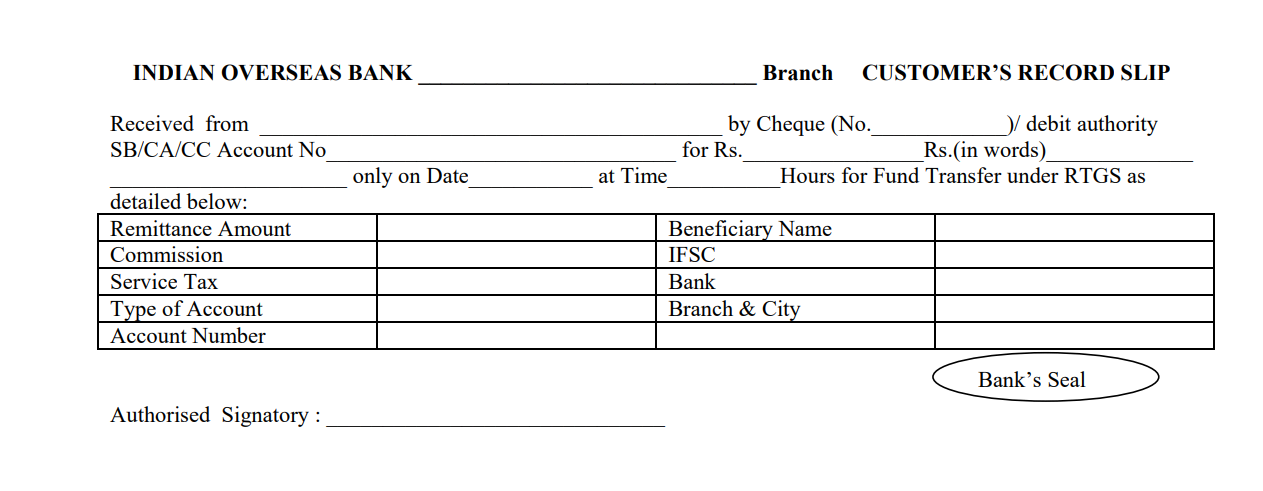

(Image Source: Indian Overseas Bank)