Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

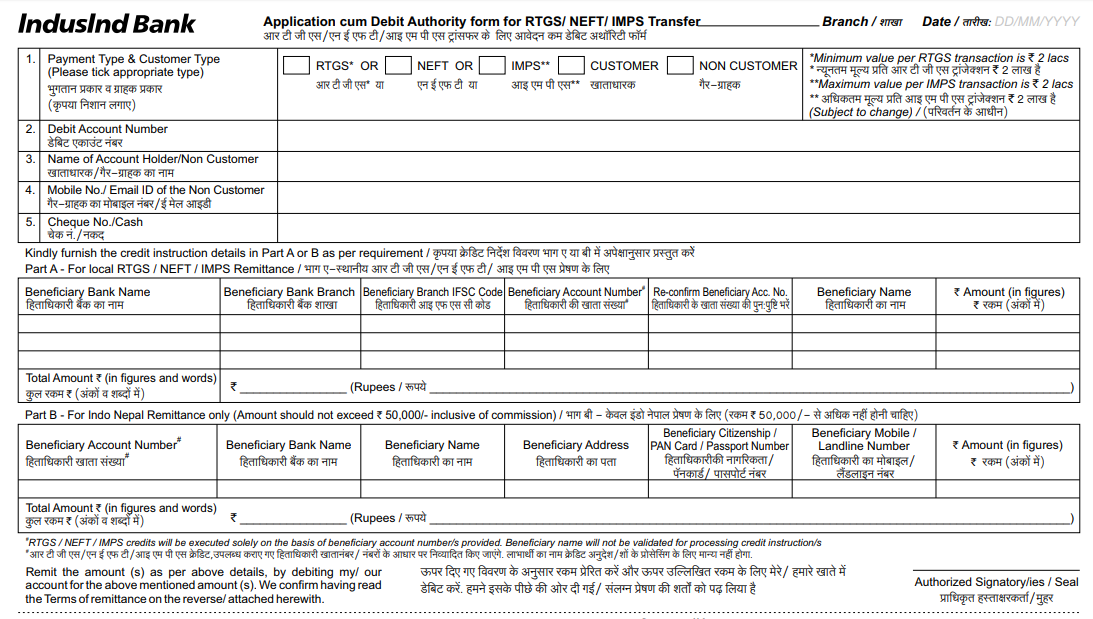

IndusInd Bank RTGS form is a combined application for RTGS, IMPS and NEFT transfer. The bank allows RTGS transactions to both bank account holders and non-customers. RTGS or Real Time Gross Settlement is a continuous money transfer process in which the transaction takes place individually and not in slots.

One can download the IndusInd Bank RTGS form online from the official link (https://www.indusind.com/content/dam/indusind/formcenter/Request%20Forms/RTGS%20NEFT%20IMPS%20From.pdf).

IndusInd Bank RTGS transaction enables account holders make direct and quick payments using cheques, pay orders and demand drafts. Users can do online RTGS transactions by following the below steps:

The payer gets a successful message after the amount is deposited in the beneficiary bank account. In order to know the status of the transaction, the payer can check the hyperlink provided by the bank after the payment is made.

The IndusInd Bank RTGS form provides complete details, terms and conditions regarding the RTGS payment system. For this reason, it becomes convenient both for the customers and non-customers of the bank to initiate RTGS translation at any of the IndusInd branches.

The applicant must fill the below details to initiate RTGS at IndusInd.

As per the instructions mentioned in the IndusInd Bank RTGS form, the minimum value per RTGS transaction is Rs 2 lakhs per day; there is no upper ceiling for this mode of electronic mode of transaction. RTGS is controlled by the Reserve Bank of India (RBI). The amount is directly settled in the record books of RBI and for this reason, the transaction cannot be revoked. RBI guidelines state that the RTGS transaction should reach the beneficiary account within 30 minutes of initiation of the transfer. In case, the transaction fails, the money must be returned to the sender’s account within 2 hours.

The IndusInd Bank RTGS form also consists of several terms and conditions. The applicants need to adhere to the same in order to proceed with the transition. These terms and conditions are

RTGS is the fastest high-value money transfer mode in India. Approximately 45000 bank branches have participated in this electronic payment system.