Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

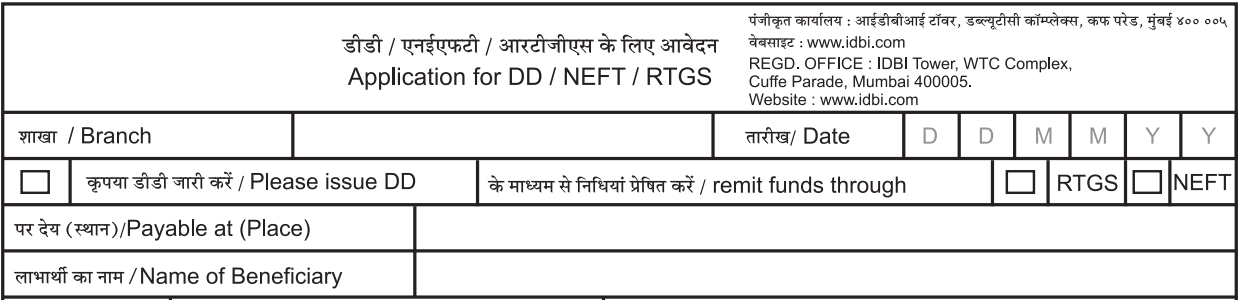

Real Time Gross Settlement or RTGS is a mode of money transfer in India. Most of the private and nationalized banks of the country offer this option of electronic money transfer to their customers. IDBI account holders can also transfer money via RTGS by filling up the IDBI RTGS form.

Get Free Credit Report with monthly updates. Check Now

(Image Source: IDBI)

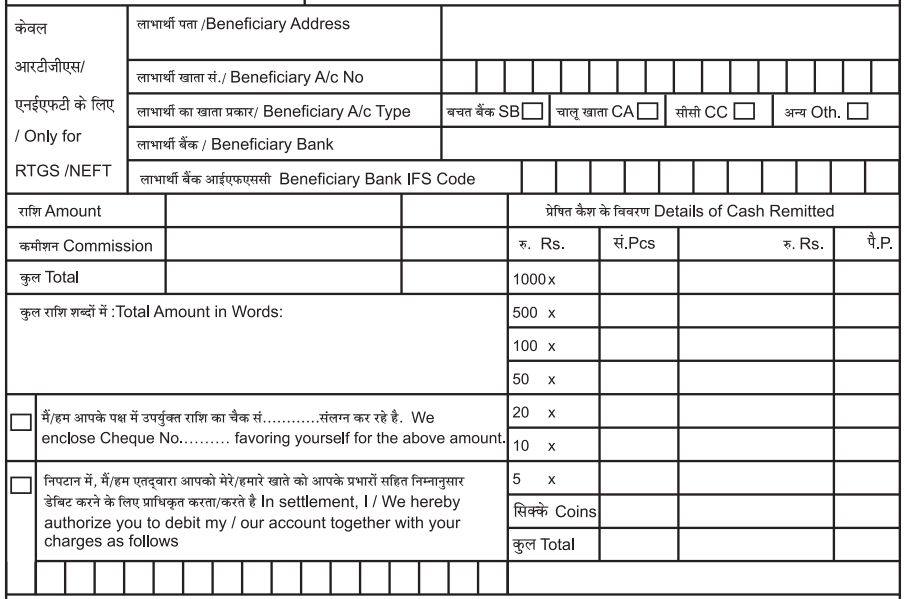

IDBI has a single application form for NEFT, RTGS and Demand Draft. For this reason, it is essential that the sender selects the right option while filling up the form. The following details should be kept handy while filling up the RTGS form.

(Image Source: IDBI)

(Image Source: IDBI)

(Image Source: IDBI)

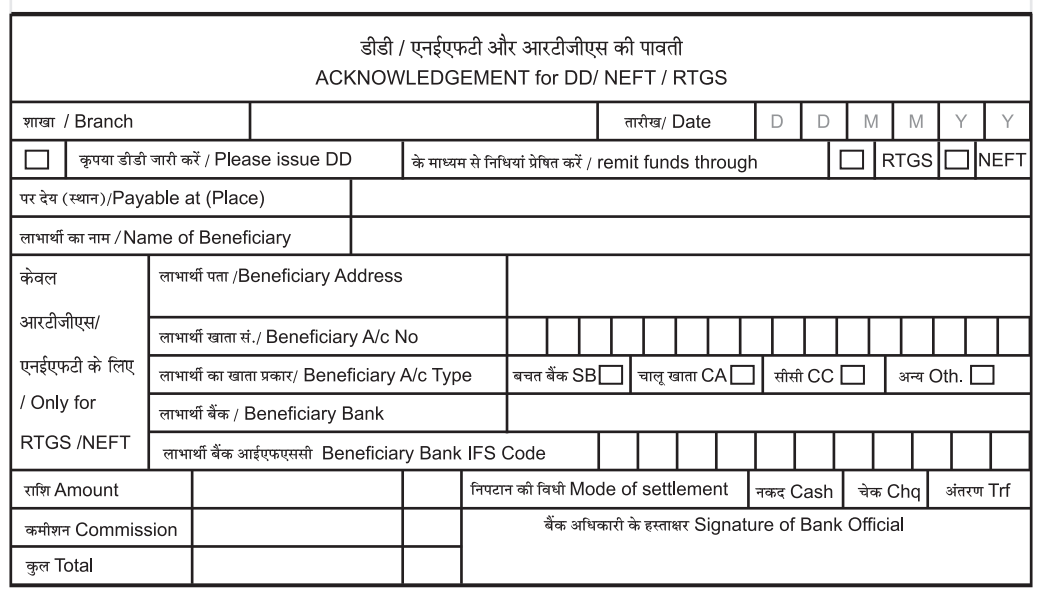

The sender gets an acknowledgement slip after submitting the IDBI RTGS form. In case the payment is not done or delayed, the sender can raise a concern or escalate the matter by showing the acknowledgement slip.

There are some specific terms and conditions for RTGS money transfer through IDBI. These include

RTGS transactions at IDBI ensures that

The minimum amount which can be transferred is Rs 2 lakh. The maximum amount which can be transferred depends on the transaction mode; if RTGS is done at the bank branch then more amount can be transferred. Moreover, there is no fee for the inward transaction.

The RTGS transaction at IDBI is available from Monday to Sunday 24×7. This change in timings has been made to boost the adoption of the digital payments system. Earlier, the same service was available from 9 am to 4 pm. Likewise, the users can initiate the RTGS transaction online using the IDBI RTGS form at any time of the day but it will be processed by the bank only within business hours.

According to RBI guidelines, the amount transferred through RTGS must be deposited in the beneficiary account within 30 minutes. If the time is crossed, the sender can raise a complaint by calling the customer care number. If the issue is still not resolved, the sender can escalate the case to the RBI grievance cell.