Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Most of the private and public sector banks of India permit RTGS transactions. In order to boost digital banking, RTGS and NEFT transactions have been highly encouraged by the central bank of the country, Reserve Bank of India. Allahabad Bank also has the RTGS money transfer facility at all its branches. The bank has a common formatted Allahabad Bank RTGS form across its branches to keep the process same and simple.

Real Time Gross Settlement or RTGS is a high-end money transfer mode; users who want to transfer more than Rs 2 lakhs in a single transaction can opt for this electronic money transfer mode; there is no upper ceiling to the amount.

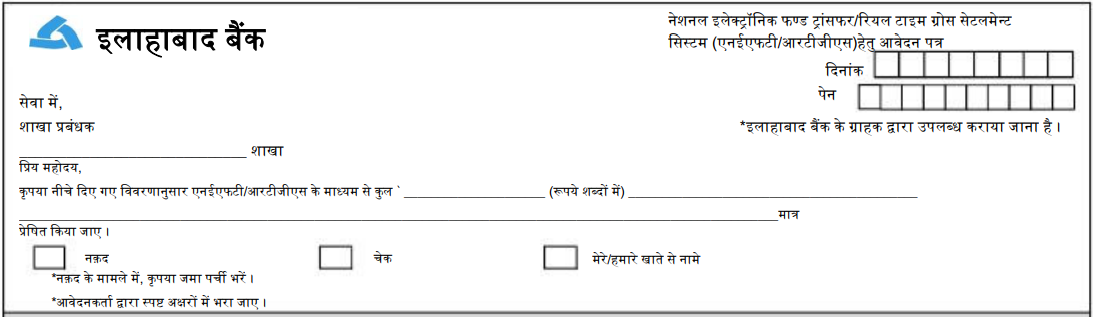

The Allahabad Bank RTGS form is available both in English and Hindi. The local branches might even have a form in regional language to make the process even more easy for the payers. RTGS is controlled by Reserve Bank of India and for this reason, the payment cannot be reversed once it is deposited in the beneficiary bank account. According to RBI guidelines, the amount must be deposited in the beneficiary bank account within 30 minutes by the sender’s bank. In case the transaction is unsuccessful, the amount must be returned within 2 hours.

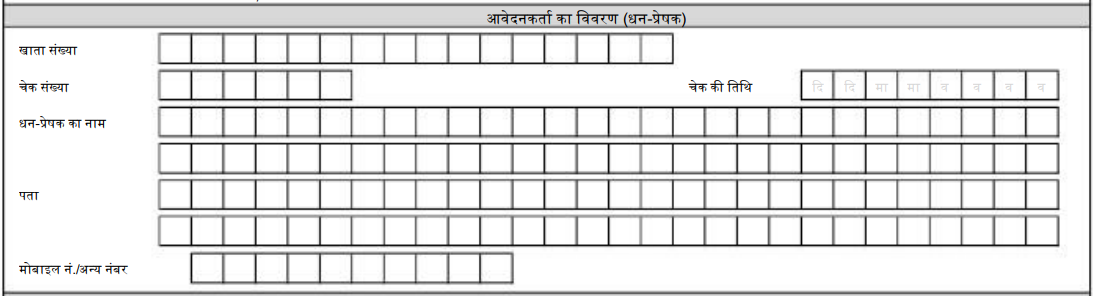

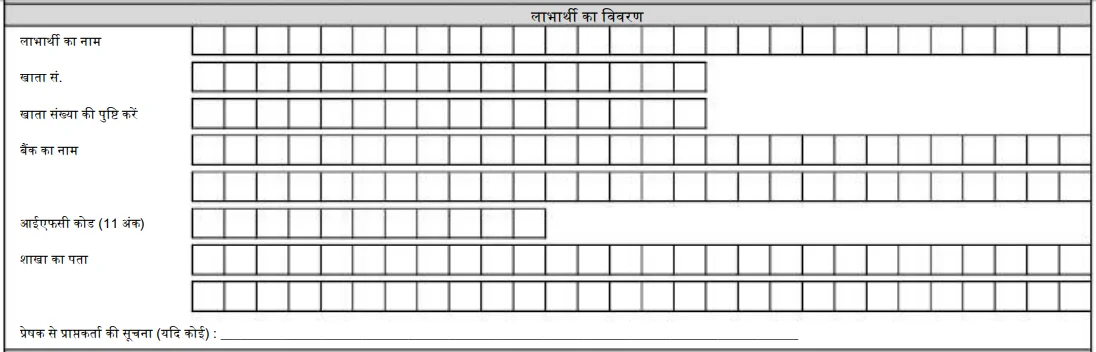

The applicant must enter the following details in the Allahabad Bank RTGS form.

Payment information- This part comes with the information regarding the amount to be paid.

Payer information– This part includes the details of the remitter or payer.

Beneficiary information– This section contains the details of the person who is receiving the payment.

RTGS payments can be made only to banks which have participated in this electronic mode of money transfer. Filling up Allahabad Bank RTGS form requires accepting the following terms and conditions.

As Allahabad Bank permits both online and offline RTGS transactions, the Allahabad Bank RTGS form is available both at the bank website and at the branch. For online transaction, the sender must add the beneficiary to the RTGS transfer mode; this must be done by logging in net banking. While non-customers of Allahabad Bank can perform RTGS transactions at the bank branch, the online RTGS payment is available only to the account holders. There is a nominal charge for RTGS transactions which are performed at the branch; online RTGS payments are free of cost.