Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

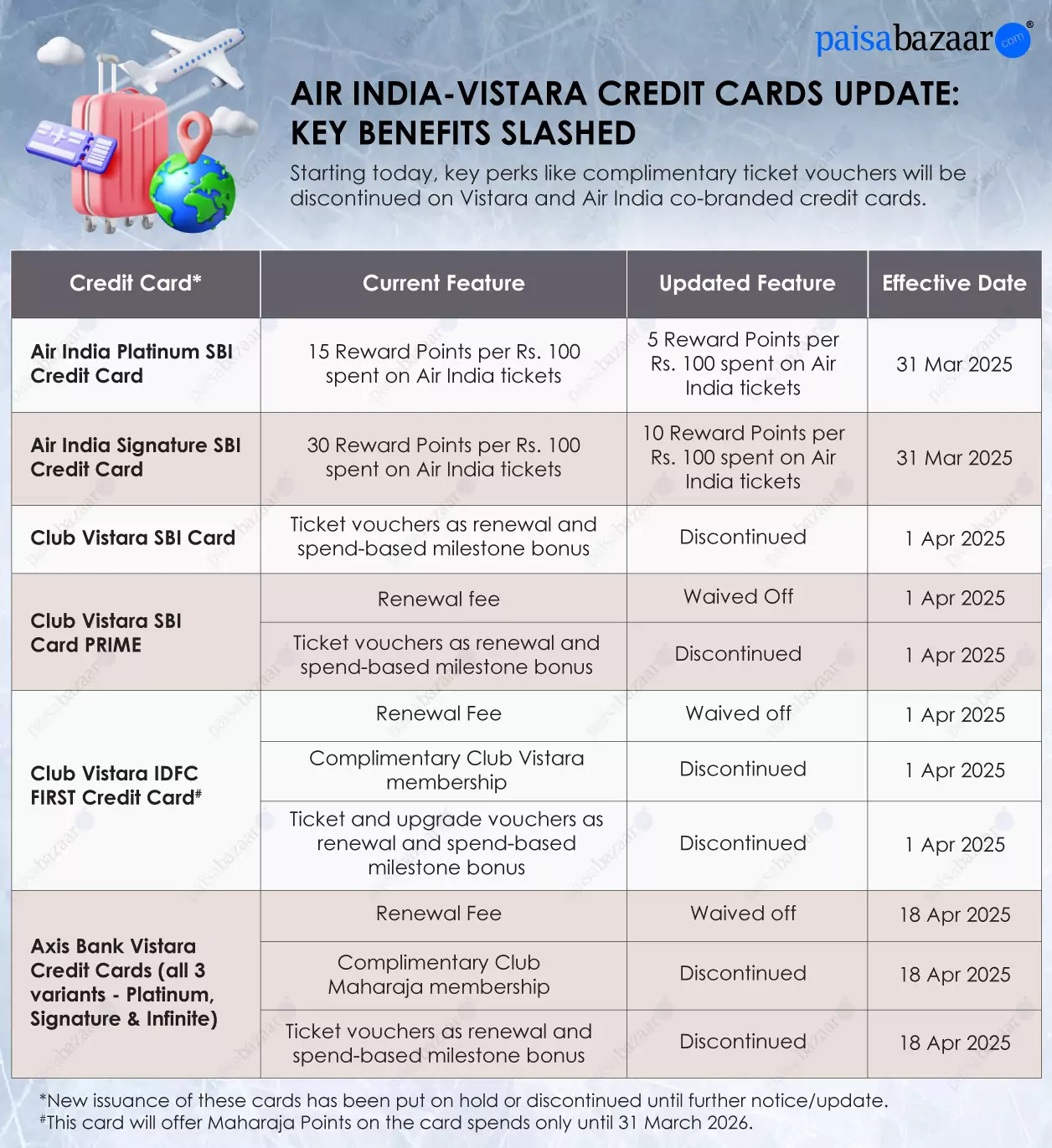

Select credit card providers, including SBI Card, Axis Bank, IDFC FIRST Bank, and American Express® have announced changes in the benefits offered by some of their credit cards which will be applicable in April 2025. While many of these feature updates are for Air India and Club Vistara co-branded credit cards as a result of the merger of these two airline groups, some other changes are regarding revisions in the rewards programs of certain credit cards. Read on to know about the detailed updates.

| On this page |

The latest changes in SBI credit cards are given below:

| Credit Card | Current Feature | Updated Feature | Effective Date |

| Air India Platinum SBI Credit Card | 15 Reward Points per Rs. 100 spent on Air India tickets booked via Air India website/app for self | 5 Reward Points per Rs. 100 spent on Air India tickets | 31 Mar 2025 |

| Air India Signature SBI Credit Card | 30 Reward Points per Rs. 100 spent on Air India tickets booked via Air India website/app for self | 10 Reward Points per Rs. 100 spent on Air India tickets | 31 Mar 2025 |

| Club Vistara SBI Card – both variants: Base and PRIME | Renewal fee | Waived Off | 1 Apr 2025 |

| Ticket vouchers as renewal and spend-based milestone bonus | Discontinued | 1 Apr 2025 | |

| SBI SimplyCLICK Credit Card | 10X Reward Points on online spends made on Swiggy | 5X Reward Points on spends made on Swiggy | 1 Apr 2025 |

Axis Bank has discontinued the following features from 18th April 2025 onwards for Club Vistara co-branded credit cards – Axis Vistara, Axis Vistara Signature and Axis Vistara Infinite:

The following features of Club Vistara IDFC FIRST Credit Card have been discontinued from 1st April 2025 onwards due to the Air India and Club Vistara merger:

The co-branded credit cards with Air India and Club Vistara have faced significant devaluations. The removal of complimentary Club Vistara memberships, bonus air tickets, and upgrade vouchers has diminished cardholders’ savings. While card providers have waived renewal fees to balance this out, it still negatively impacts overall value-back earning potential of the cardholders. Furthermore, the rewards earning rate for Air India SBI card co-branded purchases has decreased. New issuance of these co-branded travel cards have also been discontinued, hinting at a potential phase-out. With the launch of the Air India Maharaja Club after the merger, these changes may also lead to a complete revamp of the co-branded cards in the future.

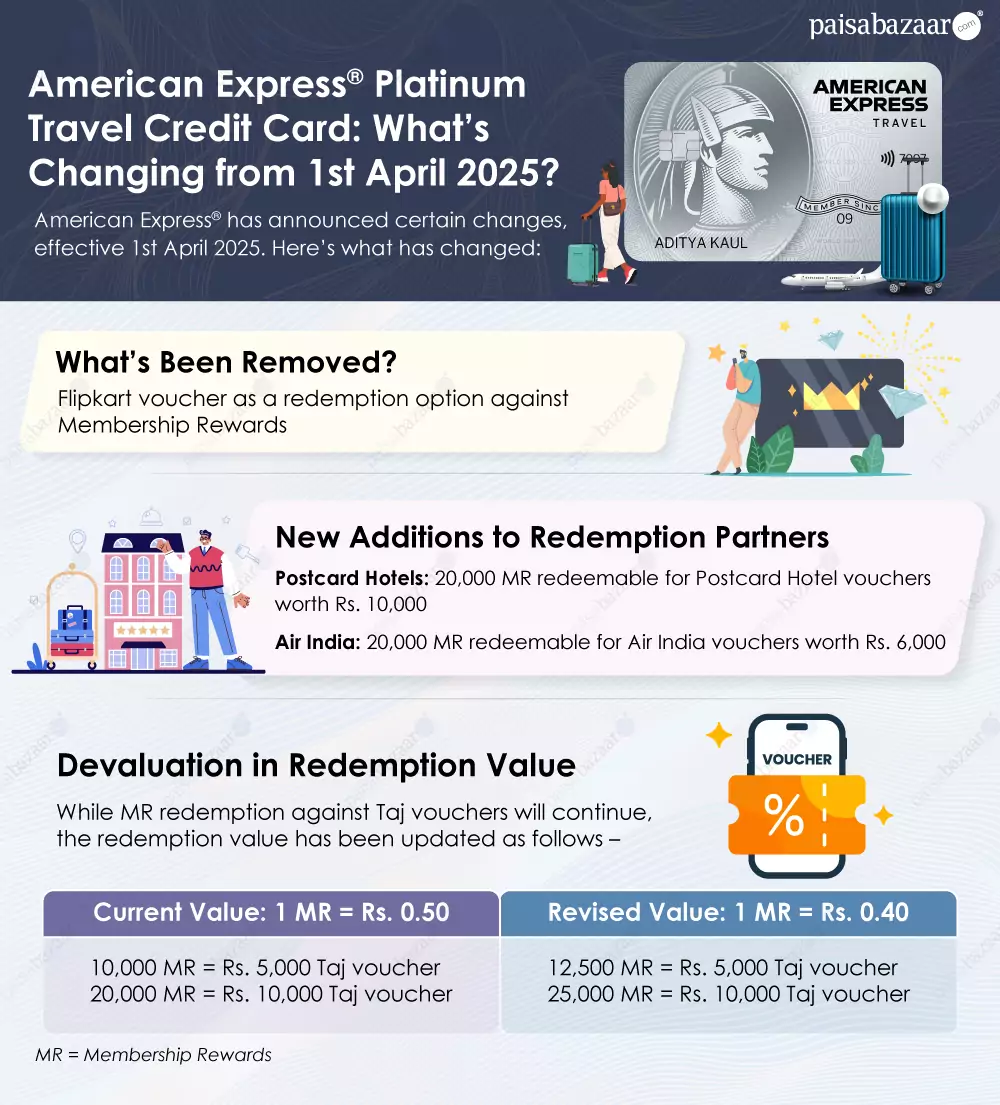

The rewards program of American Express® Platinum Travel Credit Card has undergone certain changes from 1st April 2025, as given below:

| Older Value | Revised Value |

| 1 MR = Rs. 0.50, where

10,000 MR = Rs. 5,000 Taj voucher |

1 MR = Rs. 0.40, where

12,500 MR = Rs. 5,000 Taj voucher |

The updates mentioned above may have affected the redemption options available to cardholders, however the overall value-back that you receive is not significantly impacted. While those who prefer shopping on Flipkart or staying at Taj hotels may find these adjustments disadvantageous, frequent travelers without a specific preference for airlines or hotels may benefit. You will not only have access to additional travel partners for rewards redemption, but the decrease in the redemption value for Taj vouchers from Rs. 0.50 to Rs. 0.40 is balanced out by the value offered for Postcard hotel vouchers, where 1 MR equals Rs. 0.50. This maintains the overall value-back at a similar level.