Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

TransUnion CIBIL Limited (formerly, Credit Information Bureau (India) Limited) is the India's leading credit bureau or Credit Information Company (CIC) that collects and maintains consumer and business information, as provided by the lending banks and NBFCs. It generates CIBIL Score and Report for individuals and CIBIL Rank for companies.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

TransUnion CIBIL is an RBI-licensed credit bureau authorised to collect, maintain and manage credit information provided by financial institutions. It generates CIBIL Score for individuals and CIBIL Ranks for companies. CIBIL report helps understand a borrower’s credit behaviour. CIBIL score and CIBIL Rank helps lenders assess the risk of lending and approve credit applications.

On This Page

| TransUnion CIBIL | CIBIL Score & Report | CIBIL Score Range |

| Steps to Check CIBIL | CIBIL Report Components | CIBIL Rank |

| Role of CIBIL | CIBIL Score Importance | CIBIL Customer Care |

Know your Credit Score if planning for a Loan Check Now

TransUnion CIBIL is India’s leading and most trusted credit bureau that collects and manages consumer information, as provided by the lenders every month.

At the time of credit application approval, lenders consider the CIBIL report, as the primary determinant to analyse the creditworthiness or the risk involved in lending money to the borrower. Therefore, it becomes highly important for financial institutions to check the CIBIL report in their loan approval process.

In the following sections, we will discuss key details about India’s leading Credit Information Company (CIC), TransUnion CIBIL and its role in the borrowing or lending process.

Credit score generated by TransUnion is known as CIBIL score. The detailed credit information report containing your CIBIL score is known as CIBIL report.

|

Get Your Latest Credit Score in Just 2 mins. Check Now

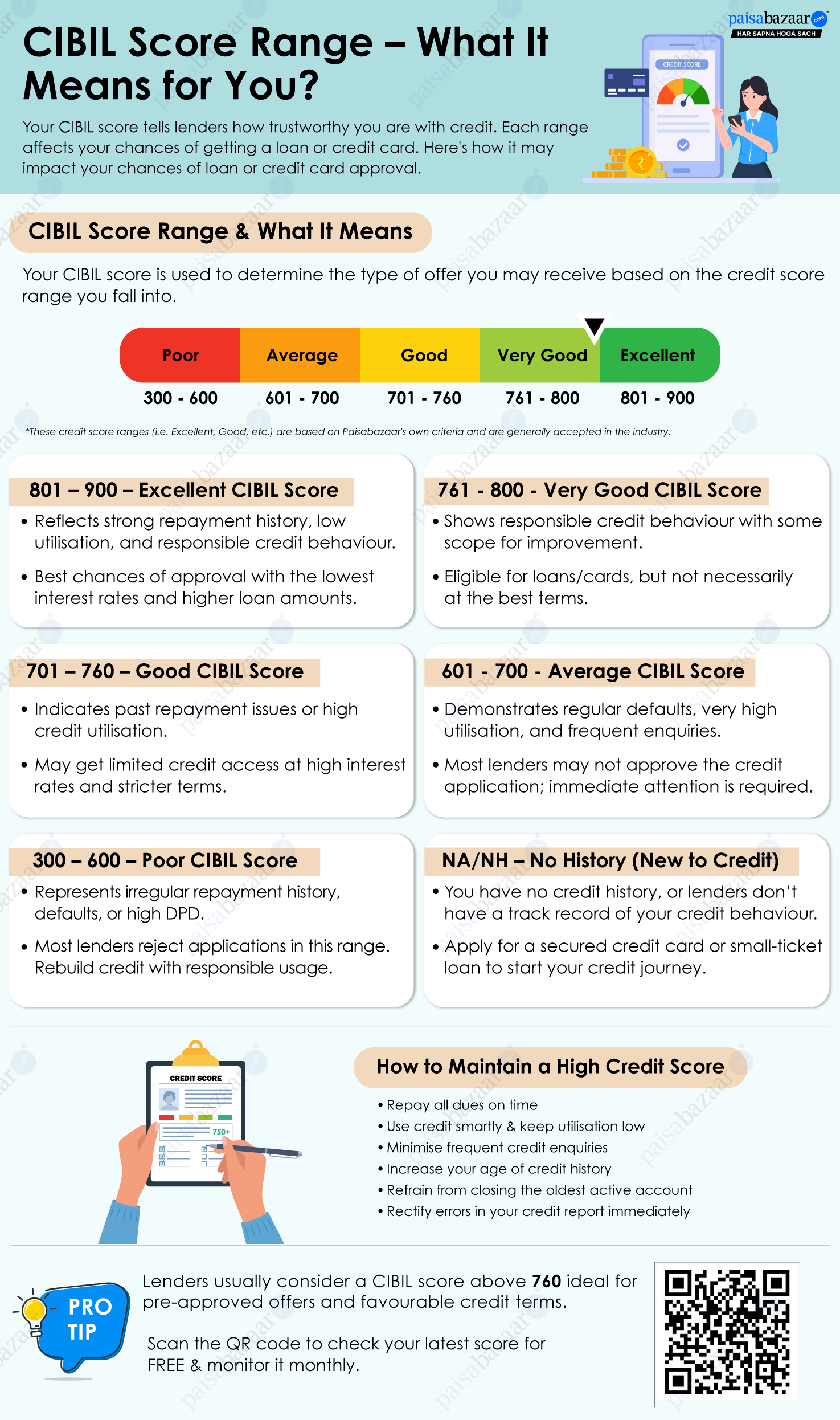

CIBIL score ranges between 300 and 900. Closer the score to 900, more is it considered favourable for loan or credit card approval. Let us understand the CIBIL score range and its significance in detail.

| CIBIL Score | Score Range | What it Means | What it Signifies |

| 801 – 900 | Excellent | You have a superb credit history | You would meet the eligibility criteria of most banks and NBFCs, and are likely to get best offers at this score. |

| 761 – 800 | Very Good | You have been responsible with credit and have displayed very good credit behaviour. | Most banks and NBFCs would be willing to offer you credit. |

| 701 – 760 | Good | You have a good credit score, and your credit application may get approved by some lenders. | You may still be ineligible for most loan and credit card offers. You should work on improving your score to increase your creditworthiness. |

| 601 – 700 | Average | Your credit score needs improvement. | Only a few lenders are likely to approve your credit application, and even if it is approved, you may end up paying interest at a higher rate and with stricter loan terms. |

| 300 – 600 | Poor | Immediate attention required. Your credit history is damaged and you will have to rebuild your credit score. | Very less chances of new loan approval. Check your credit report to determine why your credit score is low and take action quickly. |

| NS/NH/0 | New to Credit | It means you have never taken a loan or a credit card and have no credit history. | To be eligible for the best offers on loans and credit cards in the future, you need to build your credit score. |

*These credit score ranges (i.e. Excellent, Good, etc.) are based on Paisabazaar’s own criteria and are generally accepted in the industry.

Follow these simple steps to check and download your CIBIL Score and receive monthly updates:

Step 1: Click here to check your CIBIL score

Step 2: Enter your basic details, such as name, mobile number, and email address and verify it by using OTP authentication

Step 3: Click on the ‘Get Credit Report’ button to know your credit score

Step 4: Select the CIBIL score, choose the language and month, and click to download your credit report

You have to follow these steps only for the first time. From next, you can simply login to your Paisabazaar account and check your latest updated CIBIL score.

Your CIBIL report is secured and you will have to enter a password to view report. Your Date of Birth (DDMMYYYY format) is the password of your downloaded CIBIL report pdf.

Note: If you find any discrepancy in your credit report, you can raise a dispute with CIBIL.

Check FREE CIBIL Score in 2 Minutes Check Now

The following are the various components of the CIBIL report:

CIBIL Score

Personal Information

Contact InformationYour address(s), mobile number, email ID, and telephone numbers are provided in this section Account Information

Enquiry Information

|

Note: CIBIL credit report provides a detailed historical record of how an individual has handled debt in the past. Please note that the credit report does not include details of an individual’s investment or savings.

Also Read: 7 Easy Steps to Improve your Credit Score

TransUnion CIBIL calculates and generates CIBIL report and CIBIL score for individuals, as well as a commercial Company Credit Report and CIBIL Rank for companies, enterprises and organizations.

The closer a company’s CIBIL Rank is to 1, the higher the chances of getting approved for fresh credit at lower interest rates.

Your CIBIL Score is Available Instantly Check Now

CIBIL credit reports play a crucial role in approving or denying credit applications for new credit, such as loans and credit cards. The details of this process are as follows:

Suggested Read: Reasons for Rejection of Your Credit Card Application

TransUnion CIBIL Limited

One World Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai – 400 013

Read in Detail: CIBIL Customer Care

Know your Credit Score if planning for a Loan Check Now

Ans. You can avail various services of TransUnion CIBIL by creating a ‘myCIBIL Account’ which provides access to the CIBIL self-service portal.

It includes services like checking CIBIL score, viewing/downloading CIBIL credit report, and initiating correction of report errors through CIBIL dispute resolution.

Ans. CIBIL maintains a record of your credit history for up to 7 years from the date of the last report.

Ans. Yes, the CIBIL score is only applicable in India as it is generated based on data provided by Indian lenders only.

Ans. No, TransUnion CIBIL neither has a mobile application for India nor deos it provide any WhatsApp number to users.

However, partners of CIBIL, such as Paisabazaar.com, have mobile apps through which you can check your CIBIL score with monthly updates.

Ans. No, CIBIL does not publish a wilful defaulter list, as it does not maintain any defaulter list. It just maintains a database of cases that contains suit-filed cases and non-suit-filed cases, where a lender can search for a wilful defaulter.

Individual banks and RBI, however, maintains a list of the borrowers who have failed to repay the loan despite their capacity to do so.

Ans. Banks and other financial institutions submit consumer credit record regarding loans and credit cards to CIBIL and other credit reporting agencies every 15 days.

Ans. No, CIBIL is not authorized to edit, change or delete any of the records of your credit history report. It just collects data from its member financial institutions and evaluates it to generate a credit file report and credit score.

Ans. CIBIL Score of NA/NH stands for not applicable/no history. It simply means one of the following:

Ans. CIBIL score of ‘NA/NH’ does not indicate a poor credit history. However, it may decrease the chances of getting a loan sanctioned by some lenders as the risk of lending cannot be estimated by prospective lenders in such cases.

Ans. Yes, some lenders may offer you a loan with a low CIBIL score, as long as you meet the other eligibility criteria. However, you may have to pay a higher interest rate or receive a lower loan amount.