Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Stamp Duty and Registration Charges are the two critical factors that impact a customer’s property purchasing budget in Mumbai. Stamp duty is a type of property tax paid by the buyer while buying a property of any type, be it freehold/leasehold, land (agricultural/non-agricultural), independent house/flat, residential flat or commercial property. Stamp Duty in Mumbai is levied under the Maharashtra Stamp Duty Act, and the amount is majorly determined on the basis of the location and type of the property. However, to promote affordable housing, the Maharashtra government has reduced stamp duty charges on properties for the next two years in the areas falling under the Mumbai Metropolitan Region Development Authority (MMRDA).

The table below shows various charges applicable to property registration in Mumbai.

| Area | Stamp Duty in Mumbai | Registration Charges in Mumbai |

| Within municipal limits | 5% of the market value | 1% of the market value |

| Within limits of Municipal Council/Panchayat/Cantonment of any area within MMRDA | 4% of the market value | 1% of the market value |

| Within Gram Panchayat limits | 3% of the market value | 1% of the market value |

Stamp duty rates are calculated on the higher value between the Ready Reckoner rate and the value of the property as stated in buyer-seller agreement.

Get Home Loan at the Low Interest Rate from Top Lenders Apply Now

There are several factors that affect the Stamp Duty charges in Mumbai. These are:

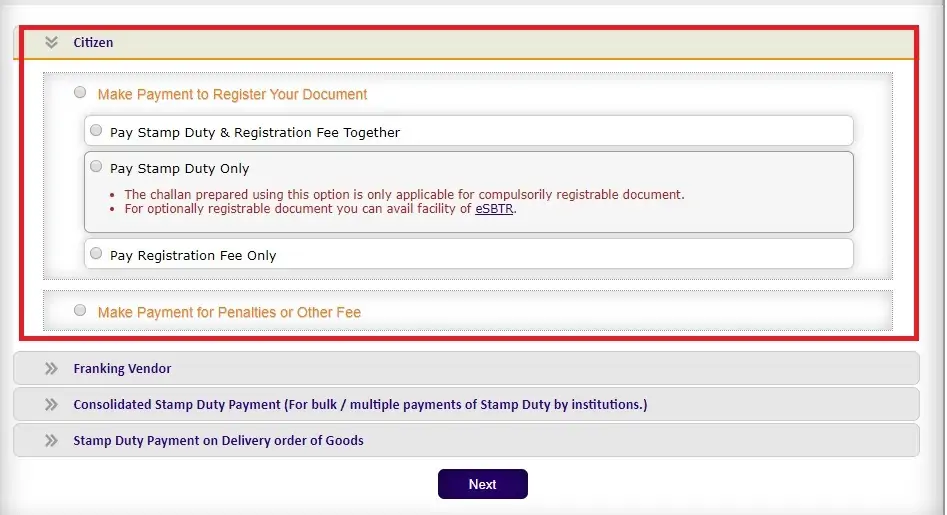

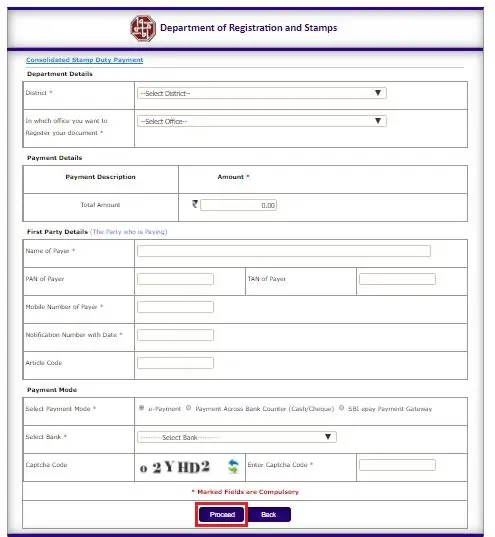

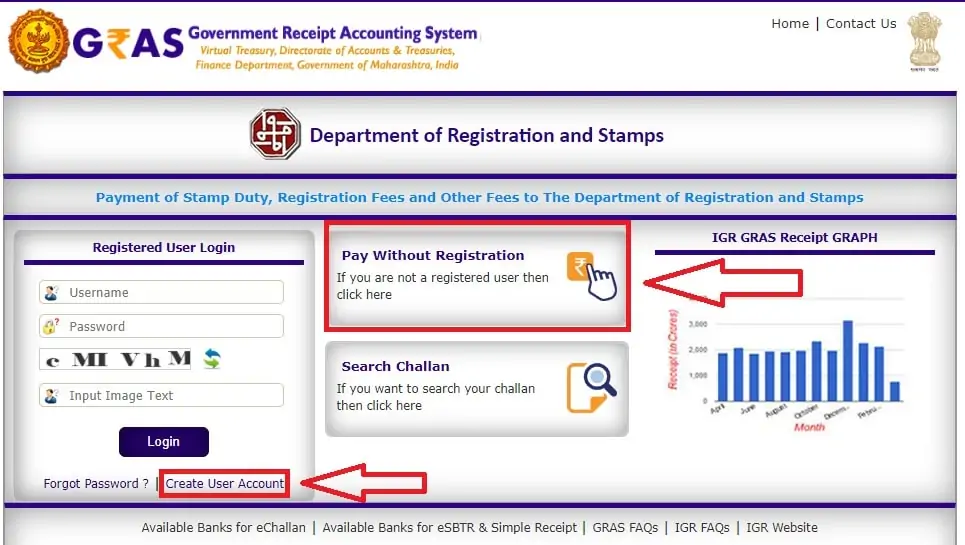

In Mumbai, the payment of Stamp Duty and Registration Charges can be done online through the Government Receipt Accounting System (GRAS). Follow the steps mentioned below to do the same.

If you choose ‘Create User Account’, submit your details and login into your account to pay Stamp Duty and Registration Charges. If you choose ‘Pay Without Registration’, follow the steps below,