Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

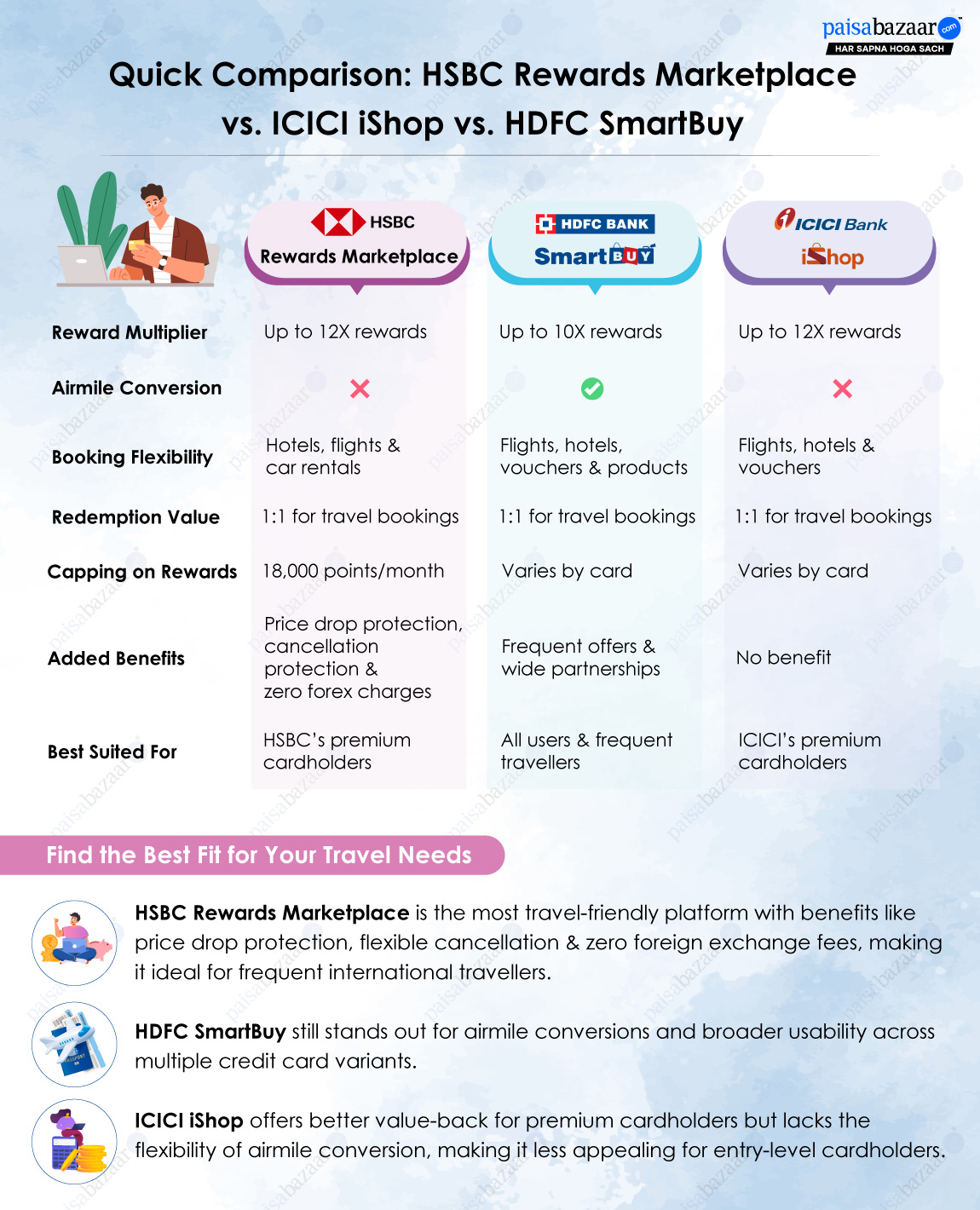

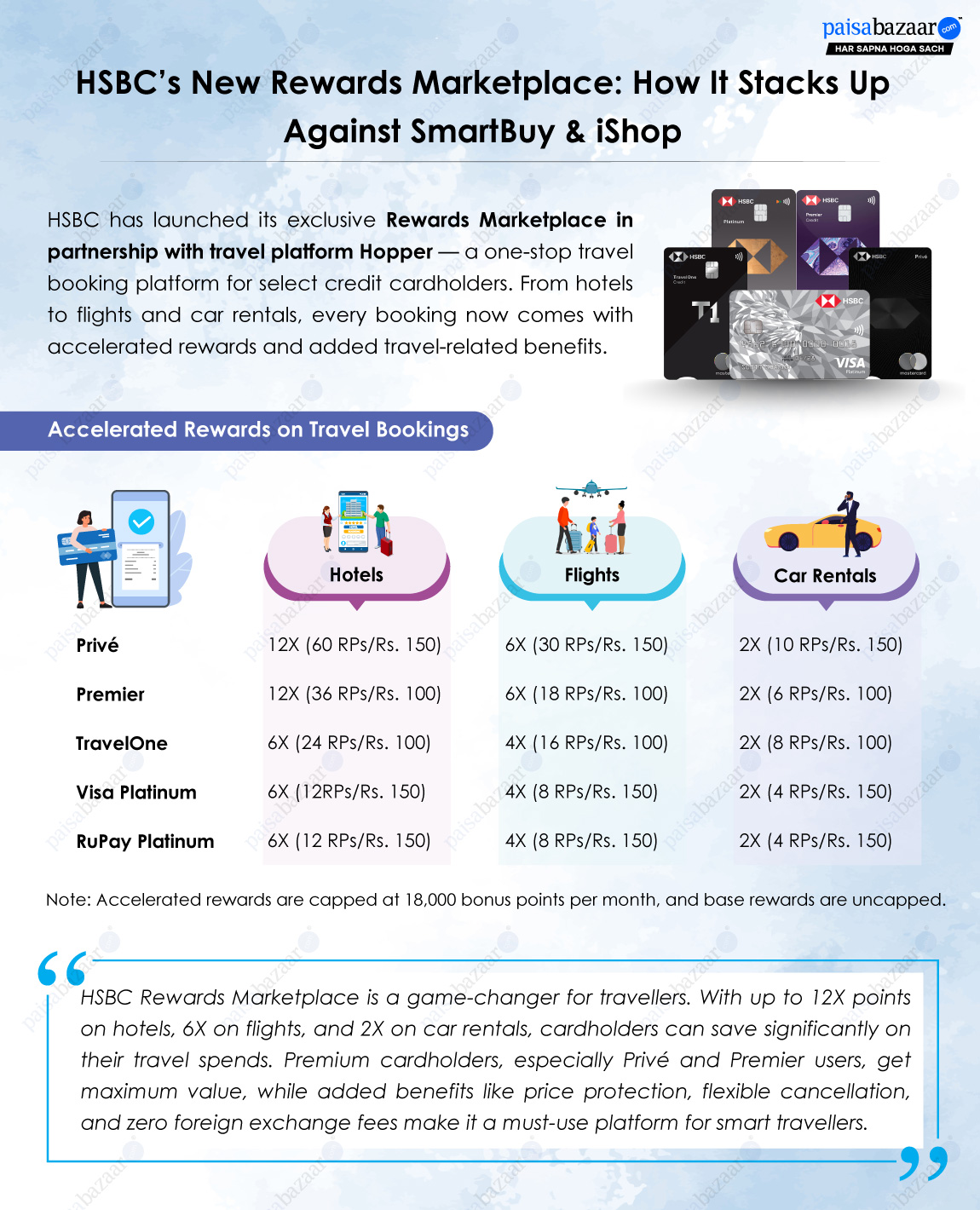

After ICICI, HSBC has also launched its own travel rewards portal, i.e., HSBC Rewards Marketplace, in partnership with travel platform Hopper. Now, HSBC credit cardholders can also earn accelerated reward points on their travel spends, including flight & hotel bookings and car rentals.

Through HSBC Rewards Marketplace, select HSBC credit cardholders can earn up to 12X points on hotel bookings, 6X points on flight bookings and 2X points on car rentals. Cardholders can redeem the accumulated reward points through this platform at a ratio of up to 1:1 and save significantly on their travel expenses. However, this platform is only accessible to Privé, Premier, TravelOne, Visa Platinum, and RuPay Platinum cardholders.

So, can this platform truly compete with ICICI’s iShop and HDFC’s SmartBuy? Let’s find out.

What is HSBC Rewards Marketplace?

What is HSBC Rewards Marketplace?HSBC Rewards Marketplace is a rewards-based travel platform that is accessible to select HSBC credit cardholders. This platform allows HSBC cardholders to earn accelerated reward points on travel bookings, including flights, hotel bookings and car rentals. Cardholders can redeem the accumulated reward points against their travel bookings at a value of up to Rs. 1 per point and save on their travel spends.

While this platform directly competes with iShop and SmartBuy, the reward redemption is limited only to travel bookings. Whereas, both iShop and SmartBuy allow redemption against travel bookings, vouchers, and other categories.

Here is a list of eligible HSBC Credit Cards along with their reward rate on travel bookings on Rewards Marketplace:

| Credit Card | Hotels | Flights | Car Rentals |

| Privé | 12X (60 points/Rs. 150) | 6X (30 points/Rs. 150) | 2X (10 points/Rs. 150) |

| Premier | 12X (36 points/Rs. 100) | 6X (18 points/Rs. 100) | 2X (6 points/Rs. 100) |

| TravelOne | 6X (24 points/Rs. 100) | 4X (16 points/Rs. 100) | 2X (8 points/Rs. 100) |

| Visa Platinum | 6X (12 points/Rs. 150) | 4X (8 points/Rs. 150) | 2X (4 points/Rs. 150) |

| RuPay Platinum | 6X (12 points/Rs. 150) | 4X (8 points/Rs. 150) | 2X (4 points/Rs. 150) |

Note: Accelerated rewards are capped at 18,000 bonus points per month, and base rewards are uncapped.

Cardholders can redeem the accumulated reward points against partner airlines and hotels as per the below details:

| Airline/ Hotel | Redemption Ratio |

| Partner Airlines | |

| Air India, Air France–KLM, British Airways, Etihad Airways, EVA Air, Japan Airlines, Singapore Airlines, Qantas Airways, Qatar Airways, Thai Airways, Vietnam Airlines | 1:1 |

| Air Asia | 1:3 |

| Hainan Airlines, Turkish Airlines, United Airlines | 2:1 |

| Partner Hotels | |

| Accor, IHG® Hotels & Resorts, Marriott International, Wyndham Hotels & Resorts | 1:1 |

| Shangri-La | 5:1 |

Follow the steps below to redeem reward points through the HSBC Rewards Marketplace:

Step 1: Log in to the HSBC mobile app and select your credit card.

Step 2: Tap on ‘View More’ and then click on ‘Redeem Points’.

Step 3: Click ‘Redeem Points Now’ to be redirected to the Rewards Marketplace.

Step 4: Select the ‘Travel with Points’ option and make your bookings using your credit card.

Apart from accelerated rewards, this platform offers flexible travel benefits that are listed below:

Best Price Guarantee: In case a cardholder finds a lower rate within 24 hours of booking, the difference amount will be refunded as travel credit in the Travel with Points wallet, which can be used for future bookings.

No Foreign Exchange Fees: All bookings are made in Indian Rupees, so cardholders do not need to pay any foreign exchange fees.

Minimal Convenience Fees: This platform charges a minimum convenience fee of Rs. 300 for domestic flights and Rs. 700 for international flights, per customer per leg.

Cancel For Any Reason: Cardholders can add flexibility to their trip by getting up to a 100% refund in case of booking cancellation up to 3 hours before.

Dedicated Customer Service: Cardholders can connect on 000 80008 20206 (free within India) or +44 20 4623 5225 (overseas) regarding any queries.

Price Drop Protection: Cardholders will get a refund in the form of travel credits (up to Rs. 1,500) in case price of the flight booking drops within the next 10 days of the booking date.

Here’s a comparison of three premium cards, HSBC Premier, ICICI Emeralde Private and HDFC Infinia, to understand how much value-back these cards offer through their respective travel portals.

| Category | Amount Spent (in Rs.) | Rewards via HSBC Premier | Rewards via ICICI Emeralde | Rewards via HDFC Infinia |

| Flights | 50,000 | 9,000 | 9,000 | 16,667 |

| Hotels | 80,000 | 28,800 | 28,800 | 26,667 |

| Car Rentals | 20,000 | 1,200 | 600 | 3,334* |

| Shopping | 30,000 | 900 | 5,400 | 10,000 |

| Total | 1,80,000 | 39,900 | 43,800 | 56,668 |

*Applicable only on bookings through Zoomcar.

Let’s see how much you save as per the above accumulated reward points through the respective portals:

| Rewards Portal | Rewards Accumulated | Overall Value-back |

| Rewards Marketplace | 39,900 | Rs. 39,900 against flight & hotel bookings |

| iShop | 43,800 | Rs. 43,800 against travel & other vouchers |

| SmartBuy | 56,668 | Rs. 56,668 against flight & hotel bookings and Tanishq & Apple vouchers Rs. 28,334 on other categories |

HSBC Rewards Marketplace is a travel platform that allows cardholders to make travel bookings & earn accelerated reward points. Whereas, with HDFC SmartBuy, HDFC cardholders can earn accelerated reward points on travel bookings as well as on shopping at popular brands. Besides this, both iShop & SmartBuy portals allow cardholders to redeem the accumulated reward points against travel bookings, vouchers & other categories. Whereas, with HSBC Rewards Marketplace, the redemption is only limited to flight & hotel bookings.

However, HSBC Rewards Marketplace compensates for this by offering additional travel benefits, such as zero foreign exchange fees, price drop protection, cancellation protection and more. Overall, eligible HSBC credit cardholders can save significantly with this platform. Yet, compared to its competitors, HDFC SmartBuy turns out to be a better option due to its accessibility to all credit cardholders and wide partnerships.