Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

While co-branded travel credit cards are quite useful for travellers who are loyal to a specific airline or hotel, they are often restrictive in terms of their benefits. This is why many travellers prefer to get airline-agnostic credit cards which offer broader benefits across multiple travel partners, more flexible reward redemptions, and a better overall value.

HSBC TravelOne and Axis Atlas are two such airline-agnostic credit cards designed for users who want travel perks without being tied to a specific loyalty program. Axis Atlas has been one of the best travel credit cards for a couple of years, whereas HSBC TravelOne is a relatively newer addition to this segment. Both cards offer strong value-back on travel, but come with different strengths and lifestyle privileges.

Here is a detailed comparison of these credit cards with a break-down of their features, benefits and fees to help you decide which one better fits your travel style and spending habits.

Joining/Annual Fee

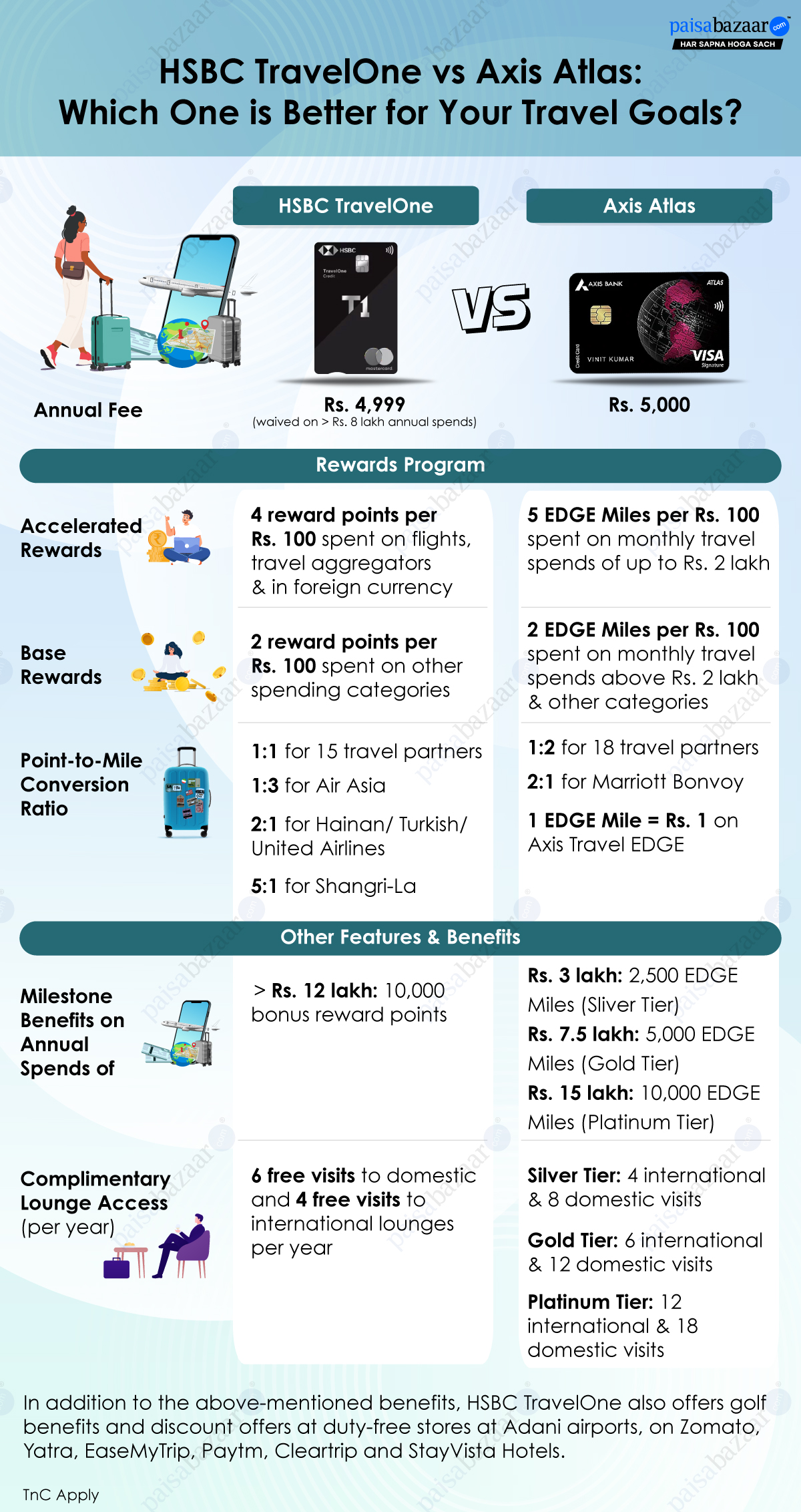

Both the cards come with similar annual fees with HSBC credit card charging a fee of Rs. 4,999 and Axis credit card charging Rs. 5,000 every year.

Fee Waiver

HSBC TravelOne comes with a fee waiver if the cardholder spends more than Rs. 8 lakh in a year, which is a little high, however Axis Atlas does not offer any such spend-based fee waiver option.

Forex Mark-up Fee

Despite being travel-focused, neither card offers any respite from the additional fee charged on international transactions; both charge high forex mark-up of 3.5%.

While both cards charge a similar annual fee, only TravelOne comes with a fee waiver option. If you can meet the spending requirement then you can avail the benefits of TravelOne free of cost, while Axis Atlas will only be profitable if the annual value-back you can earn using this card justifies the fee charged.

HSBC Travel One Credit Card:

Axis Bank Atlas Credit Card: 2,500 bonus EDGE Miles on making the first card spend within 37 days of card setup

HSBC Travel One offers more extensive joining benefits related to travel and dining categories, along with cashback and rewards which go beyond the joining fee amount. On the other hand, Axis Atlas only offers bonus EDGE Miles which match its fee in value. Though the values of joining benefits offered by these cards have a significant difference, you should note that those offered by TravelOne come with spending conditions, while those by Axis Atlas only require the cardholder to make a card spend, irrespective of the spending amount.

Given below are the rewards program details for both the travel credit cards:

| Rewards | HSBC TravelOne | Axis Atlas |

| Accelerated Rewards | 4 reward points per Rs. 100 spent on flights, travel aggregators and in foreign currency | 5 EDGE Miles per Rs. 100 spent on monthly travel spends up to Rs. 2 lakh |

| Base Rewards | 2 reward points per Rs. 100 spent on other spending categories | 2 EDGE Miles per Rs. 100 spent across monthly travel spends above Rs. 2 lakh and other categories |

| Redemption Ratio (Point to Air Miles/Hotel Point conversion) |

1:1 for 15 travel partners 1:3 for Air Asia 2:1 for Hainan/ Turkish/ United Airlines 5:1 for Shangri-La |

1:2 for 19 travel partners 2:1 for Marriott Bonvoy 1 EDGE Mile = Rs. 1 on Axis Travel EDGE |

Reward Capping: Accelerated reward points earned using HSBC TravelOne credit card are capped at 50,000 reward points per month, beyond which the base rate would apply. Axis Atlas credit card comes with a similar condition, but with a higher earning limit. Here, accelerated rewards are capped for monthly travel spends of up to Rs. 2 lakh, beyond which the base rate applies.

15 Common Travel Partners for Point-to-Miles Transfer:

Air Asia, Air France-KLM, Air India, Etihad Airways, Japan Airlines, Qantas Airways, Qatar Airways, Singapore Airlines, Thai Airways, Turkish Airlines, United Airlines, Accor, IHG Hotels & Resorts, Marriott, and Wyndham Hotels & Resorts

In addition to these, HSBC TravelOne also has British Airways, EVA Air, Hainan Airlines, Vietnam Airlines and Shangri-La Group as travel partners, while Axis Atlas also comes with partners like Air Canada, Ethiopian Airlines, SpiceJet and ITC.

Here, HSBC TravelOne’s 2% reward rate on travel spends appears to be overshadowed in comparison with 10% value-back offered by Axis Atlas on travel spends. However, accelerated value-back on travel aggregator platforms still makes HSBC TravelOne a strong contender since such travel portals are popular among many consumers due to their competitive rates. Another point to note here is that Axis Atlas comes with certain limitations on reward points-to-mile transfers. The travel partners of Axis Atlas are categorised into Group A and Group B, each subject to a separate capping on reward redemption.

Other Features and Benefits

Other Features and Benefits Other card benefits include milestone bonus, complimentary lounge access and other lifestyle-related benefits:

HSBC TravelOne Credit Card: 10,000 bonus reward points on spending more than Rs. 12 lakh in a year

Axis Bank Atlas Credit Card:

Milestone benefits offered by both the cards are in the form of bonus rewards. Though HSBC credit card offers a higher value-back, only high-spenders will be able to avail it. On the other hand, Axis Atlas comes with a tier-based milestone benefit structure where even low spenders can get some bonus savings, albeit of a lower value.

*Silver tier is the default tier offered irrespective of the annual spends

HSBC TravelOne Credit Card: 6 complimentary visits to domestic and 4 to international lounges per year

Axis Bank Atlas Credit Card:

Here, even though Axis Atlas offers up to 12 international and up to 18 domestic lounge visits every year, a number much higher that those offered by HSBC TravelOne, this access is dependent on the tier status of the Axis card user which is assigned according to the annual spends made. So, if you are a high spender and wish to get a higher number of lounge access then Axis Atlas would be a better choice.

HSBC TravelOne Credit Card also comes with golf benefits like complimentary rounds and lessons with green fee discount, along with discount of up to 20% at duty-free stores at Adani airports, on Zomato, Yatra, EaseMyTrip, Paytm, Cleartrip and StayVista Hotels. However, Axis Atlas falls behind as it does not offer any such lifestyle-related benefits.

HSBC TravelOne and Axis Atlas are both quite similar in their value-back programs, but while one also offers golf and discount benefits, the latter comes with a better reward rate. Given below are some key points to keep in mind while making a choice between these two travel credit cards –

Choose HSBC TravelOne Credit Card If:

Choose Axis Bank Atlas Credit Card If: