Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Utility bills, including electricity, water, gas, etc., along with DTH and mobile recharges are some essential expenses which make up a considerable portion of our monthly budget. However, many credit cards either exclude this spending category from their value-back programs or only offer a base savings rate. So, credit card options that cater to these spends are quite limited. If you are looking to explore credit cards that actually reward you on such payments, Axis Bank has some strong options.

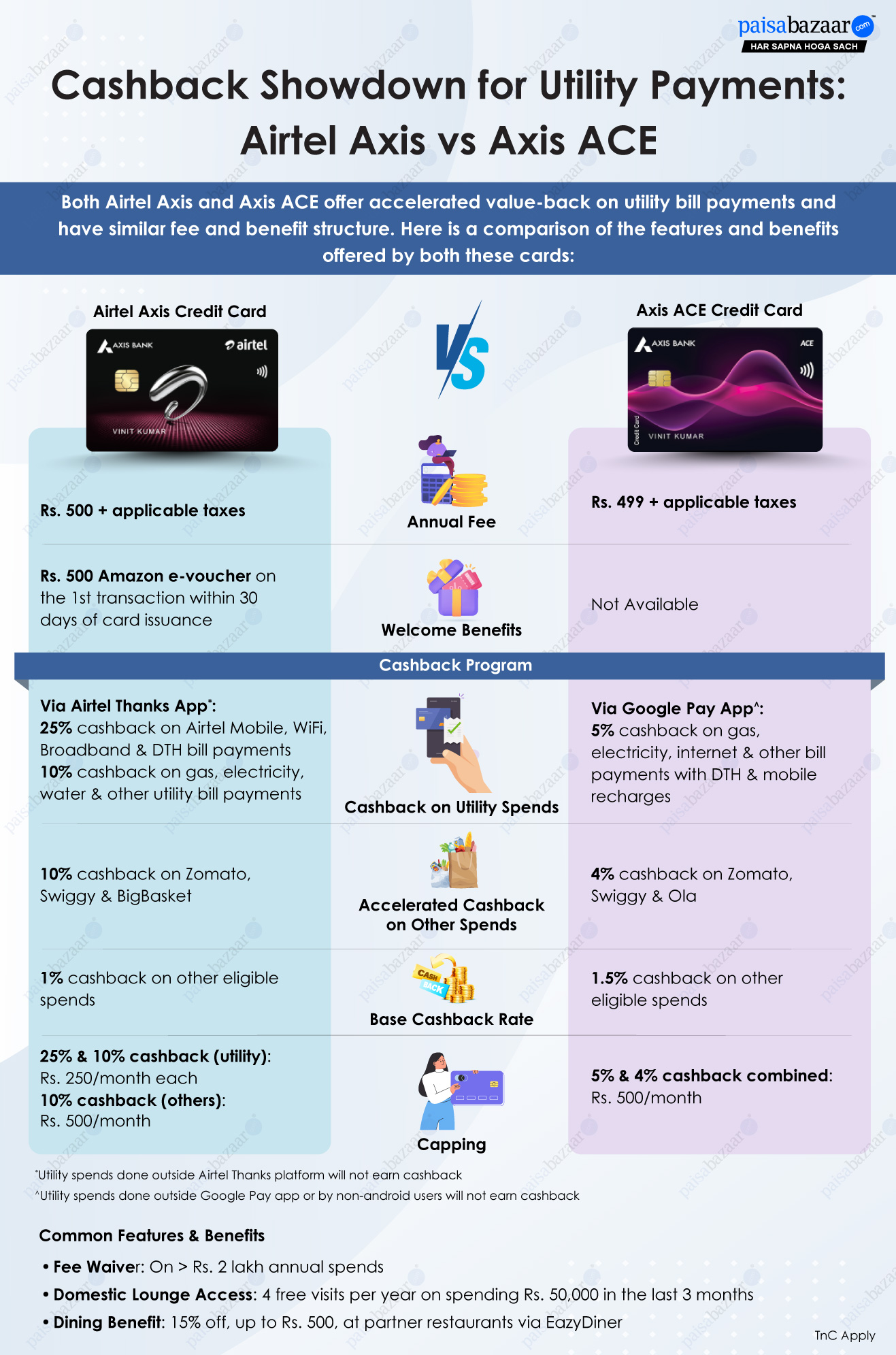

Two of the Axis Bank Credit Card offerings, namely Airtel Axis and Axis ACE, stand out by providing noteworthy saving rates on utility bill payments. Both are cashback cards offered at a low annual fee with accelerated value-back on bills, recharges and select preferred partner brands. Though offering similar benefits and fees, their utility benefits are associated with different payment portals and come with different capping conditions.

Here is a detailed comparison of the fees, features and benefits of Airtel Axis Credit Card and Axis Bank ACE Credit Card to analyse which one comes with a better overall value-back and is more suitable for your utility bill payments:

Card Fee and Joining Benefit Comparison

Card Fee and Joining Benefit ComparisonBoth credit cards come with similar low annual fee and the same spend-based fee waiver condition –

Joining/Annual Fee:

Fee Waiver: On spending more than Rs. 2 lakh in a year

Joining Benefit: Though they have a similar fee structure, only Airtel Axis offers a welcome bonus in the form of an Amazon e-voucher worth Rs. 500 as compensation for its joining fee on making the first card transaction within 30 days of card issuance.

| Cashback Category | Airtel Axis | Axis ACE |

| Cashback on Utility and Recharge Bill Payments | Via Airtel Thanks App: 25% cashback on Airtel Mobile, WiFi, Broadband & DTH bill payments 10% cashback on gas, electricity, water & other utility bill payments |

Via Google Pay App: 5% cashback on gas, electricity, internet & other bill payments with DTH & mobile recharges |

| Accelerated Cashback on Preferred Partners | 10% cashback on Zomato, Swiggy & BigBasket | 4% cashback on Zomato, Swiggy & Ola |

| Base Cashback | 1% cashback on other eligible spends | 1.5% cashback on other spends |

| Capping | – Rs. 250 per month each for 25% & 10% cashback on utility bills/recharges – Rs. 500 per month for 10% cashback on preferred partners |

Rs. 500 per month for 5% & 4% cashback combined |

Here, both Axis Bank Credit Cards come with similar cashback benefits with accelerated value-back on utility bill payments, recharges and preferred partners. Even the preferred partner list of each card has 2 out of 3 brands in common, namely Zomato and Swiggy. However, despite these similarities, the accelerated cashback rates look vastly different with 25% and 10% on Airtel Axis and just 5% and 4% on Axis ACE. Such a contrast could have made Airtel Axis a clear leader in this card comparison, however the low capping limits on both the cards somewhat level the field between these two credit cards. Moreover, each of these cards offers cashback on utility bills paid using different payment platforms, where one prefers Airtel Thanks, the other favours Google Pay. The base cashback rates offered by these cards are also quite close in value and are not accompanied by any capping on cashback earning.

Given below is a breakdown of possible monthly spends, along with their corresponding cashback earnings using Airtel Axis and Axis ACE credit cards:

| Category | Monthly Spends | Airtel Axis | Axis ACE |

| Electricity | Rs. 6,000 | Rs. 250 (capped) | Rs. 300 |

| Water Supply | Rs. 1,000 | – | Rs. 50 |

| Gas Supply | Rs. 500 | – | Rs. 25 |

| Mobile Recharge | Rs. 600 | Rs. 150 | Rs. 30 |

| WiFi Bill | Rs. 1,400 | Rs. 100 (capped) | Rs. 70 |

| Zomato | Rs. 800 | Rs. 80 | Rs. 25 (capped) |

| Swiggy | Rs. 800 | Rs. 80 | – |

| Ola | Rs. 4,000 | Rs. 40 | – |

| Grocery (BigBasket) | Rs. 4,000 | Rs. 340 (capped) | Rs. 60 |

| Miscellaneous Shopping | Rs. 6,000 | Rs. 60 | Rs. 90 |

| Total | Rs. 25,100 | Rs. 1,100 | Rs. 650 |

Through this comparison of cashback earnings on various monthly spends, Airtel Axis Credit Card seems to be the clear winner. It offers around 4.38% savings with cashback worth Rs. 450 more than that offered by its competitor which only offers around 2.58% savings. However, if you only consider utility and recharge spends, the difference in savings is not that big with Airtel Axis offering Rs. 500 cashback on Rs. 9,500 utility-related spends and Axis ACE offering cashback worth Rs. 475. This draws our focus to how capping on preferred partners plays an important role in differentiating between the cards’ savings potentials.

Here, the capping limitations applicable on Airtel credit card amount to a total of Rs. 500 on utility and recharges combined and Rs. 500 on preferred partners. Whereas the capping of Rs. 500 on all utility, recharges and preferred partners combined on the latter brings down the maximum possible cashback to half of that allowed by Airtel Axis on these spending categories.

Suggested Read: Best Cashback Credit Cards in India

Both Airtel Axis and Axis ACE credit cards offer the same lifestyle benefits as follows:

Airtel Axis Bank Credit Card and Axis ACE Credit Card both come at almost the same annual fee and offer accelerated cashback on similar categories, including utility bill payments, and a similar base rate on other eligible spends. Furthermore, even their fee waiver conditions, domestic lounge access and dining discount features are identical. Nevertheless, the key differences lie in the detailed terms and conditions of their cashback programs.

Choose Airtel Axis Bank Credit Card If:

Choose Axis Bank ACE Credit Card If: