Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

In good news for those who had not been able to link their PAN card with Aadhaar, the Central Board of Direct Taxes (CBDT), working under the Central Government has yet again extended the deadline. Taxpayers have now got time till 31st March 2020 to link their PAN cards with Aadhaar. Earlier, the deadline was set to 31st December 2019 after which, as per media reports, PAN cards not linked with the respective Aadhaar cards were liable to be deactivated until cardholders linked it with Aadhaar.

CBDT issues clarification on linking of PAN with Aadhaar.

There were reports in media that PANs which are not linked with Aadhaar by 31.12.2019 may be invalidated. Now,the cut-off dt for intimating Aadhaar no & linking PAN with Aadhaar is 31.03.2020, unless specifically exempted

— Income Tax India (@IncomeTaxIndia) December 31, 2019

CBDT said in an official statement that quoting PAN and Aadhaar while filing Income Tax Returns starting April 1st 2019 will still be mandatory unless specifically exempted by the organisation.

It is also made clear that w.e.f.01.04.2019, it is mandatory to quote and link Aadhaar number while filing the return of income, unless specifically exempted.

— Income Tax India (@IncomeTaxIndia) March 31, 2019

Those who have not linked their PAN cards with Aadhaar can get it done at the earliest to avoid last minute rush. The Income Tax Department has made ample provisions for taxpayers to get it done both online and offline.

One can link PAN with Aadhaar card through SMS as well. The mobile number, however, should be registered in UIDAI’s database. Write an SMS UIDPAN<12 Digit Aadhaar> <10 Digit PAN> and send it to 567678 or 56161.

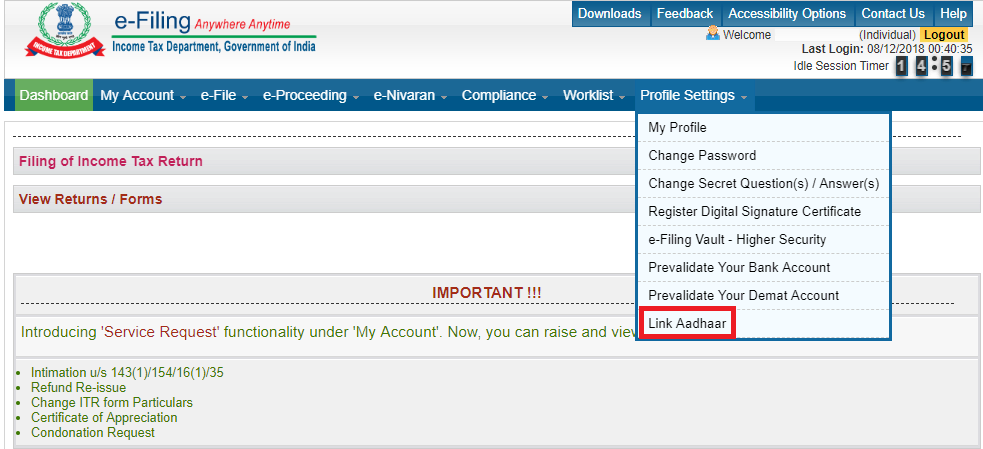

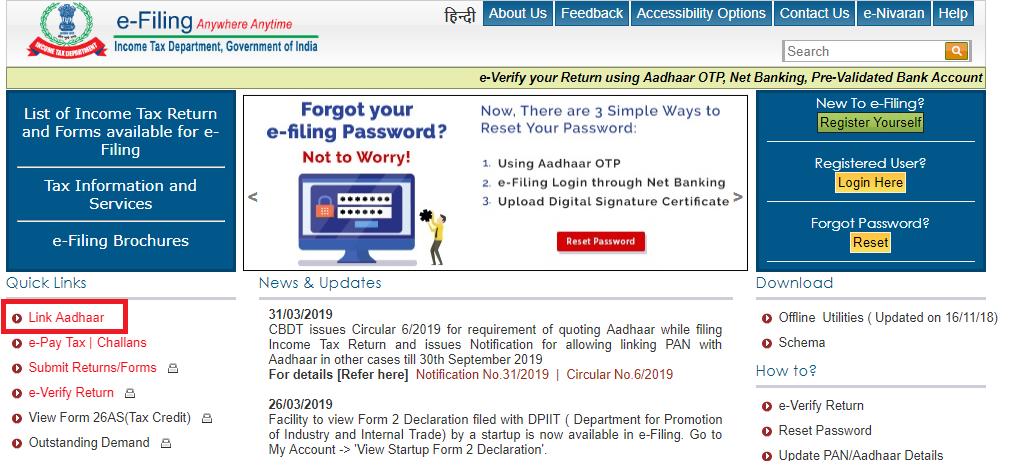

There are two methods to link PAN with Aadhaar online. In the first procedure, one has to login to the ITD account and link the PAN card with Aadhaar. Those taxpayers, who do not have an account at Income Tax Department’s e-Filing portal, can do it directly through the Link PAN portal.

One has to follow the steps mentioned below to link PAN with Aadhaar by logging in to ITD’s portal:

There is a provision for taxpayers to link PAN with Aadhaar without logging in to the ITD portal as well. One has to follow the steps mentioned below:

There may be cases where PAN card of an applicant may not be linked with Aadhaar. In such cases, the name of the applicant does not match on both the documents. In case of a mismatch, one has to get the details updated and link the documents again.

The government has already deactivated a number of PAN cards in the past on various grounds. One should link PAN with Aadhaar for a number of reasons:

Also Read: How to Check if PAN Card is active or not?