Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

A Recurring Deposit (RD) is a savings vehicle where one makes monthly instalments for a predefined tenure, to earn fixed returns. The interest rate offered on RD is the same as that on Fixed Deposits (FDs) for a particular bank. It is considered one of the most risk-free investor-friendly investment schemes available in the market.

Get Your Free Credit Report with Monthly Updates Check Now

The minimum duration for investment is 6 months, and maximum tenure is 10 years. Perfect for short-term investment goals, returns from RDs are assured, with no accompanied market risk.

Systematic Investment Plan (SIP) is a mode of investment in Mutual Funds, which involves a regular investment of small amounts of money at predefined intervals. The frequency of instalments is as per the investor’s choice and ranges from a daily basis to annual.

Investors who seek high returns on investment and can tolerate high risk should opt for SIP to fulfil their financial goals.

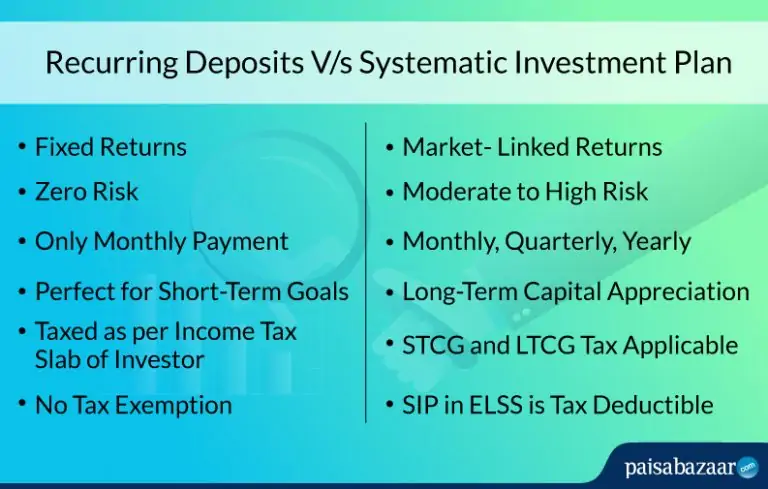

The returns from RD are fixed, depending on the interest rate specified by the bank. The interest rate offered is the same as that on Fixed Deposits (FDs). On the other hand, returns from SIP in Mutual funds are not fixed but linked to market fluctuations. If the underlying securities of the investment portfolio perform exceptionally well, the returns delivered are comparatively high.

Since the returns from SIP are market-linked, one is never certain about the returns from this investment. If the market sentiment is in line with the thought-process of the fund manager, the returns would be high, if not, the fund might report losses for that period.

This makes SIP in Mutual Funds a riskier investment option than RDs, as the returns from the latter are assured, as per the predetermined rate of interest.

An individual has to invest every month in a Recurring Deposit (RD), whereas the frequency of SIP instalment is as per the investor’s wish. It can be daily, weekly, monthly, quarterly, semi-annually or annually. The flexibility to choose the investment frequency in SIP makes it a preferred choice over RD based on this parameter.

Checking Credit Report Monthly has no impact on Credit Score Check Now

The decision to invest in a Recurring Deposit or a Systematic Investment Plan depends on the investment objective and horizon of the investor. If the investment horizon is short, say, 1 year to 4 years, RD could be the preferred choice of investors. Whereas, if you want to invest for a longer duration, say for more than 5 years, it is advisable to choose SIP in Mutual Funds as it becomes less risky in the long run and delivers higher returns. RDs are meant for fulfilling short-term savings goals, while SIP helps in long-term wealth creation.

The interest earned on RD is directly added to one’s taxable income and taxed as per the income tax slab of the investor.

Taxation on SIP in Mutual Funds depends on the type of mutual fund scheme. Short Term Capital Gains Tax and Long Term Capital Gains Tax is levied as per the holding period of mutual fund units, which differs for equity and debt mutual funds. Equity Linked Savings Scheme (ELSS) is one such mutual fund scheme which is eligible for a tax deduction on investment up to ₹1.5 lakh under Section 80(C) of the IT Act. However, to avail the tax benefit, each SIP instalment needs to be locked in for 3 years.

Here is a list of benefits offered by SIP mode of investment in Mutual Funds:

Suppose you invest Rs.500 in a mutual fund at a 10% rate of return. After a year, interest earned would be Rs.50. From the next year, you’ll earn interest on Rs. 550. Thus, in the long run, one can greatly benefit from the compounding effect.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Here is a list of benefits offered by Recurring Deposits: