Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

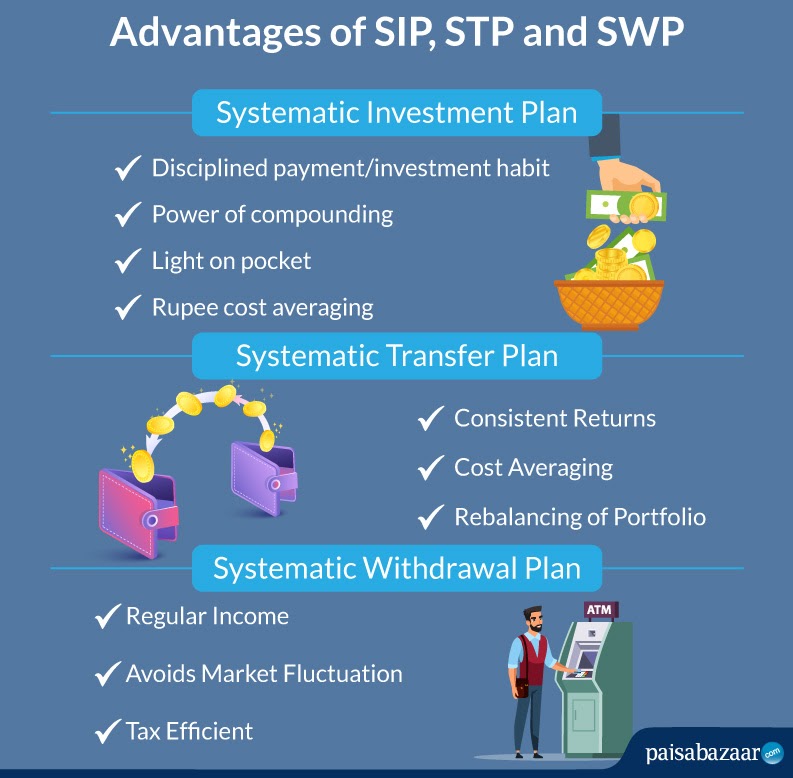

Systematic Investment Plan (SIP), Systematic Transfer Plan (STP) and Systematic Withdrawal Plan (SWP) are all related to Mutual Funds and often confuse retail investors. While Systematic Investment Plan (SIP) is a mode of payment in mutual fund schemes and Systematic Withdrawal Plan (SWP) is just opposite of SIP, a mode of withdrawal/redeeming units from the funds. Systematic Transfer Plan (STP) is a mode of transfer of money from one mutual fund plan to the other in a systematic manner periodically.

An alternative to lump sum payment in mutual funds, SIP allows investors to invest the money in mutual funds through small installments monthly. This reduces the financial burden on the investor and gives the added benefits of power of compounding and rupee cost averaging. Each time you pay the installment amount, you buy more units of the fund. The fund money instead of one downpayment spreads over the time period of your investment tenure

In this process, money from a fund is transferred to another mutual fund scheme but from the same Asset Management Company/AMC. This is not one time transfer of the whole amount but done through periodic payments of fixed amounts from time to time. It is similar to SIP as the investment in the fund scheme is being done through installments, but the difference is that the installment money is not withdrawn from the bank as in SIP but from the previous fund plan. This also averages out the costs like SIP as well as rebalances the portfolio through transfer and reallocation of the money from one asset to another like from Debt Funds to Equity or vice-versa

It is contrary to SIP where you withdraw the invested money from the fund plus the returns earned via short periodic withdrawals over the time. Each time you withdraw the money, you redeem certain units and gradually the number of units decline before it goes zero which means you have withdrawn the whole amount. You can also choose to withdraw only the returns earned per month instead of the invested amount which keeps it intact. These are the two types of SWPs, namely Fixed Income and Appreciation Withdrawal. Fixed Income is obtaining a fixed amount as income by redeeming certain units and Appreciation Withdrawal is receiving only the returns as per the varying ROI (Rate of Interest)

| Parameters | SIP | STP | SWP |

| Kind of Plan | Investment | Transfer | Withdrawal |

| Process | Monthly Installment to one scheme | Monthly Transfer from one MF scheme to another | Periodic Withdrawals from a mutual fund scheme |

| Financial Goal | Long Term Capital Appreciation | Capital Appreciation for idle money | Source of regular income |

| Taxability | No tax on investments but capital gains | Taxation of every monthly transfer amount as it is redeemed from the previous mutual fund | Every withdrawal is taxed as its money/gains after redemption of units |

Also Read: Taxation of Mutual Funds