Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Over the years, it has been widely noticed that investors have often confused Systematic Investment Plan (SIP) and Mutual Fund as two mutually exclusive financial products, or assumed Mutual Funds to be a second name for lump sum investments. Many have googled the difference between SIP and Mutual Funds, only to find that, in essence, the former is a mode of investment into the latter.

In this article we will explain the different concepts to rid you of any further confusions.

Table of Contents :

A mutual fund is an investment instrument where investors pool in their assets which are later invested in equity, debt and other money market securities, by the professional fund manager. They are further classified into equity funds, debt funds and hybrid funds, based on the asset allocation.

The returns generated from the mutual fund investment are distributed proportionally among the investors. A professional and competent manager who has a sound knowledge of the financial market manages the fund, thus bridging the gap of layman’s knowledge of the financial world and that of an expert.

While investing in Mutual Funds, you can either go for a Lump Sum investment or opt for a Systematic Investment Plan (SIP). Yes! You read that right. SIP is a mode of investment in Mutual Funds, and not an altogether different product to be compared with Mutual Funds. Hence, the point of comparing SIP with Mutual Funds becomes redundant. What it needs to be compared with is the other mode of investment, i.e. the lump sum mode.

Lump Sum investment refers to a one-time investment than an individual makes in a mutual fund scheme. Investors with a large sum of disposable income in hand, coupled with a good risk appetite, go for lump sum investment. Whereas, through SIP, you make regular investment of small amounts of money in a mutual fund, at predefined intervals. One can invest as low as Rs. 100 (in some schemes) or Rs 500 in a mutual fund scheme via SIP. This option is not available in the lump sum mode, where the minimum investment is much higher, mostly around Rs 5,000.

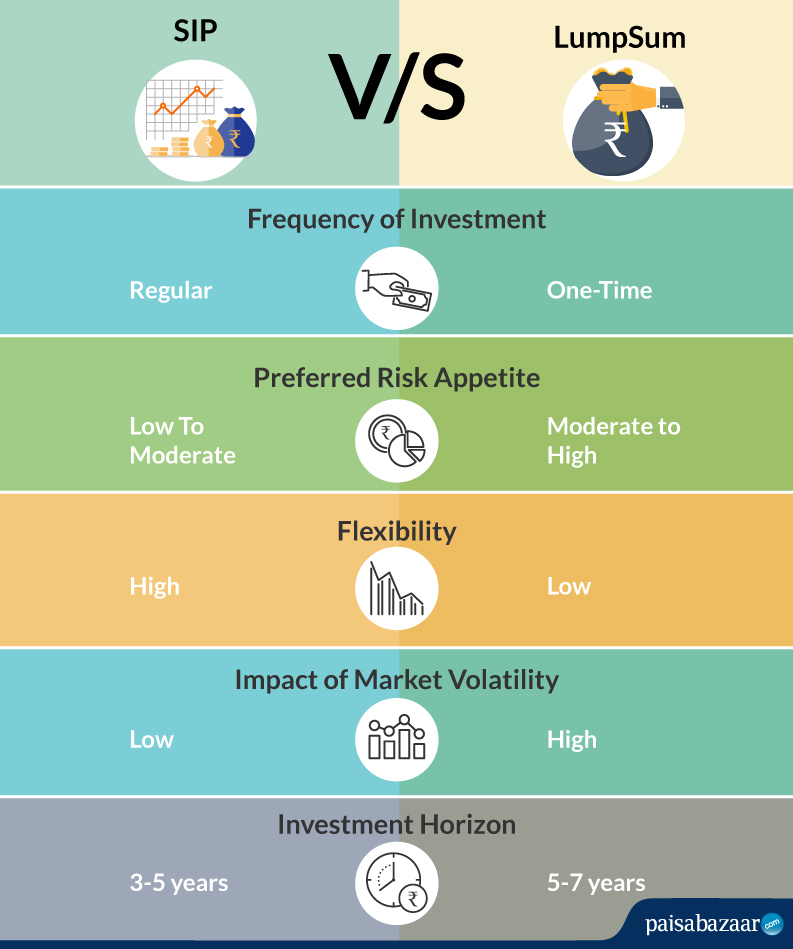

The two modes of investment have been compared on the following parameters:

On the other hand, SIP allows you to have flexibility in terms of investment, where you can invest small amounts of money on a regular basis (either weekly, fortnightly, monthly, etc.) as per your convenience. This doesn’t disturb your expenditure pattern and paves way to disciplined investment.

SIPs prevent investors from such losses and ensure decent returns as your investment is managed by a team of market experts. Through regular, disciplined investment, one can mitigate the risk of a potential market crash and need not worry about when and how to invest.

Additionally, SIP enables investors to increase their investment amount as per their wishes. There are several fund houses that allow investors to increase the SIP amount.

Suppose you invest Rs.500 in a mutual fund at a 10% rate of return. After a year, interest earned would be Rs.50. From the next year, you’ll earn interest on Rs. 550. Thus, in the long run, one can significantly benefit from the compounding effect.

Here is a list of top 10 mutual fund schemes that have delivered impressive SIP returns over the years. It should be noted that the 5 -Year Returns of the following funds, might not look attractive as of now, owing to the recent economic slowdown. However, the returns are expected to jump back, once the market conditions normalise.

| Fund Name | AUM (cr.) | 5- Year Returns |

| Axis Bluechip | Rs. 11,824 | 6.75% |

| Axis Midcap | Rs. 5,193 | 4.54% |

| Axis Long Term Equity | Rs. 21,659 | 3.22% |

| Canara Robeco Bluechip | Rs. 353 | 2.98% |

| SBI Focused Equity | Rs. 8,264 | 2.93% |

| Mirae Asset Emerging Bluechip | Rs. 9,614 | 1.63% |

| JM Multicap | Rs. 139 | 1.59% |

| Axis Small Cap | Rs. 2,507 | 1.41% |

| SBI Small Cap | Rs. 3,476 | -0.39% |

| DSP Tax Saver | Rs. 6,096 | -2.50% |

{Data as on March 27, 2020; Source: Value Research}

{Funds have been ranked based on the 5 -Year Returns}