Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Table of Content:

Information ratio (IR) or Appraisal Ratio is defined as a mathematical measure used to determine the consistency of a fund manager to provide investors with risk-adjusted returns over the long term. A higher ratio typically represents the ability of a fund manager (mutual fund scheme) to outperform other fund managers or the benchmark, over a specific period of time. In most cases, the IR value is annualized similar to longer-term returns data to facilitate an easier understanding. It should be noted that using the Information Ratio is most effective when the funds or portfolio of similar type are compared to each other.

The following are some key pointers to keep in mind when selecting a mutual fund to invest in, based on this ratio:

For instance, you want to invest in a good fund and you are confused between two funds say Fund A and Fund B. Now, you want to compare the information ratio of these two funds to select the better option. Let us take S & P 500 index as the benchmark.

Fund A has given 11% returns where the benchmark has given 8% returns and the standard deviation of the fund and benchmark returns is 6%. And, Fund B has given 12% Returns where the benchmark has given 8% returns and the standard deviation is 9%

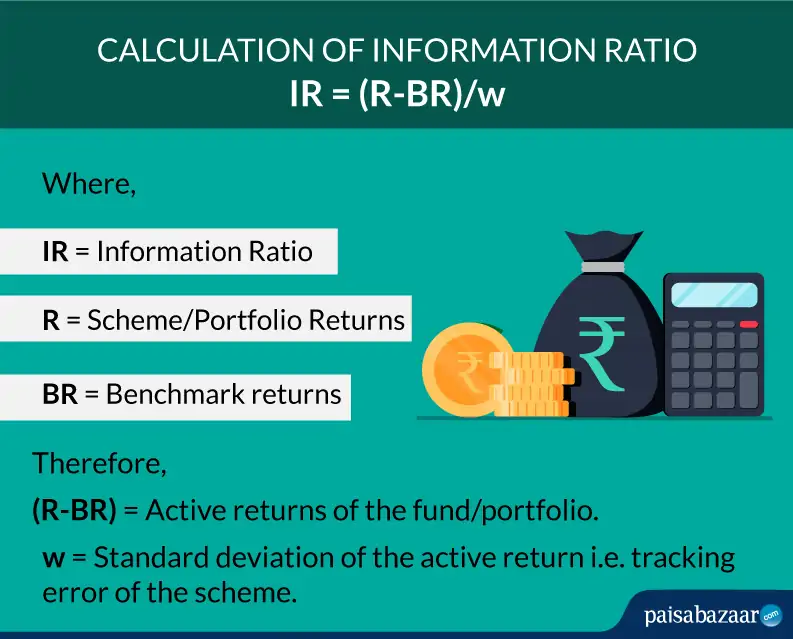

Using the formula of Information ratio:

IR= (11% – 8%)/6% = 50%

IR= (12% – 8%)/9% = 44%

The Information ratio of Fund A is more than that of Fund B. This implies that Fund A is more consistent with the returns and has the potential to give better returns than Fund B.

Q.1: Why IR is a reliable tool to help investors choose the best fund?

Ans: Information ratio is a reliable tool to choose the best fund because it is more practical and accurate as compared to other available tools such as Sharpe Ratio. It doesn’t just compare returns but also analyses the reliability and expertise of a fund manager and his investment strategy.

Q.2: Do you want a high or low information ratio?

Ans: Higher information is always better than low information ratio as it shows that a fund has performed greatly under expert management. High IR also depicts the efficiency of the fund manager in minimizing the the risk and delivering better results than the benchmark.

Q.3: Which is a better tool sharpe ratio or information ratio?

Ans: Information is a better tool to judge the reliability and potential of a fund as it measures the returns, fund manager’s expertise and portfolio construction as a whole. Whereas, Sharp ratio will only help you measure the difference between returns of the portfolio and the returns given by the benchmark.