Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Table of Contents :

Mutual funds are a type of investment schemes that pools together investors’ money and invest it in different types of financial instruments such as stocks, bonds, government securities, gold, etc.

Mutual funds are managed by professional investment managers called fund managers. These experts buy and sell securities on behalf of investors. The performance of the fund depends on the performance of the investment portfolio. For this, the fund managers spend a considerable amount of time on market analysis and for choosing the right stock to buy.

Get Your Free Credit Report with Monthly Updates Check Now

Mutual funds are essentially a basket of many financial instruments that generate returns over a period of time. If an investor invests in a mutual fund scheme, s/he buys units of that scheme based on the Net Asset Value(NAV) of that fund on the day of the transaction.

The fund manager invests the collected funds in various financial instruments, such as equity stocks, debt instruments, derivatives, arbitrage, etc to generate returns for the portfolio holders. The total capital gains from these allocations get added to the assets under management of the fund, on which the NAV of the fund depends.

The investors can redeem the fund units as per their convenience. The units are redeemed on the current NAV of the fund, which would have probably be substantially higher when compared to the NAV at which the units were bought. This increase highlights your total gains on the investment. If the NAV at the time of redemption is not much higher than at the time of investment, it is suggested to remain invested in the fund, and wait for the market sentiment to move in your favour.

Investors generate returns through mutual funds in the following ways:

While investing in Mutual Funds, investors have two modes of investment to choose from. First is, Lumpsum investment and the second is the Systematic Investment Plan. The former is typically preferred by investors with high-risk appetite, as it involves one-time payment.

On the other hand, SIP involves a regular investment of small amounts of money at predefined intervals. This instils disciplined investment habits amongst investors who find it difficult to save. When you invest in a mutual fund scheme via SIP, you essentially buy the fund units at the NAV applicable on the day of the transaction. For instance, if you’ve chosen 5th of every month for SIP instalment of ₹500, you would get fund units as per the NAV of that day. This ensures that you buy more units when the market is down and fewer units during a bullish market. This is known as rupee cost averaging. It is one of the key benefits of investing in mutual funds via SIP.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

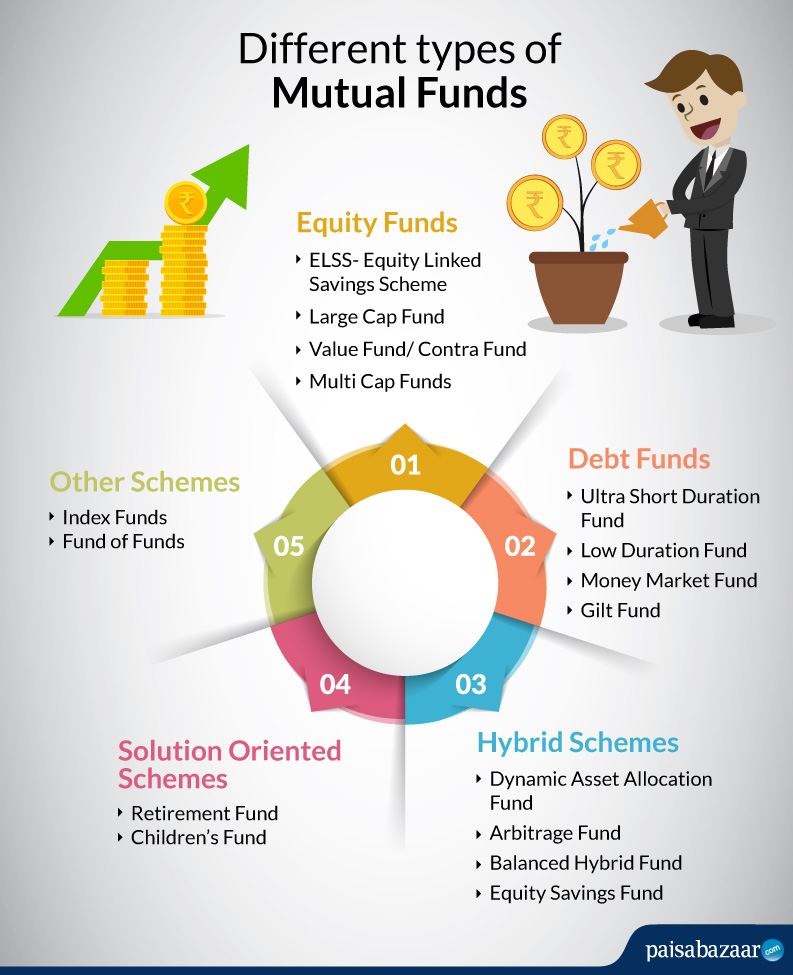

Fund houses and financial institutions offer a variety of mutual funds. These can be classified into several categories based on the type of scheme, fund objectives, assets invested, etc. Here is a look at different types of mutual funds:

Read More: Types of Mutual Funds in India

Earnings from Mutual Funds are either in the form of capital gains or dividends. Investors are liable to pay tax on capital gains, while the tax on dividends is paid by the fund house before distribution. Dividend income of the mutual fund is tax-free at the hands of the investor.

The capital gains tax on the mutual funds depends on the holding period as well type of mutual fund. Investors are liable to pay either short term capital gains tax (STCG) or long term capital gains tax (LTCG) depending on the holding period of mutual fund units. However, the taxation rate of STCG and LTCG varies depending on the type of mutual fund.

Checking Credit Report Monthly has no impact on Credit Score Check Now

Also Read: Mutual Fund Taxation: How Mutual Funds are Taxed in India?

Mutual funds are designed to help investors achieve their long-term and short-term financial objectives. Here are some of the benefits:

Also Read: Top Mutual Funds to Invest in 2020

Your Credit Score and Report Is Now Absolutely Free Check Now

The Mutual Fund industry offers a plethora of opportunities to investors for significant long term capital appreciation and wealth creation. However, before diving into the world of mutual funds, it is imperative that one analysis the below-mentioned factors and accordingly take decisions.