Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Table of Contents :

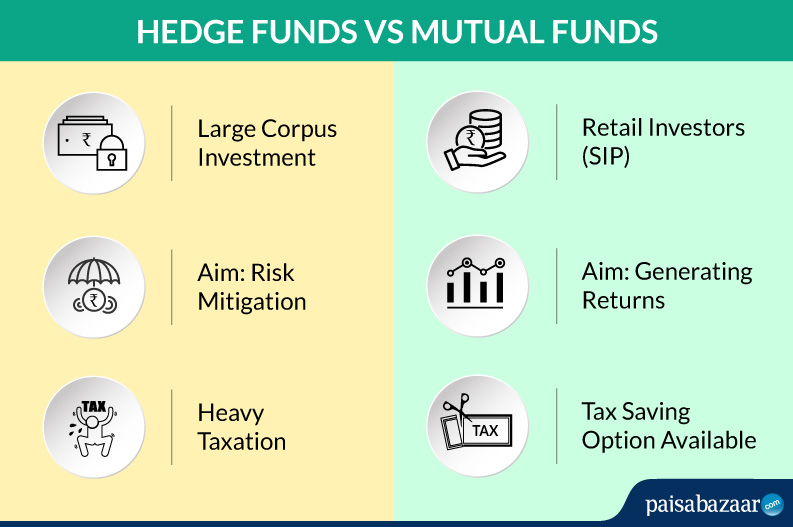

A Hedge Fund pools resources from investors and invests them in domestic as well as international markets to generate quality and long-term returns. “Hedge” essentially means to protect oneself from any potential financial loss or any other adverse circumstances. They are often set up as private investment limited partnerships where only accredited and institutional investors can invest their money.

Securities and Exchange Board of India (SEBI) has categorized hedge funds under Category III as Alternative Investment Funds. It defines hedge funds as “ funds which employ diverse or complex trading strategies and invests and trades in securities having diverse risks or complex products including listed and unlisted derivatives.”

As the name suggests, hedge funds are supposed to “hedge” against market risk. Their investment style and fund management are directed at achieving the aim of generating returns at reduced risks. Although, with changing times, the strategies involved changed and currently, hedge funds tend to be more risky, relative to mutual funds and other saving instruments.

Institutional investors, high net worth individuals (HNIs), accredited investors, insurance firms, banks are some of the major entities that invest in hedge funds. These investors have large corpus of money for their investment expansion.

Individuals with high risk appetite should invest in these funds as a hedge fund manager buys and sells securities at par with the market fluctuations. Since the portfolio management style is quite aggressive, individuals with low risk tolerance should stay away from hedge fund investment.

Unlike mutual funds, hedge funds have a concept of lock-in period. The money invested should be locked-in for at least one year before it can be redeemed. Thus, investors who want to invest in funds with high liquidity should look for other investment avenues like mutual funds or equities.

Hedge funds in India are at a nascent stage right now and this is because of lack of capital sourcing, regulations, etc. They have recently started mushrooming in India and have a lot of hurdles ahead of them before they become a popular investment option among investors.

An average investor in India has a low risk tolerance as compared to her western counterpart. This poses a difficulty for a hedge fund in pooling resources for further investment.

Also, it is difficult for financial market regulations to accommodate the complex functioning of hedge funds. This is why, hedge funds in India are not required to get registered with a market regulator.

In India, there are no separate taxation laws for hedge funds. They are taxed as any other Alternative Investment Vehicle. Heavy taxation on returns from hedge funds has been criticised for a long time. This is one of the reasons for slow growth of hedge fund industry in India.

We can only hope for better governance and regulations on hedge funds in India which will provide a good ecosystem for the growth of the hedge fund industry.