Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

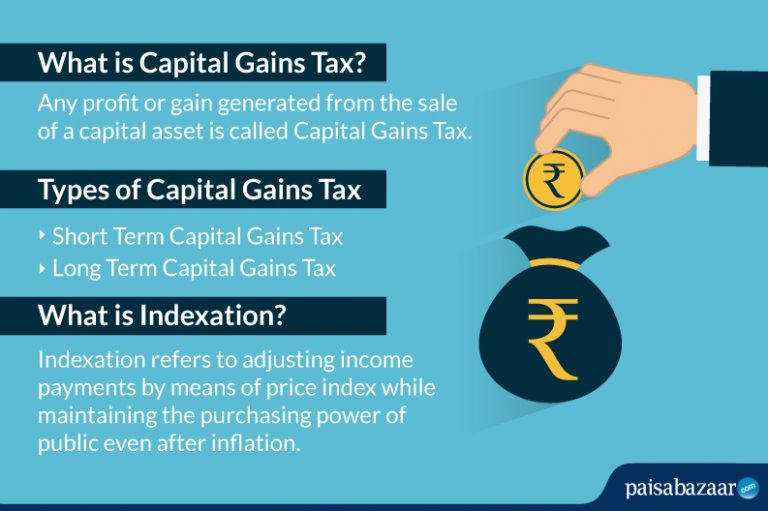

Selling your funds at a profit brings along the liability of payment of capital gains tax. If your holding period is 3 years or less, the earnings are characterized by short term capital gains (STCG), in which case no exemption on tax is granted. However, if your holding period is more than 3 years, the gains are characterized as long term capital gains (LTCG), wherein you are taxed at 20% of the gains, along with the benefit of indexation. Indexation takes into account inflation to reduce your tax liability. In addition to indexation, there are two other sections of the Income Tax Act, 1961 that offer relief from the tax liabilities on capital gains on all assets. Note that the third section dealing with capital gains exemption (Section 54 of the Income Tax Act) only applies to gains on house property. The applicable sections are:

Section 54F grants an exemption to the gains on any capital asset (including debt funds), if they are invested in a residential property. However, there are a number of conditions are attached:

Just as the case with Section 54F, this exemption was earlier given to gains from any capital asset including debt funds. Before the introduction of Budget 2018, Section 54EC allowed you to claim an exemption on the gains in debt funds by reinvesting the proceeds in the bonds of National Highways Authority of India (NHAI) and Rural Electrification Corporation (REC). These bonds carried interest of around 3.5% which was taxable and had a tenure of 3 years. However, Budget 2018 restricted the scope of this section to gains from land and real estate, along with an increase in the tenure of these bonds to 5 years. As a result, you can no longer take the benefit of this section in claiming relief on your gains in debt mutual funds.

Also Read : Know About Tax Benefits of Mutual Funds in India

Linking adjustments made to the value of a good or service, the technique of Indexation is used by organizations to connect prices and asset values to inflation. Indexation can be used by individuals to reduce tax liability on gains in debt mutual funds. The taxable gain is reduced after factoring the Cost Inflation Index (CII) published by the Income Tax Department every year. While investing in debt funds, Indexation helps reduce your overall tax liability by adjusting the purchase price of the instrument.

For example, assume that you buy a debt fund in 2010 for Rs. 100 and sell it in 2014 for Rs. 150. Since you have sold it after three years, the gain is long term and a tax of 20% with indexation will apply. The Cost Inflation Index (CII) in FY 10 was 148 and the CII in FY 14 was 200. As a result, your purchase price for tax purposes will rise to 200/148 = 135 and your taxable gain will be 150 – 135 = 15. The tax payable will be 20% of 15 = Rs. 3. Hence, even though you have made a gain of Rs. 50, your actual tax is only Rs. 3 after applying indexation.