Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

While looking for fixed income investment avenues, we come across numerous options such as bonds, certificates of deposit, treasury bills, debt funds, bank fixed deposits, etc. Out of these, certificates of deposits and fixed deposits are usually compared as both are time deposits that offer fixed interest rates. Let’s look at the two financial vehicles in detail to get a holistic view of the two instruments and choose which one to invest in.

Table of Contents :

Bank fixed deposits are one of the most popular investment options available in India. A fixed deposit account essentially offers a fixed interest rate on your principal investment. This fixed-income security is offered by almost every scheduled bank in India. Numerous investors in India have availed the benefits of Bank FD.

Get Your Free Credit Report with Monthly Updates Check Now

Different Banks/NBFCs provide fixed deposit accounts with different maturities ranging from 7 days to 10 years.

CDs are financial assets that are issued by banks and financial institutions. They offer fixed interest rates on the invested amount. The primary difference between a CD and a Fixed Deposit is that of the value of the principal amount that can be invested. The former are issued for large sums of money (1 lakh or in multiples of 1 lakh thereafter).

The maturity period of Certificates of Deposit ranges from 7 days to 1 year if issued by banks. Other financial institutions can issue a CD with maturity ranging from 1 year to 3 years.

To know more about CDs, visit: Certificates of Deposits

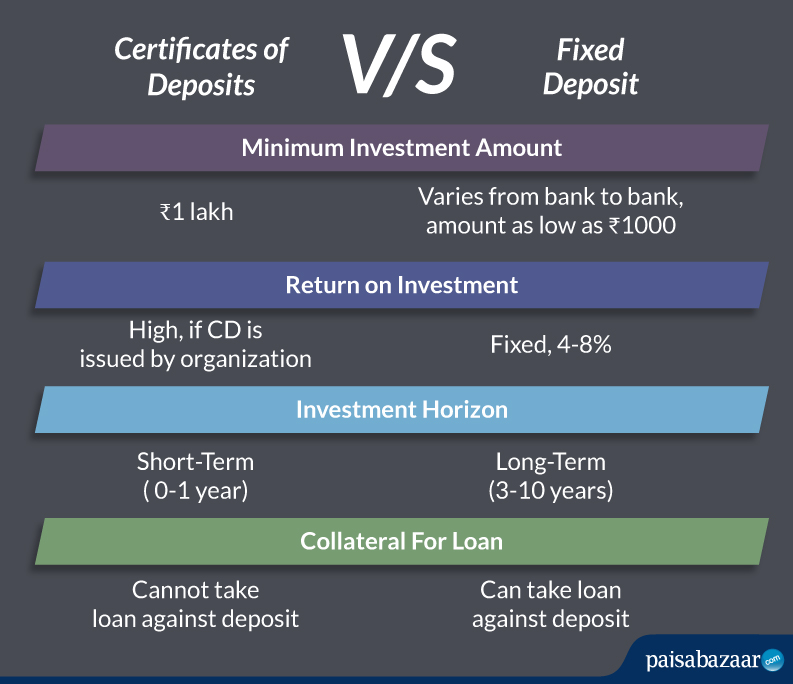

This is one of the most important differentiating factors between CDs and FDs. the minimum investment amount for an FD starts from ₹1,000 in some banks, whereas the minimum investment amount for a CD is ₹1 lakh. Because of the restriction on the investment amount, CDs are more popular amongst organizations than individuals who are looking to park their surplus for the short term and earn interest on the same.

The interest rate offered by banks on FDs varies as per the maturity period of the security and ranges from 3.5% to 8%. This means that if you’ve locked your money in a fixed deposit account for 3 years at 6% interest rate, you will receive the same interest rate for the entire maturity period, irrespective of the changes in the interest rates in the overall market. The interest rate on CDs issued by organizations offers higher interest rates than that offered by commercial banks. So, if one wants to take a little risk for earning high returns, s/he can choose to invest in CDs.

FDs are a popular saving vehicle for the long term, with the highest maturity period of 10 years. However, CDs are good for short term investment as those issued by the banks have the highest maturity period of 1 year. For CDs issued by financial institutions, the maturity period ranges from 1 year to 3 years.

One more reason why investment in Fixed Deposits is popular in India is that investors can avail loan against their deposits in FD accounts. One can avail loan up to 90% of his/her FD savings. On the other hand, this benefit is not available in case of CDs. Since CDs are transferable, they essentially have no lock-in period, because of which banks do not consider it as substantial collateral for availing the loan.

Checking Credit Report Monthly has no impact on Credit Score Check Now