Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

The approval and denial of your credit application depend mainly on a very important factor – credit score. If you have a poor credit score and you want to know how to increase CIBIL score to become creditworthy in future, then you should follow a disciplined credit behaviour.

Now Get Credit Score for FREE in your Language Check Now

It is not possible to improve your CIBIL score overnight. However, you can follow some suggestions to improve your credit score gradually. Let us discuss some important insights on how to improve CIBIL score over time so that you are creditworthy in future:

Read in Detail: Found an Error in your Credit Report? Here’s How to Raise a Grievance

Get Your Latest Credit Score in Just 2 mins. Check Now

Do you Know?

|

Suggested Read: Best Secured Credit Cards in India

If you are wondering how to improve credit score apart from following the factors mentioned above, you can consider some additional ways to increase credit score as mentioned below:

Know your Credit Score if planning for a Loan Check Now

Suggested Read: Benefits of Increasing your Credit Card Limit

| Credit Insights

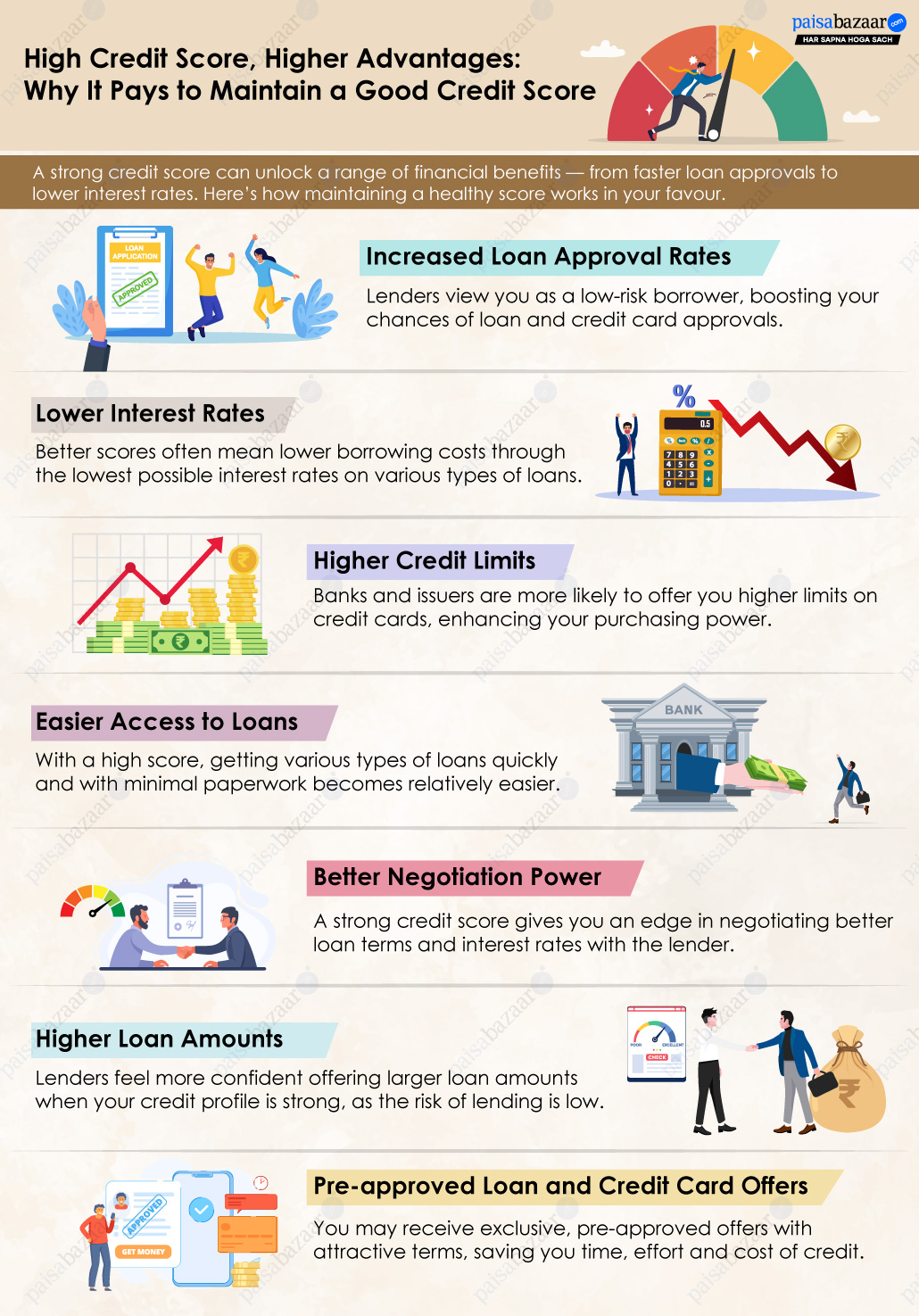

Most lenders look at an applicant’s CIBIL score (credit score provided by TransUnion CIBIL) before approving the application. A good credit score can help get loans approved at relatively lower rates and relaxed terms, apart from numerous pre-approved offers. Applicants with poor scores are not eligible for pre-approved offers; they have to pay higher interest rates and adhere to stricter loan terms set by lenders. It is also noteworthy that most lenders do not approve credit applications of applicants with a poor credit score (650 or below). Even if a loan application is approved, the applicant has to pay the interest at a higher rate. |

Your CIBIL Score is Available Instantly Check Now

A good credit score can help you get loans or credit cards easily and at a relatively lower cost of credit, whereas a low credit score can act as a major hindrance for those looking for credit urgently.

You should check your credit score regularly to understand your score improvement trajectory. You can witness the credit score improving if the pointers mentioned above are followed in a disciplined manner. Usually, it may take a few months for the improvement to reflect in your credit report. However, it completely depends on an individual’s situation. All one needs is to be smart, patient and disciplined while handling credit.

In case you find it difficult to assess your credit profile and want the guidance of a credit expert, you can subscribe to Paisabazaar’s Credit+ program and seek expert assistance to improve your credit score.