Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Until now only savings and current accounts could be linked to UPI platforms. Now, however, the Reserve Bank of India has allowed the linking of credit cards to UPI platforms.

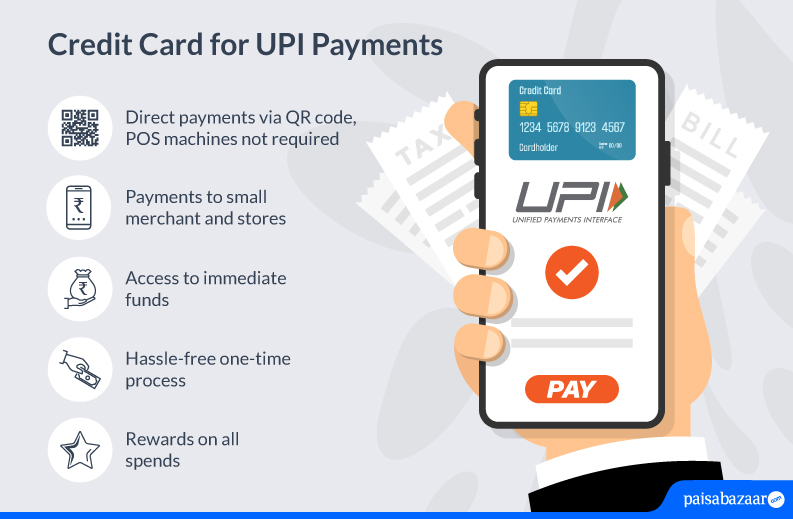

UPI payments and credit cards both come with diverse benefits. While UPI allows hassle-free, quick, and convenient options, credit cards come with rewards, discounts, and most importantly, access to immediate funds. Thereby, to offer you the best of both worlds, leading card issuers like HDFC Bank, Axis Bank, SBI Card, IDFC FIRST Bank, Bank of Baroda etc, have initiated linking of credit cards to UPI.

The procedure will begin with RuPay credit cards. This move offers more convenience to the users as they can use their mobile phone to make a payment while availing the benefits of a credit card. Users can directly link their RuPay Credit Cards with the UPI app of their choice such as Google Pay, PhonePe, Paytm, BHIM UPI, etc.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

(i) One of the main benefits of this integration is the access to immediate funds that comes with a credit card. Users will be able to make UPI payments, even when they do not have sufficient funds at that point in time. With this integration, users relying mainly on credit cards will get wider accessibility to make payments via UPI through a Buy Now Pay Later facility.

Note: Credit card linked UPI transactions process will follow UPI standard transaction limits.

(ii) Though many users already own credit cards and debit cards, paying with cards requires the users to carry the card everywhere, swipe, and sometimes authenticate with OTP. On the other hand, UPI offers the convenience to make payments using your mobile phone which most consumers have with them at all times. They just need to scan the code or enter the mobile number of the recipient in order to make a transaction.

(iii) Linking a credit card with your UPI app offers you wider accessibility to shop and purchase. This is because, while it could be challenging to find POS machines for payments, you can find UPI QR codes even at smaller shops and services.

(iv) Via the partnership of UPI and credit cards, you can consolidate multiple online payments related to bill payments, shopping bills, and small merchant transactions at a single platform. Thus, you are saved from the hustle of managing multiple financial apps and tracking your transactions.

(v) UPI transactions are processed in no-time. Thus, via the credit card UPI integration, immediate funds and speed combine together to provide instant aid in emergency situations.

(vi) Just like credit cards, nowadays UPI apps also come with applicable offers and discounts from time to time, across different merchants for shopping and travel bookings. Thus, linking a credit card to UPI can be helpful, as you can avail a great offer, even when you have limited funds at that point in time.

(vii) In comparison to a regular UPI payment linked to your savings account, credit card UPI payments are more rewarding. This is because credit cards come along with rewards and cashback, and using them frequently helps you earn more. Thus, easy access to UPI payments, and rewards on credit cards, can help you save more.

| Axis Bank | Bank of Baroda | Canara Bank |

| Federal Bank | HDFC Bank | ICICI Bank |

| IDFC FIRST Bank | Indian Bank | Kotak Mahindra Bank |

| Punjab National Bank | SBI Card | Union Bank of India |

| Yes Bank | ||

| BHIM UPI | BHIM PNB | Canara ai1 | |||

| CRED | Kiwi | Google Pay | |||

| HDFC PayZapp | PhonePe | Paytm | |||

| Slice | Mobikwik | ||||

| Indian Oil Axis Bank Credit Card | HDFC Bank MoneyBack+ Credit Card | IDFC FIRST Power Credit Card |

| Bank of Baroda HPCL Rupay Credit Card | HDFC Bank IRCTC RuPay Credit Card | Kotak League RuPay Credit Card |

| Indian Oil HDFC Bank Credit Card | ICICI Coral Credit Card | RuPay SBI IRCTC Credit Card |

| Kotak Mojo RuPay Credit Card | PNB Millennial Credit Card | Yes Prosperity Rewards Plus Credit Card |

(i) Hassle-free process: Linking your credit card to UPI is hassle-free, as it is just a one-time process. For making payments via this method, you do not need lengthy passwords or login details.

(ii) Secured Transactions: Credit linked UPI payments are enhanced with double the security features of both UPI & credit cards. UPI payments are secured with factors like two-factor authentication, biometric verification, security PIN, etc. On the other hand, a card comes with fraud protection covers and limited risk of unauthorized transactions. Thus, with the integrated transactions, you avail double the secured features.

(iii) Contactless payments have been an emerging credit card feature for a long time. However, UPI-linked credit card payments have added more to the contactless feature, by dismissing the role of ‘tap’, ‘touch’, and punch buttons. Thus, your credit card payments are more contactless than they have ever been.

To link your RuPay Credit Card with a UPI app, follow the steps as mentioned below:

To make a UPI payment using credit card via app such as Google Pay, follow these steps:

While credit cards come with a lot of conveniences, you must always ensure using them carefully. Understand that, it is only the responsible usage of a credit card, that can help you maximize the benefits it offers. Wider accessibility or access to immediate funds often comes with a risk of overspending, which can lead to increased credit card bills, which if not paid on time, can levy hefty finance charges. Once you start using this facility, you should keep a track of the transactions you put on your credit card. Besides, you should spend only as much as you can afford to repay back on time and ensure responsible usage.