Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

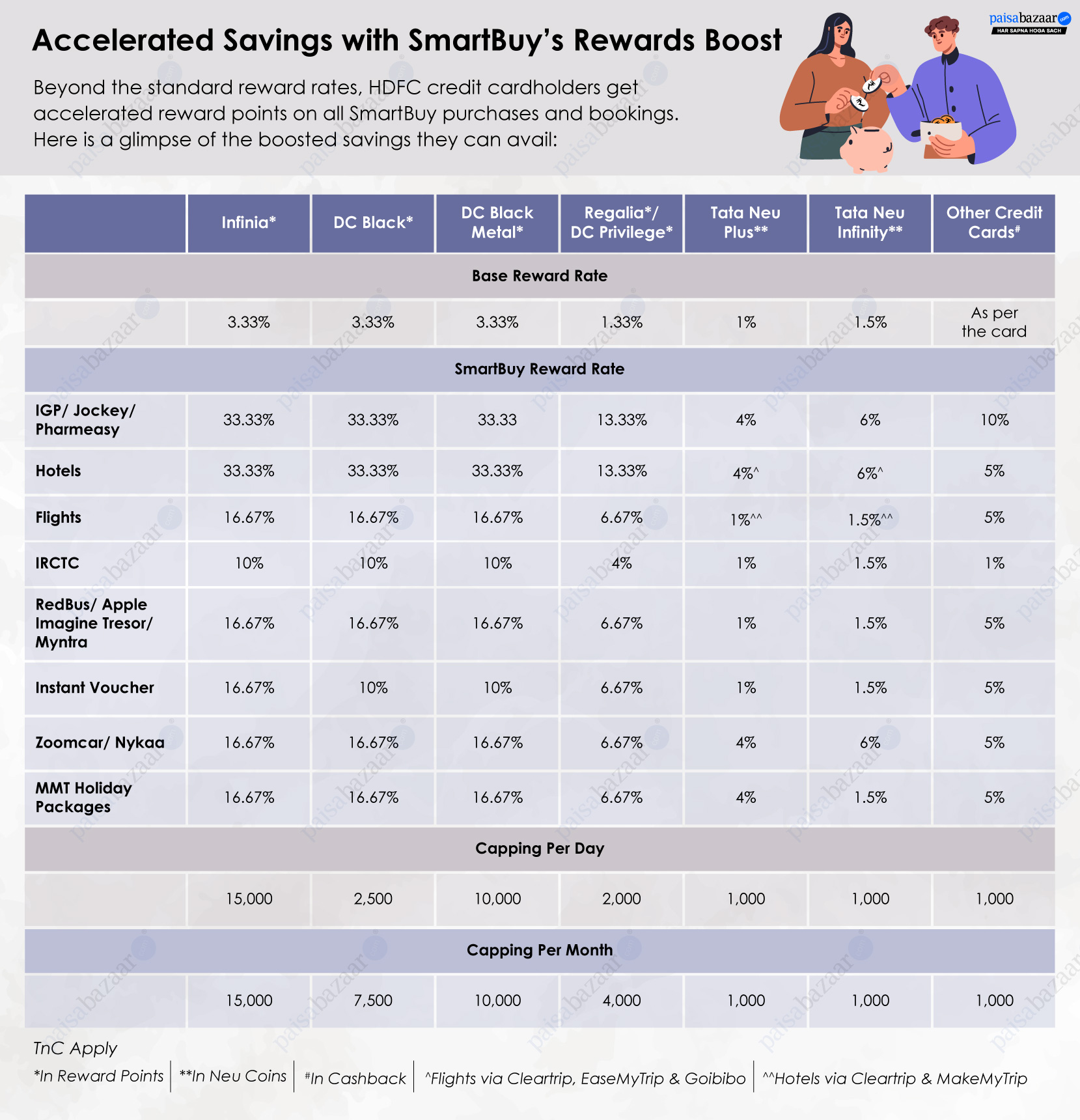

If you are an HDFC Credit card user, you must have heard of the ‘SmartBuy’ Platform that allows users to make the most of their card’s rewards program along with additional earning on select HDFC Cards. If you have not been utilizing the HDFC SmartBuy Platform, you are most likely losing out on substantial savings.

HDFC Bank is popular for offering some of the best credit cards in India. You may find a card suitable for your spending patterns across travel, shopping, premium benefits, or a card with distinctive value back via rewards or cashback. However, besides the rewarding features and benefits, what is more worthwhile, is the issuer’s rewards redemption portal- SmartBuy. By using an HDFC card on SmartBuy users can earn accelerated rewards up to 10X points, and a redemption value as high as 1 rupee per point.

In simple words, SmartBuy is a rewards marketplace, where you can use your card to either earn or redeem reward points. The benefits on the portal are extended across multiple categories like shopping, travel, dining, etc, associated with leading day-to-day and luxury brands. Via SmartBuy, the issuer has simplified maximizing reward benefits for users, by offering all ongoing deals and discounts at a single platform.

Features such as exponential rewards, unique product catalog, tie-up with practical brands and simplified redemption process, mark HDFC SmartBuy as one of the best rewards earning and redemption portals. By using the HDFC card on SmartBuy, one can derive the maximum value back on their credit card transactions. But how? Read on to know more.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

While SmartBuy is popular for rewards redemption, you can also earn accelerated rewards here to double up your savings. With some cards, mostly premium ones like Infinia, Regalia, etc, you may earn direct accelerated rewards by making shopping and travel transactions on SmartBuy. On the other hand, some might require an additional effort to make a voucher purchase via Gyftr, and earn rewards on the voucher.

Gyftr is an extension of the SmarBuy portal, you can purchase an instant voucher as per your brand preferences, and earn accelerated rewards.

Direct Accelerated Rewards: If you own any of the cards listed below, you can directly shop or make travel bookings via the card and earn up to 10X points for the transactions.

| HDFC Credit Card | General Reward Feature | Reward Feature on SmartBuy |

| HDFC Diners Club Privilege Credit | 4 reward points on every Rs.150 spent | Earn up to 10X reward points on spends via SmartBuy |

| HDFC Infinia Credit Card | 5 reward points on every Rs.150 spent including spends on Insurance, Utilities and Education | Up to 10 times reward points on your travel and shopping spends on SmartBuy |

| HDFC Diners Club Black | 5 reward points for every Rs. 150 spent | Up to 10X reward points via SmartBuy |

| IRCTC HDFC Bank Credit Card | 5 reward points per Rs. 100 spent on IRCTC Ticketing Website/ Rail Connect App | Additional 5% cashback on Train ticket booking via HDFC Bank SmartBuy |

Instead of general purchases, making purchases on SmartBuy can help you earn maximum rewards. For instance, let’s assume you use your HDFC Infinia Credit Card for a travel booking of Rs. 30,000, via an online travel portal MakeMyTrip. Here, as per the base reward structure offered on the card, you will earn 5 reward points on every Rs. 150 spent, thus, you will earn 1,000 points here. However, utilizing the same card for travel booking on SmartBuy may fetch you 10x reward points, thus, 10,000 reward points as per 50 points on every Rs. 150 spent.

Accelerated Rewards via Voucher purchase through Gyftr

If you do not own a card offering direct rewards on SmartBuy, you can still earn accelerated rewards on your HDFC card via Gyftr. Here, you can access a wide range of instant vouchers from top brands across electronics, beauty, entertainment, fashion, travel, dining, home and furniture etc. On purchasing a voucher you get an upfront discount, general reward as offered on your card, plus the bonus rewards offered on making a Gyftr purchase. The bonus rewards offered can range up to 10x rewards. However, unlike in most cases, the reward points are not credited to your card account, but are adjusted by offering you an instant voucher at a discounted price. For instance, a voucher worth Rs. 10,000 may cost you Rs. 9,010, after applicable upfront discount, and value of general and bonus reward points.

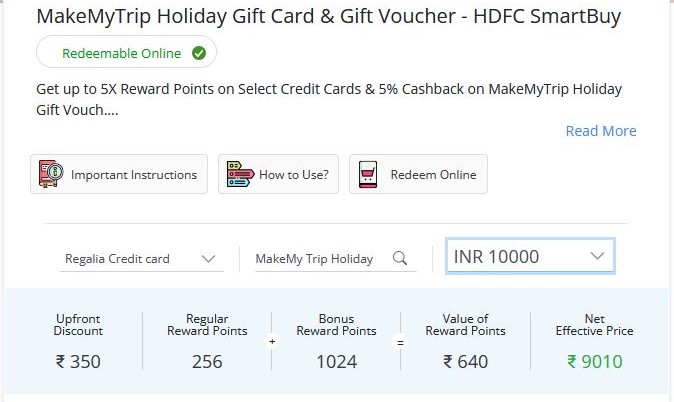

For better understanding, consider the example stated below, as derived from a real time offer on Gyftr for HDFC Regalia Credit Card.

Here note that with HDFC Regalia you get 4 reward points on every Rs. 150 spent, thus, for Rs. 9,650 (10,000 – upfront discount of Rs. 350), you get 256 points. However, on this transaction, you also earn 1024 bonus reward points via SmartBuy for purchasing a voucher at Gyftr. Thus, you clearly earn 4X reward points here, as 1024 bonus rewards in this category. In total you earn 1280 rewards, that are collectively redeemed at a cost of 1 reward point=Rs. 0.50 in offering you a lower discounted price.

Note: Rewards and redemption value may vary from card to card, and offer to offer.

HDFC Cards has an edge over other credit cards in the market, due to its flexible and highly beneficial rewards redemption process. You get to redeem your accumulated reward points across multiple options such as brand vouchers, airmiles, cashback, flight and hotel bookings etc. If you have premium cards like Infinia, Regalia, Diners Club Black or Privilege; along with the direct accelerated rewards you can also access unique redemption catalogs, such as Dining catalog for Diners Club Privilege or Gold Catalog for Regalia Gold.

You can get a high redemption value as high as Rs. 1 for each reward point, but it may vary from card to card, as listed in the table below:

Value of 1 HDFC Reward Point against Varying Redemption Options

| Credit Card | Product Catalog (in Rs.) | Unified SmartBuy (in Rs.) | Cashback (in Rs.) | Airmiles | Exclusive Catalog (in Rs.) |

| HDFC MoneyBack Credit Card | Up to 0.25 | 0.2 | 0.2 | 0.25 | – |

| HDFC MoneyBack+ Credit Card | 0.25 | 0.25 | 0.25 | 0.25 | – |

| HDFC Millennia Credit Card | Up to 0.30 | 0.30 | 1 | 0.30 | – |

| IndianOil HDFC Bank Credit Card | Up to 0.20 | – | 0.20 | – | – |

| HDFC Regalia Credit Card | Up to Rs 0.35 | 0.5 | 0.20 | 0.5 | – |

| HDFC Regalia Gold Credit Card | Up to Rs. 0.35 | 0.5 | 0.20 | Up to 0.5 | Exclusive Gold Catalog on select Premium brands at a value of 1 RP = Rs 0.65 |

| HDFC Diners Club Privilege Credit Card | Up to Rs 0.35 | 0.5 | 0.20. | – | Exclusive Privilege Dining Catalog on select Restaurants at a value of 1 RP = Rs 0.50. |

| HDFC Infinia | Up to Rs 0.50 | 1 | 0.30 | 1 | Apple products and Tanishq vouchers at a value of 1RP = Rs. 1 |

| HDFC Freedom | 0.15 | 0.15 | 0.15 | 0.15 | – |

| HDFC Diners Club Black | Up to 0.50 | 1 | 0.30 | 1 | – |

| HDFC Diners ClubMiles | Up to 0.35 | 0.50 | 0.20 | 1 | – |

| IRCTC HDFC Bank Credit Card | – | 1 (for train ticket bookings) | – | – | – |

Note: SmartBuy redemption is not applicable on certain co-branded HDFC Credit cards like Intermiles HDFC Credit Cards, Tata Neu HDFC Cards, Swiggy HDFC Credit Cards, and HDFC IndiGo Credit Cards.

Important Things to Note:

- All cards are not eligible for earning accelerated rewards on SmartBuy.

- If you own an HDFC cashback credit card, you are offered cashback as ‘cashpoints’, which function the same as reward points.

- Reward redemption options on HDFC co-branded cards are specific to the associated brands, and may differ from regular SmartBuy options.

- Product vouchers on Gyftr, may offer varying value for different HDFC credit cards. A similar voucher may earn you 4X rewards on one card, and 2X rewards on another.

- The acceptable cards list for a Gyftr voucher may vary from time to time, and voucher to voucher.

- Before earning or redeeming reward points, you must keep a check on the maximum rewards capping for a day or month, and minimum transaction value requirement for earning rewards.

- For travel bookings via SmartBuy, check the maximum limit on payment via rewards. In most cases, it is 70% of the booking amount, meaning you can pay 70% via reward points redemption, and rest to be paid via your credit card.

(i) Focus on reward count and maximum reward value: Spend the most on the accelerated category, and redeem where you earn the maximum value back. For instance, if you own a HDFC Millennia Credit Card, utilize the card for maximum spends at associated partner brands- Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato, to earn 5% cashback (offered as cashpoints.) Now if you spend Rs. 20,000 on these brands collectively, you may earn around 1,000 cash points in a month. These can offer you an equivalent value back at a ratio of 1:1, when redeemed against statement balance.

(ii) Focus on the spending category: Use your card to spend for categories that earn you the maximum value back. For instance, it is better to use your HDFC Infinia credit card for travel bookings, than any other card you own, because (i) you earn accelerated rewards (ii) you get a high redemption value for direct travel bookings and flight conversion into air miles.

Let’s assume you spent Rs. 30,000 for direct travel bookings on SmartBuy. Here you get 10,000 points. Now if you redeem these 10,000 points for airline conversion, you get a 1:1 benefit. Assuming you convert the airlines to Club Vistara loyalty points, you can book direct flight tickets from Mumbai to Bangalore by utilizing specific points , as follows:

Thereby, with 10,000 points on your Infinia card, you can avail up to 2 economy class flight tickets, or 1 premium economy ticket, or 1 Business Class ticket (by paying the remaining balance).

The redemption value of CV Points is taken from Vistara Airlines website as of October 12, 2023. This is subject to change at the airline’s discretion. Moreover, we have given the example based on Mumbai to Bengaluru one-way flights; the point requirment may vary on choosing other destinations or for connecting flights.

(iii) Avail as many bonus reward points as possible: Try putting most of your expenses on your credit card to meet the milestone benefit criteria that could fetch you bonus reward points. Some cards may also offer you bonus points via card activation, subject to spend based condition, within a certain number of days.

(iv) Choose the Right Credit Card: You can only derive the maximum value back with your credit card, when you earn rewards on most of your spends. For that, you must choose a card that matches best with your spending patterns and preferences.

Let’s assume , you shop a lot at Marks & Spencers and Myntra, thus, choosing a card that can offer you accelerated rewards here, can help you earn the maximum rewards on your major spending category. Thus, HDFC Regalia Gold can be the best suited card here. As per you needs and preferences, you can compare multiple cards, shortlist the best suited ones, and ultimately choose the right card that matches all your requirements related to fee charges, complimentary features, rewards on accelerated category etc.