Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

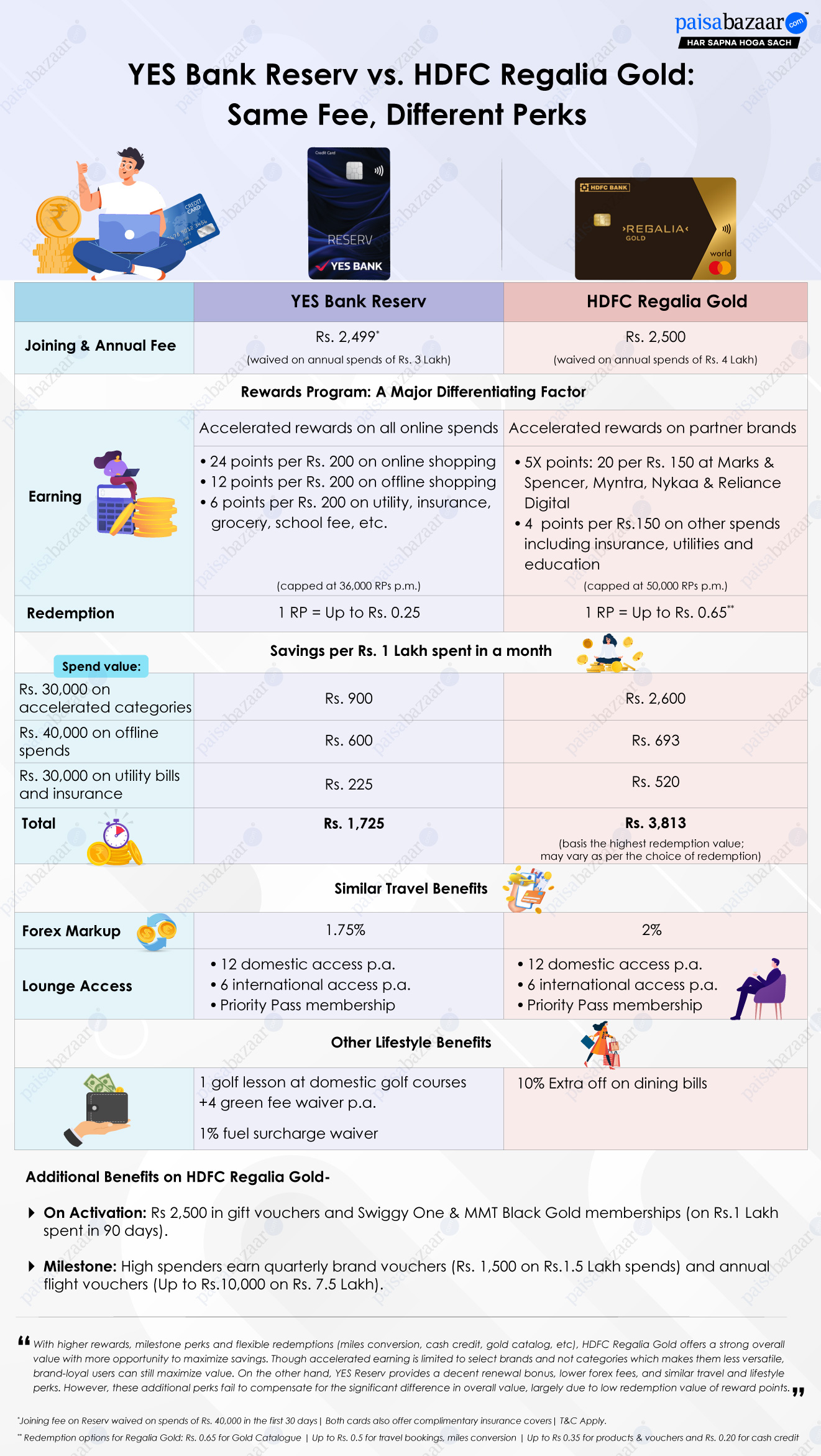

Well-rounded value across multiple categories like shopping, travel and dining is not limited to premium credit cards. Some mid-range cards also offer impressive returns at much lower fee and come with easier eligibility terms. In this article, we compare two such cards: HDFC Regalia Gold and YES BANK Reserv – both suited for consumers seeking all-rounder credit cards.

While Regalia Gold is an enhanced variant of the widely popular HDFC Regalia Credit Card, YES Reserv is a renamed and revamped version of YES FIRST Exclusive Credit Card. Both cards charge an annual fee of ~Rs. 2,500 but the value-back is distinct, especially for high-spenders looking to get maximum returns in the form of rewards.

Read a detailed comparison of these two cards to understand how their reward structure, travel benefits and other features differ and which would be right pick for you.

In the first year, YES Reserv allows a spend-based fee waiver whereas Regalia Gold offers complimentary memberships and bonus reward points worth the fee. Both cards offer a decent start but the savings differ by a good margin, as shown below:

| Card | Benefit | Spend Condition | Savings |

| YES Reserv | 1st year fee waiver | Rs. 40,000 in 30 days | Rs. 2,500 |

| Regalia Gold | Gift Voucher | Rs. 2,500 fee payment | Rs. 2,500 + Rs. 900 (for Swiggy One)+ MMT membership benefits |

| Swiggy One and MMT Black Gold memberships | Rs. 1 Lakh in 90 days |

YES Reserv offers accelerated rewards on all online spends whereas Regalia Gold keeps it limited to selected brands. Though this could be a limitation for those who spend online without any merchant restrictions, those loyal to its partner brands can easily maximize value.

Additionally, for offline spending, Regalia Gold again takes the lead with a high base reward rate. Both the cards include often-restricted transactions like utility, insurance, and education spends in their rewards program. But even on these categories, the value-back is better on Regalia Gold.

Here is how much you save on spends across the following categories:

| Spends On | Amount | YES Reserv | HDFC Regalia | ||

| RPs earned | Value-back | RPs earned | Value-back | ||

| Marks & Spencer, Myntra, Nykaa & Reliance Digital | Rs. 30,000 | 24 points per Rs. 200 | Rs. 900 | 20 per Rs. 150 | Rs. 2,600 |

| Online shopping | Rs. 30,000 | 24 points per Rs. 200 | Rs. 900 | 4 points per Rs.150 | Rs. 520 |

| Offline shopping | Rs. 30,000 | 12 points per Rs. 200 | Rs. 450 | 4 points per Rs.150 | Rs. 520 |

| Utility, insurance, education | Rs. 30,000 | 6 points per Rs. 200 | Rs. 225 | 4 points per Rs.150 | Rs. 520 |

Hence, the value-back for Regalia Gold will differ based on the redemption option. But all options serve a higher value-back than Reserv except redemption against statement balance.

From the above table, it is clear that YES Reserv is a better choice for users who spend on all online purchases without any merchant restrictions. Whereas, Regalia Gold is a better choice for users who spend online with the partner brands but mostly use the card for offline shopping. But, for high-spenders, the value-back difference in general online shopping is compensated well via the milestone benefits on Regalia, as discussed below:

HDFC Regalia Gold’s milestone benefit is a major add-on that enhances its overall value for high spenders. Since the benefits are divided into multiple quarterly and annual thresholds, cardholders can strategize their spends to get maximum value. On the other hand, YES Reserv only offers renewal fee waiver. The table below shows how much you can save by putting maximum spends on these two card:

| Amount Spent p.a. | YES Reserv | Regalia Gold |

| Rs. 3 Lakh | Annual fee waiver of Rs. 2,499 | – |

| Rs. 4 Lakh | – | Annual fee waiver of Rs. 2,500 |

| Rs. 5 Lakh | – | Flight voucher worth Rs. 5,000 |

| Rs. 6 Lakh | – | Rs. 6,000 (via quarterly benefits of Rs. 1,500, basis quarterly spend of Rs. 1.5 Lakh) |

| Rs. 7.5 Lakh | – | Additional flight voucher worth Rs. 5,000 |

| Total benefits on spends of Rs. 7.5 Lakh | Rs. 2,500+ value-back via rewards program | Rs. 18,500*+ value-back via rewards program |

*The value-back on Regalia Gold may vary on not meeting the quarterly spend-based condition.

YES BANK Reserv also offers a renewal benefit of 8,000 bonus points (worth Rs. 2,000 based on per reward value of Rs. 0.25). But this again is subject to payment of an annual fee of Rs. 2,500.

The cards offer similar travel perks across domestic and international travel and some varying lifestyle benefits.

On both HDFC Regalia Gold and YES Reserv:

On YES Reserv:

On HDFC Regalia Gold:

Flight vouchers as an annual milestone benefit and brand vouchers (of Marriott, Myntra, Reliance Digital and Marks & Spencer), as a quarterly milestone benefit further enhance the overall travel experience and lifestyle privileges on HDFC Regalia Gold. But additional golf benefits on Reserv could be a slight add-on for golfers.

Choosing the right credit card for you between YES Reserv and HDFC Regalia Gold should be based on your lifestyle preferences. While both cards are a good option to consider if you want extensive reward benefits with travel perks, here is how to make a choice.

Choose HDFC Regalia Gold if:

Choose YES Reserv if:

In conclusion, understand that if you are choosing YES Reserv only for its return on online spends (without any merchant restrictions), then you can get similar benefits on cards like Cashback SBI or YES BANK Paisabazaar PaisaSave at a lower fee. But, if you want online shopping benefits along with extended travel and lifestyle benefits like lounge access and golf, you may choose Reserv. On the other hand, HDFC Regalia Gold outshines with a higher overall value through core rewards and milestones as well as other additional perks. Since highest reward rate on HDFC Regalia Gold is limited to select brands, people should consider their brand preferences before applying.