Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

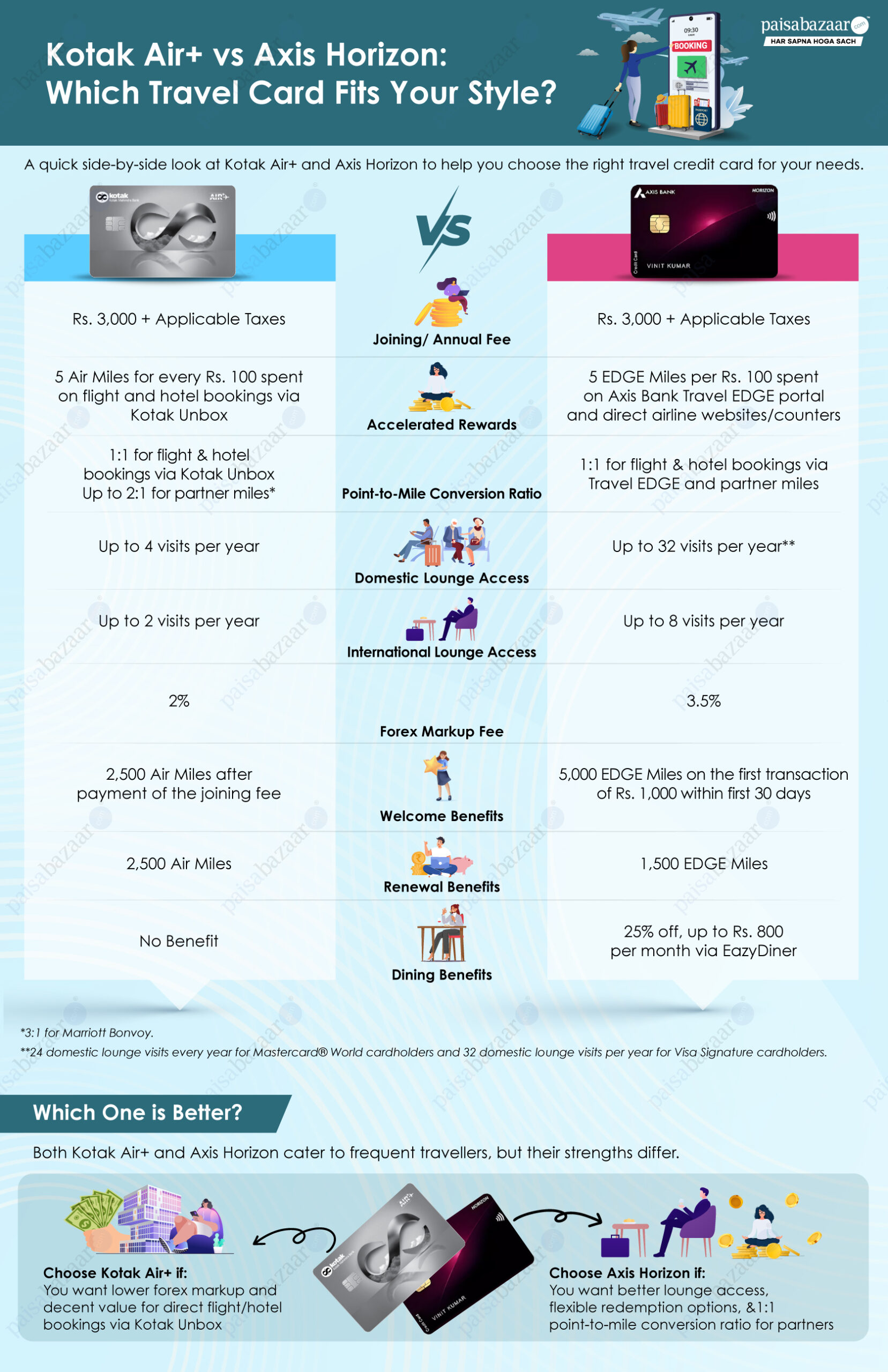

Choosing the right travel credit card can make a big difference in how you earn and redeem rewards. Two popular contenders in this category are Kotak Air+ Credit Card and Axis Horizon Credit Card. While both cards charge the same annual fee and offer up to 5% value-back on travel spends, they cater to slightly different needs.

Kotak Air+ is a decent option for frequent travellers who are primarily looking to save on their travel spends through Kotak Unbox. Axis Horizon is an all-round travel card with accelerated rewards, decent lounge access benefits, and more.

Here is a detailed comparison of these airline agnostic credit cards to help you understand which one fits your travel style.

| Particular | Kotak Air+ | Axis Horizon |

| Accelerated Rewards | 5 Air Miles per Rs. 100 spent on flight & hotel bookings through Kotak Unbox | 5 EDGE Miles per Rs. 100 spent on Travel EDGE portal and direct airline websites/counters |

| Base Rewards | 2 Air Miles per Rs. 100 spent on other categories | 2 EDGE Miles per Rs. 100 spent on other categories |

| Reward Redemption | 1 Air Mile = Rs. 1 for flight & hotel bookings through Kotak Unbox

1 Air Mile = Up to 0.5 Partner Mile |

1 EDGE Mile = 1 Partner Mile/ Rs. 1 for flight & hotel bookings through Travel EDGE |

| Partner Hotels & Airlines | 5+* | 15+** |

Note: The reward redemption ratio for Marriott Bonvoy for Kotak Air+ Card is 3:1.

*Partners: Accor, Air Canada, Air France, British Airways, Cathay Pacific, Etihad Airways, Qatar Airlines and United Airlines.

**Partners: Accor Hotels, Air Canada, Ethiopian Airlines, Etihad, Japan Airlines, Marriott International, Qatar Airways, Singapore Airlines, Turkish Airlines, Thai Airways, United Airlines, Wyndham Hotels, Air France-KLM, Air India, Air Asia, ITC, IHG® Hotels & Resort, Qantas Airways, and SpiceJet.

Both cards offer the same reward points on travel and other spends. However, Axis Horizon has an upper edge as it offers accelerated (5X) rewards not only on travel spends through Travel EDGE but also on bookings made directly via airline websites or counters, which enhances its overall value.

When it comes to redemption, both cards offer up to a 1:1 reward redemption ratio. However, Axis Horizon offers a 1:1 redemption rate for both partner points and travel bookings through Travel EDGE. On the other hand, while Kotak Air+ offers 1:1 redemption ratio for travel bookings via Kotak Unbox, this ratio drops to 2:1 for partner points, which restricts the overall value-back.

Additionally, Kotak Air+ has fewer partners compared to Axis Horizon. Despite limiting the reward redemption to 5 Lakh EDGE Miles per year for partner points, Axis Horizon offers better value-back if planned smartly.

Overall, Axis Horizon turns out to be the better option due to its 1:1 redemption ratio against partner points and travel bookings through Travel EDGE, accelerated rewards on bookings made directly with airlines, and a wider range of partner hotels & airlines.

| Particular | Kotak Air+ | Axis Horizon |

| Forex Markup Fee | 2% | 3.5% |

| Domestic Lounge Access | Up to 4 visits in a year | Up to 32 visits in a year* |

| International Lounge Access | Up to 2 visits in a year | Up to 8 visits in a year |

*24 domestic lounge visits every year for Mastercard® World cardholders and 32 domestic lounge visits per year for Visa Signature cardholders.

When it comes to lounge access, Axis Horizon clearly stands out with a higher frequency of both domestic and international lounge visits. An important point to note is that domestic lounge visits on Axis Horizon vary from 24 to 32 per year, depending on Mastercard or Visa variant. Despite being a travel credit card, Axis Horizon has a relatively high forex markup fee of 3.5%. Hence, Kotak Air+ is a better option for overseas spends due to its lower forex markup fee of 2%.

Overall, Axis Horizon is the clear winner for complimentary airport lounge access. However, for consumers looking to save on international transactions, Kotak Air+ turns out to be a more suitable option with its lower forex markup fee.

| Particular | Kotak Air+ | Axis Horizon |

| Welcome Benefits | 2,500 Air Miles after the payment of joining fee | 5,000 EDGE Miles after first transaction of Rs. 1,000 or more within 30 days of card issuance |

| Renewal Benefits | 2,500 Air Miles after the payment of annual fee | 1,500 EDGE Miles after the payment of annual fee |

Axis Horizon more than compensates for its joining fee of Rs. 3,000 with bonus miles worth Rs. 5,000. Kotak Air+ also offers satisfactory welcome benefits worth Rs. 2,500, without any spend-based condition. When it comes to renewal benefits, neither card offers any annual fee waiver. However, Kotak Air+ offers better renewal benefits worth Rs. 2,500, compared to bonus miles worth Rs. 1,500 with Axis Horizon.

Kotak Air+ Credit Card

Axis Horizon Credit Card

Both Kotak Air+ and Axis Horizon are travel credit cards that cater to consumers who are not loyal to a specific airline or hotel. Axis Horizon is a suitable option for frequent travellers who want to earn decent value-back on airline bookings made directly through airline websites as well as through the Travel EDGE portal. Besides this, up to 8 international and 32 domestic lounge visits every year make Axis Horizon a preferable option for flyers who prefer to relax during their journey.

On the other hand, Kotak Air+ is a suitable option for travellers who prefer to make bookings through Kotak Unbox and want to save on international spends with a low forex markup fee, especially if lounge access benefits are not a major priority.

Choose Kotak Air+ if:

Choose Axis Horizon if: