Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

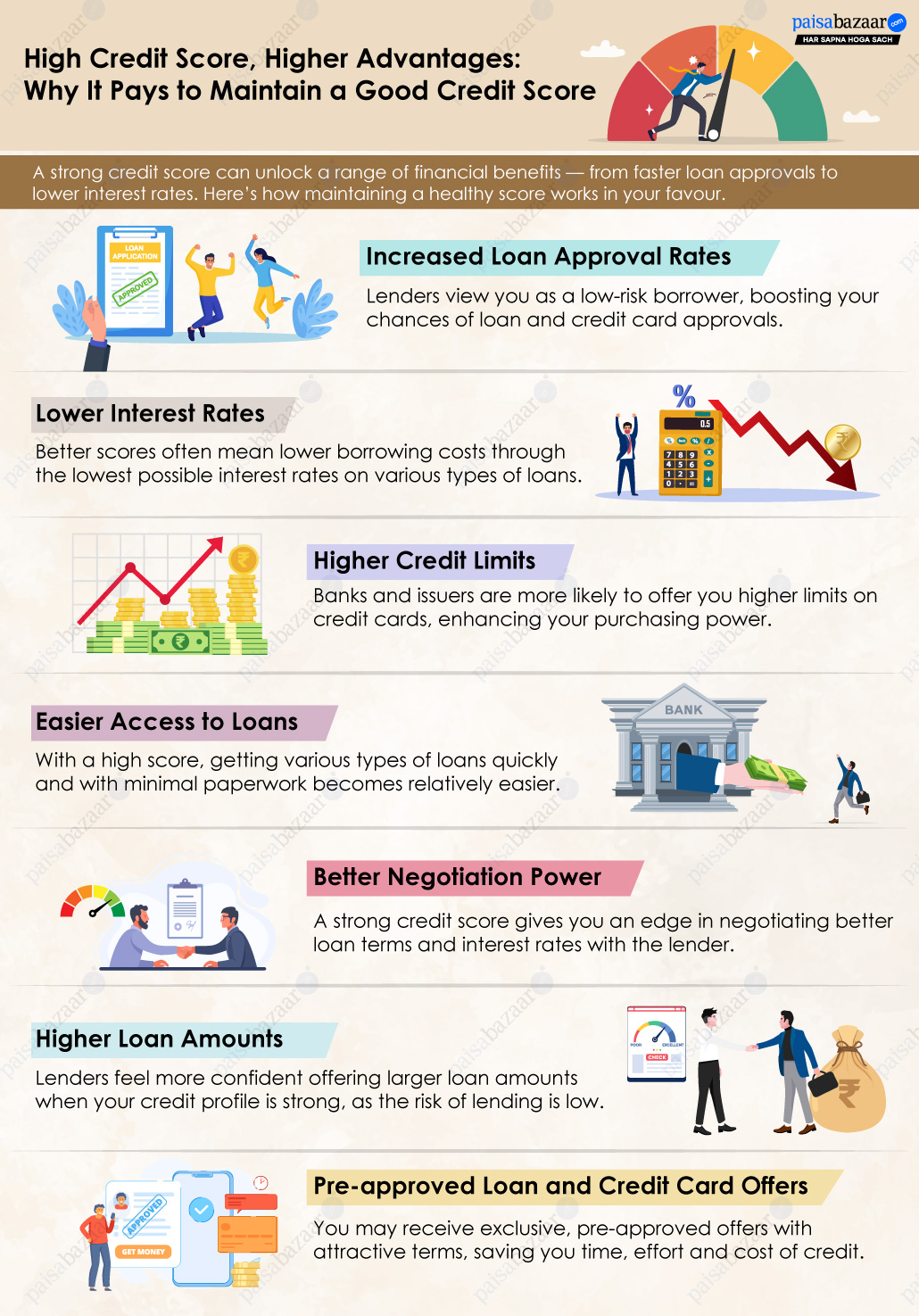

CIBIL score is the first thing that lenders check to assess your creditworthiness. A good score (preferably above 760) improves your chances of approval for loans and credit cards and also give you access to better offers and lower interest rates. On the other hand, a poor CIBIL score can limit credit opportunities and make approvals difficult. Read on to know about the ways how you can improve your CIBIL score.

How to Improve Your CIBIL Score: Snapshot

|

The most important thing for lenders is to know how likely you are to repay the borrowed money. Missed credit card bills or loan EMIs are recorded in the Days Past Due (DPD) section of your credit report and stays for up to 36 months. Such delayed or missed payments have a direct negative impact on your credit score. Hence, to maintain a good credit score, ensure timely bill payments.

If you tend to forget bill due dates, set standing instructions to auto-pay your bills as and when due or set reminders. A smart way to ensure timely credit card bill payment is to use Paisabazaar App, where you can add all your credit cards and manage repayments easily. You receive alerts when new statement is generated and when bills are due.

Credit utilisation ratio (CUR) shows the amount of your available credit that you are already using. Though using a large amount and paying back timely does not have major impact on your credit score, consistently maxing out your credit cards signals a credit-hungry behaviour and could lower your credit score. Hence, try to maintain a low CUR to improve, especially if you are already struggling to improve your CIBIL score.

To lower your CUR, avoid putting high-ticket purchases on your credit cards for some time. You can also request a limit increase on your credit cards or get a new credit card to increase your overall available limit. But be mindful that you do not utilise the additional limit.

When you apply for a new loan or credit card, the lenders initiate a hard enquiry on your credit profile, which can temporarily reduce your CIBIL score . However, multiple hard enquiries within a short span can indicate credit-hungry behaviour and, as a result, lower your credit score. Hence, when you intend to take a loan or a credit card, do proper research, compare various options available and apply with one lender.

There are two types of credit enquiries – soft enquiries and hard enquiries. When you check your own credit score to stay credit-aware, it is considered a soft-enquiry and has no impact on your score. In contrast, a hard enquiry is made when a lender or credit card issuer pulls your CIBIL report as part of a credit application.

Even if you have maintained a good credit history, an error in your credit report that goes unnoticed can cause major damage to your credit score. This could include incorrect personal information, wrong account details, mismatched overdue or paid-off amounts, duplicate accounts, etc. For instance, you have already paid off your loan completely but it is still appearing due to an administrative error at the end of the lender/bureau.

Make it a habit to review your detailed credit report every few months, and if you spot any suspicious activities, discrepancies, etc. report them to the lender or credit bureau immediately to get them corrected.

Avail Paisabazaar’s Credit+ Service to get personalized credit assistance. Our credit expert will call and analyze your credit report and suggest solutions to build further or improve your credit score. We also help you identify errors in your credit report and rectify them at the earliest through our Credit Rectification Service.

Consumers with a longer credit history and a consistent record of timely repayments are trusted by the banks as well as bureaus. Hence, if you are new-to-credit or have a poor credit score, it is best to start as early as possible.

For example, if you have an old credit card, it is advisable not to close it, even if you no longer use it. Though closing such accounts may not have a remarkable impact on your credit score immediately, a longer history can be helpful when a lender assesses your credit application in future.

New-to-credit consumers or those with a poor credit score can get a secured credit card against FD to build or rebuild their score. A secured credit card is offered against a fixed deposit and hence approval is guaranteed. It works exactly like an unsecured card wherein you can make purchases and earn value-back in the form of rewards or cashback. Secured card activity is reported to credit bureaus and with responsible usage, you can improve your credit score.

If a loan applicant does not meet some of the loan eligibility criteria, the lender may ask the borrower to get it co-signed or guaranteed by a co-applicant who has better creditworthiness. However, when the primary borrower fails to pay the EMIs on time, the credit score of the co-signor/guarantor also takes a hit.

Hence, if you are a co-signer or guarantor, you should regularly monitor if the repayment of the loan EMIs is made on time and discuss it with the borrower if there is a default in the repayment.

Apart from the above mentioned ways to improve your credit score, here are some more things to keep in mind:

A good credit score can help you get loans or credit cards easily and at a relatively lower cost of credit, whereas a low credit score can act as a major hindrance for those looking for credit urgently.

You should check your credit score regularlyto understand your score improvement trajectory. You can witness the credit score improving if the pointers mentioned above are followed in a disciplined manner. Usually, it may take a few months for the improvement to reflect in your credit report. However, it completely depends on an individual’s situation. All one needs is to be smart, patient and disciplined while handling credit.

In case you find it difficult to assess your credit profile and want the guidance of a credit expert, you can subscribe to Paisabazaar’s Credit+ program and seek expert assistance to improve your credit score.