Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

One can travel abroad for various reasons – education, work or fun. While travelling, incidents like loss of baggage or passport, medical emergency, flight cancellation are not uncommon. This is when a travel insurance policy comes to the rescue by providing financial protection against risks and losses encountered during the trip.

Travel insurance provides coverage for the expenses and damage associated with travelling in India and abroad. It covers financial loss due to many unforeseen events like theft, death, medical emergencies, loss of luggage, flight delay, etc. that one usually tends to overlook while planning the vacation or a trip.

Travel insurance can be put under different categories. You can choose it according to your need and requirement. Following are the types of travel insurance you can purchase while travelling:

Student Travel Insurance: The student travel insurance plan offers medical and financial aid to students travelling abroad for their education. This plan will cover sudden medical or financial emergencies faced by students in a new country throughout their stay. It can be availed by a student who is already pursuing education abroad or by a student planning to go overseas for studies.

Domestic Travel Insurance: If you are travelling anywhere within India, you can avail domestic travel insurance. Under this plan, one gets the medical and financial aid for medical emergencies, loss of baggage, delay and cancellation of the trip, etc.

Family Travel Insurance: Family travel insurance can be bought for all direct family members of the policyholder. This policy covers accidental costs, hospital allowance and the loss of baggage.

Senior Citizen Travel Insurance: It is a comprehensive plan for people in the age group of 61-70 years to make their travel a pleasant experience. It provides coverage for medical services, healthcare facilities and pre-existing conditions.

Group Travel Insurance: If you are a group of 20 or more people, you can buy group travel insurance plan. It covers trip cancellation, baggage loss or damage, medical evacuation and delay of trips.

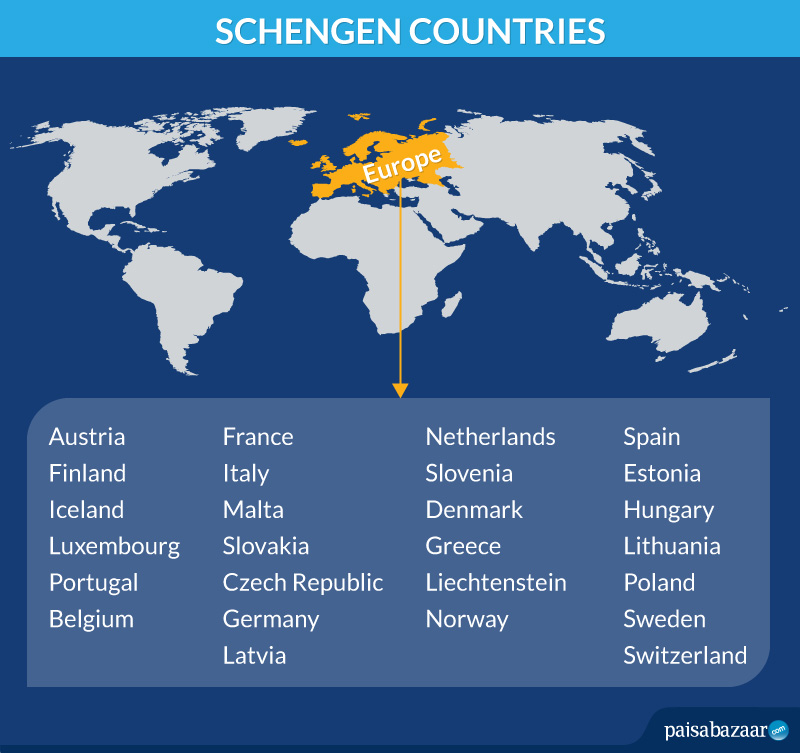

International Travel Insurance: This type of travel insurance is taken while travelling outside India. This is further divided into different types for different regions and countries. For instance, a travel insurance required for Middle East would be different from the one needed for travelling to the US. The 2 common types of international travel insurance are:

The coverage offered by insurer varies for different providers. Following are the most common inclusions under travel insurance policy:

Travel insurance has different types of plans under its umbrella, so eligibility criteria and age limit will also differ from policy to policy. Let’s understand this.

Different situations would need different sets of documents. Some of the essential documents which need to be submitted to the insurance company to process claims are:

Note: This is not an exhaustive list and insurance company might ask for additional documents.

On the submission and acceptance of the required documents, it will take approximately 15 working days for the final settlement of the claim.

Travel insurance does not cover all the cases and situations that you might face while travelling. The insurance will not be liable to pay if the claim has been raised due to the following conditions:

Some of the insurance companies offering travel insurance in India are as follows:

All travel insurance plans do not cover all the aspects of travel risks. The aspects which are not covered may disappoint you. Below are some of the aspects which one should know about travel insurance:

Medical expenses: When you are travelling abroad or within India, hospital expenses is the last thing we want to spend on. A travel insurance covers the risk of unwanted expenses for cases like injuries, surgeries, and emergency medical evacuation. Depending on the plan you have chosen, you may get a 24/7 care service that will cover your travelling expenses to the nearest medical facility.

Baggage mishandling: It is common for the baggage to get misplaced, stolen, or mishandled duting flights or travelling. In such a situation, if you have not bought a travel insurance, you will lose the money spent in the baggage, along with the valuables stored in the bag. With travel insurance, either your money will be reimbursed, or your luggage will be replaced with a new one, as per your policy.

Trip cancellation: Some weather conditions or technical issues may force you to cancel your trip. As disheartening as it may seem, you will also lose the money you paid for the travel booking and the hotel bookings. But with the help of trip cancellation coverage in travel insurance, you can get your money back.

It is not required for most of the insurance companies, provided the adult is up to the age of 70 years, but if you have any pre-existing condition, you should disclose it in the proposal form.

The premium for travel insurance depends on the age of the insured, place you are travelling to, duration of your trip and the kind of coverage you have opted for.

In case you lose your travel funds or it gets stolen, Travel insurance will arrange emergency cash for you.

Yes, a part of your premium will be refunded back provided no claim has been made during the policy.

There are chances that you might come across unforeseen situations in a foreign land. Having a travel insurance policy will help you tackle such emergencies. It protects you against travel risks such as loss of baggage, trip delay, accident, loss of passport, etc.

A deductible is the amount you will have to pay from your pocket after which insurance company pays out the claim.

The Indian Railways is offering travel insurance of Rs. 10 lakh cover to its customers who book tickets through Indian Railway Catering and Tourism Corporation (IRCTC) website or its mobile app.

The insurance, applicable for only Indian citizens, is available at an affordable premium of 49 paise per passenger. To avail the facility, passengers need to select ‘Travel Insurance’ while booking the train tickets on the IRCTC website. Also, the travel insurance will be valid for all passengers booked under one PNR.

Here are the details of the coverage offered by IRCTC:

Customers can get the insurance by simply following the below-mentioned steps:

The Insurance Regulatory and Development Authority of India (IRDAI) has asked online ticket booking portals to not make travel insurance coverage a pre-selected default option while purchasing tickets online. This will allow the traveller to go through the benefits, terms and conditions offered under the travel insurance on the screen itself.

Another major change that has also been implemented immediately is that in case of domestic travel, such ticket booking portals cannot issue travel insurance policy 90 days before the travel date. However, for international travel, it can be issued anytime.