Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Form 15H is a self-declaration that may be submitted by senior citizen aged 60 years or above to reduce TDS (tax deducted at source) burden on interest earned from fixed deposits (FD) and recurring deposits (RD) investments. Under existing rules, TDS is deducted on interest earned from bank FD and RD held by senior citizens only if annual interest income from these deposits exceeds Rs. 50,000 for financial year 2023-24.

Table of Contents :

Forgetting to submit the required form on time may lead to deduction of TDS by the bank in interest income from deposits exceeding Rs. 50,000 for the applicable year. The individual will have to file an income tax return to claim a refund of the excess TDS deducted by the bank. TDS is usually deducted on a quarterly basis. Hence, one should make sure to submit the required form as early as possible in order to avoid deduction of TDS for the applicable financial year.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Form 15H for senior citizens is useful for a variety of purposes. The list of these is as follows:

Form 15H is a self-declaration form which helps individuals above 60 years of age save Tax Deducted at Source (TDS) on the interest income earned by them on their fixed deposits. The assessee is supposed to submit a declaration form to his banker to apply for no deduction or lower deduction on fixed deposits made by him.

Form 15H is perhaps best defined as a self-declaration form which clearly states that the assessee is not liable to pay taxes on the interest income earned by him. This is because the amount earned by the depositor as interest is lower than the minimum amount of money taxable under IT norms.

An individual has to furnish Form 15H to his deductor on time i.e. either before the due date of the interest payment or before the end of the applicable financial year. This form is an undertaking by the assessee, stating that the income earned in previous year does not fall in the taxable income bracket and is thus not liable to be taxed.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The Income Tax Act of India, 1961 requires various TDS deductors to allocate a UIN or a Unique Identification Number to all individuals submitting Form 15G or Form 15H to them. The tax deductor is supposed to file a statement of the forms submitted to them by all the tax payers on a quarterly basis. This statement consists of the details of all forms submitted to them and a list of all the sources of income which have been exempted from tax. These forms must be retained by the tax deductor for a minimum period of 7 years subsequent to submission.

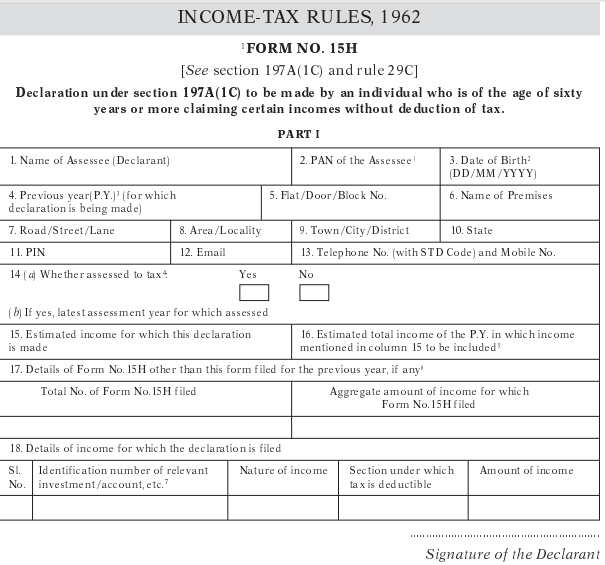

The following is a sample of the Form 15H as available on the Income Tax Department website:

Form 15H is available in fillable format on the website of most banks operating in India. However, you can easily download Form 15H for free from the Income Tax website. Once you have downloaded the form, you have to print it, fill it out and submit it with the appropriate bank/authority in order to decrease your TDS burden. Do keep in mind that separate Form 15H has to be submitted with each bank/post office you have deposits with to reduce your overall TDS burden.

Form 15H is divided into two parts – Part 1 and Part 2.

Part 1: This part has to be filled out by senior citizen individual applicants who wish to claim TDS on different types of income earned by them during the fiscal.

Let’s understand various points that have to be duly filled by the applicant before submitting the form.

Part 2: The second part of the form has to be filled and submitted by the deductor who is required to deposit the TDS deducted with the bank authorities. For example: A bank, which is supposed to deduct TDS on the interest earned by a depositor on fixed/recurring deposits.

As per changes effective from June 1, 2016, certain rental income can also be declared and included in Form 15H declarations. The various types of incomes that fall under this category are:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Form 15H for PF withdrawal has to be filled when you withdraw offline. Purpose of form 15H is to request EPFO not to deduct TDS. Such TDS is applicable only if one is withdrawing EPF before completion of 5 years of service and/or amount withdrawn is greater than Rs. 50,000.

Provident fund withdrawal before five years of completion of service will attract TDS effective June 1 2015.

Q. What is the validity of Form 15H?

Form 15H can be used by an individual only for a particular assessment year. 15H Form is valid only for 1 financial year and a person will have to use a new form for different assessment years.

Q. What is the difference between form 15G and 15H?

Both Form 15G and Form 15H need to be submitted as a self-declaration by individuals whose income is below the taxable threshold and so no TDS should be deducted for the income credited to their account. However, Form 15G is to be submitted by individuals below 60 years of age and Form 15H can be submitted by individuals aged 60 years and above.

Read more on Form 15G

Q. What will happen if Form 15H is not submitted?

In case you do not submit Form 15H TDS will be deducted and you will get TDS certificate which can be attached while filing income tax and pay the remaining tax (in case any).