Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

The Finance Minister, Nirmala Sitharaman announced the e-assessment scheme in the Union Budget 2019-20. All Income Tax Returns (ITRs) picked for scrutiny going forward will now be assessed under the newly announced e-assessment Scheme, 2019. In the following sections we will discuss what e-assessment means? What effect it will have on the taxpayers and how is it different from the previous scrutiny assessment system?

Table of Contents :

In the Union Budget speech 2019-20, the Finance Minister Nirmala Sitharaman announced the faceless e-assessment scheme. As per the scheme, scrutiny assessment from 2019 onwards will be carried out via an electronic mode with no human interface. Thus, there will be no face to face interaction between the taxpayer and the Income Tax Department when a taxpayer’s ITR is picked for a detailed scrutiny. This is expected to make the process of scrutiny more fair and unprejudiced, thereby decreasing the chances of undesirable practices on the part of tax officials.

The Income Tax Department not only reviews the income tax return (ITR) filed by the taxpayers, but also monitors their ITR filing patterns. Based on this, the Department selects some cases for a detailed examination along with some randomly picked cases. This process of detailed examination of one’s ITR is called Income Tax scrutiny. An income tax notice under Section 143(2) of the Income Tax Act is sent to such taxpayers to inform that their ITR has been picked for scrutiny.

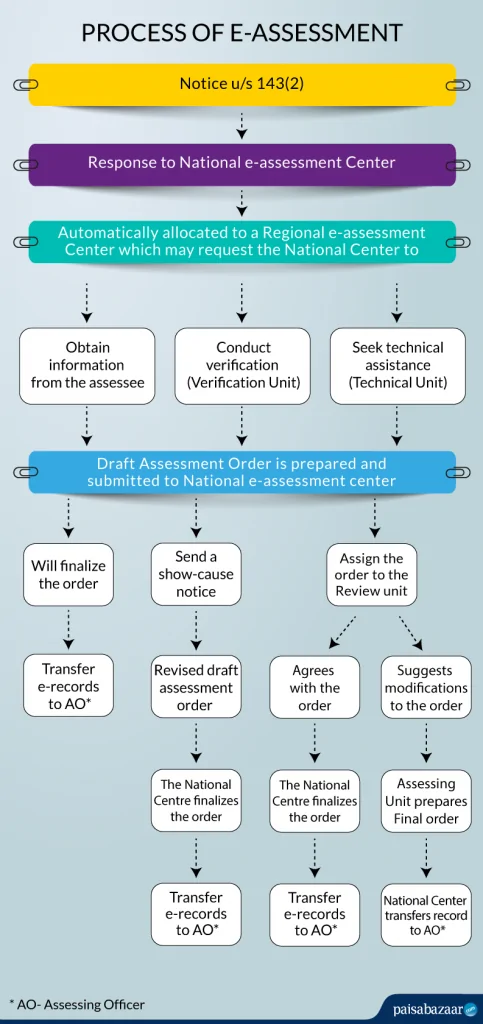

All communications between the National e-assessment Centre and the assessee, or his authorized representative, will be made exclusively by electronic mode under the e-assessment scheme.

Moreover, all internal communications between the National e-assessment Centre, Regional e-assessment Centers and various units shall be exchanged exclusively by electronic mode.

First, all the electronic records will be authenticated by affixing digital signature or electronic authentication technique. Subsequently, it will be delivered by way of:

Note: A real-time alert will be sent to the assessee or his/her authorized representative at every point of communication. The assessee will have to respond to such a communication through his/her registered account only. Finally, an acknowledgment will be received upon successful submission of response which will deem the response to be authenticated.

Note: The assessment unit will provide the details of the penalty proceedings in the assessment order sent to the National e-assessment center.

When a show-cause notice is issued to an assessee, he/she should furnish the response within the specified time limit.

The assessment unit after receiving the response from the assessee will prepare a revised draft assessment order and send it to the National e-assessment center which may:

However, when an assessee fails to submit the response within the specified time limit, the National e-assessment centre will finalize the assessment as per the initial draft assessment order submitted by the Assessment Unit.

This happens when the National e-Assessment Center sends the draft assessment order to one of the Review Units in any Regional e-assessment Center via an automated allocation system.

Subsequently the Review Unit will review the order and may:

After finalizing the draft assessment order, the National e-assessment center will transfer all the electronic records to the Assessing Officer (AO) having jurisdiction over the case. Then the AO may take the following actions:

Note: The penalties, if applicable will be imposed as per the respective sections of the Income Tax Act, 1961.

| E-assessment Scheme, 2019 | Offline scrutiny Assessment | |

| Mode of communication | Both internal and external communications will be done only via electronic mode including emails and video conferencing. | By means of sending notices and responses in paper format. |

| Personal interaction | No personal interaction between the assessee and the Income Tax Department representative such as assessing officer. | In some cases, the assessee had to personally visit the department and present answers to the Assessing officer. |

| Units involved | This scheme involves the National and Regional e-assessment centers along with Verification and Review units. | This scheme only involved the Assessing Officer and the assessee. |

| Procedure | A draft assessment order prepared by the assessing unit is examined by the National e-assessment Center. The order is then finalized/modified/reviewed to prepare a final draft. The final draft is sent to the assessing officer who implements the final decision as per the order. | The Assessing Officer evaluated the ITR and complete the assessment accordingly. |

| Pros and Cons | Communication via electronic mode will make the process more fair and just. | In certain cases, the personal interaction led to undesirable practices on the part of tax officials. |

>

1. What is the E-assessment Scheme, 2019?

Ans. The Finance Minister, Nirmala Sitharaman announced faceless e-assessment scheme in the Union Budget 2019-20. As per the scheme, scrutiny assessment from 2019 will be carried out via an electronic mode with no human interface. In other words, there will be no personal i.e. face to face interaction between the taxpayer and the Income Tax Department when a taxpayer’s ITR is picked for detailed scrutiny.

2. What is scrutiny assessment?

Ans. The Income Tax Department reviews the income tax return (ITR) filed by the taxpayers, but also monitors their ITR filing patterns. Based on this, the Department selects some cases for a detailed examination along with some randomly picked cases. This process of detailed examination of filed returns is called Income Tax Scrutiny. An income tax notice under Section 143(2) of the Income Tax Act is sent to such taxpayers to inform that their ITR has been picked up for scrutiny.

3. How should I reply to the income tax notice u/s 143(2)?

Ans. If your ITR has been picked for a detailed assessment or scrutiny, you will receive a notice under Section 143(2) via an electronic mode. Upon receiving such a notice, you should respond within 15 days through your registered account only. An acknowledgment will be received upon successful submission of response, that will deem the response to be authenticated.

4. How will electronic communications be delivered under e-assessment scheme?

Ans. Electronic communications under the e-assessment scheme will be delivered by:

Moreover, a real-time alert will be sent to the assessee or his/her authorized representative at every point of communication.

5. How will electronic communications be authenticated under the faceless scrutiny assessment scheme?

Ans. Under the e-assessment scheme, all electronic communications must be authenticated by affixing digital signature or electronic authentication technique. Thus, whenever you send a response to the IT Department, authenticate it with your digital signature.

6. How is faceless e-assessment different from the earlier system?

Unlike the previous method, e-assessment involves communication via electronic mode only. There is no personal interaction between the assessee and the department. This is expected to eliminate undesirable practices on the part of tax officials. For more info, read the Differences between the new e-Assessment.

7. What will be the advantage of the e-assessment scheme?

Ans. Under the e-assessment scheme, there will be no personal interaction between the assessee and the assessing officer. Also, the Assessing Unit will be selected by an automated system without any bias. Thus, chances of any undesirable practices on the part of tax officials will decrease making the process of scrutiny assessment more fair and just.

8. What effect will e-assessment have on taxpayers?

Ans. As the mode of communication under the e-assessment scheme will be solely electronic, the taxpayer will no longer be required to post documents or personally meet the assessing officer to answer any queries.

9. What to do when a show-cause notice is issued?

Ans. A show-cause notice is sent when a modification is proposed in the previously filed ITR. Upon receiving this notice, you should reply within the specified time limit from your registered account. Remember to authenticate the response by affixing the digital signature. Also, make sure that you receive an acknowledgement upon successful submission of the response.

10. How will the penalties be imposed after the e-assessment?

Ans. After successful e-assessment, a copy of the final draft assessment order is sent to the Assessing Officer having jurisdiction over such case. Subsequently, penalties will be imposed as per the chapter XXI of the Income Tax Act. Relevant notices will be sent to the assessee in such a case.