Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Lenders use the credit score to assess the risk of lending a product to a borrower. Thus, it becomes imperative to maintain a very good score to be creditworthy and eligible for the best loan and credit card offers. However, many of our credit actions may lead to a temporary or long-term fall in our credit score. Also, certain credit actions can lead to an increase in your credit score as well. Most of us may not be aware of how our actions can impact our score. To help everyone understand the probable consequences of their credit actions on their credit scores, Paisabazaar has developed the Score Predictor tool. Let us know more about this tool below.

Find How your Credit Actions Impact your Score using Score Predictor Check Now

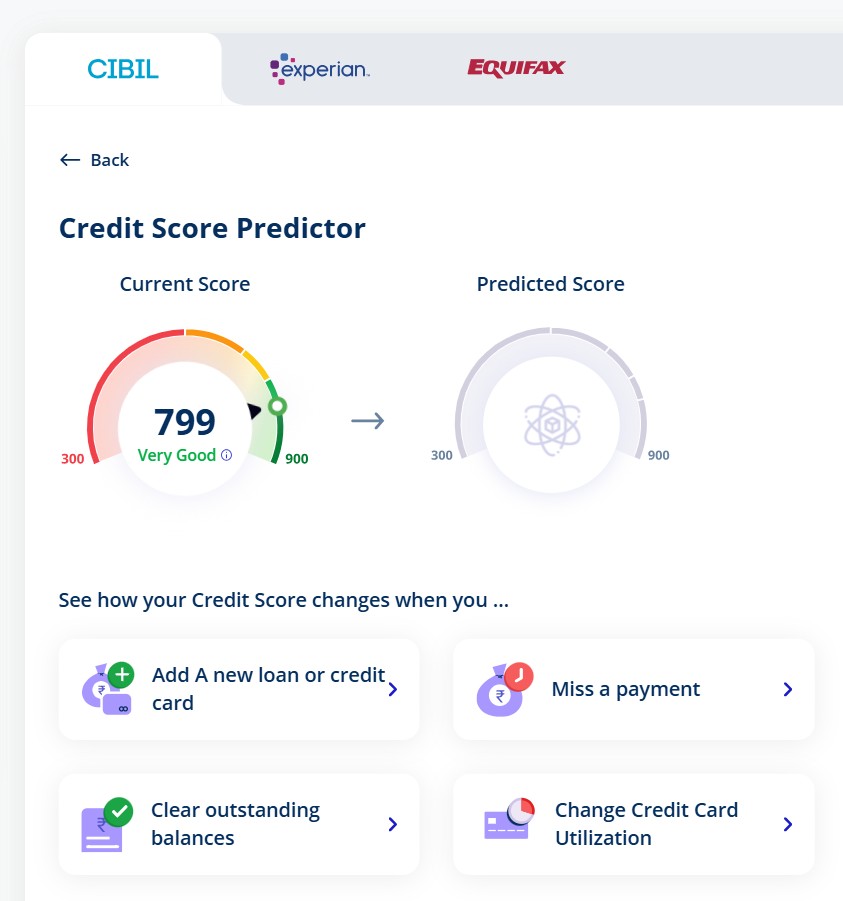

Paisabazaar’s Score Predictor tool helps users assess the impact of their credit actions on their credit score. Actionable insights provided by this tool shall help users take smart credit decisions and improve their financial literacy.

This tool uses advanced algorithms framed after studying the impact of credit actions of users on their credit health. This continuously learning tool improves its results everyday making the results more and more accurate.

The best thing about this tool is that it provides a visualisation of “before and after” comparison of credit score projections, emphasising transparency and practical learning.

Anyone can utilise this free-to-use tool and provide multiple inputs to assess the impact of various actions every time.

Score Predictor accepts various inputs from the user and, depending on the information provided, predicts an estimated score.

A user can provide four inputs to the tool, namely:

If you select the addition of a new loan or credit card option, you are asked to choose the type of account and amount, viz., credit card with credit limit, loan with the loan amount, etc.

When you select the “Miss a Payment” option, you are asked to choose the number of days by which the payment has to be delayed, for example, 30 days, 60 days or 90 days.

When you select the “Clear outstanding balances” option, you are given an option if you want to clear all dues or dues related to a specific account. The outstanding amount is provided against each account for your convenience.

On selecting the “Credit Card Utilization” option, you have to select the updated spend percent on your credit card against which you want to get your score predicted.

Score Predictor uses your latest credit score to predict results for the next month. If you already have the refreshed credit score, you can utilise this tool instantly; else it is suggested to first refresh your latest score for more accurate results.

Here’s how to use the Score Predictor tool:

Step 1: Login to your Paisabazaar account using your mobile number and OTP

Step 2: Check your latest credit score and click on the Score Predictor option

Step 3: The tool will open, where you have to input details such as the addition of a new credit account, missing a payment, etc.

Step 4: Provide additional details, if required and click on the “Predict Score” button

Step 5: The predicted score will appear on the screen. You can reset the predictor and give fresh commands again.

Also Read: Know Everything about Credit Score

Use Score Predictor to Check Impact of your Actions on Credit Score Check Now

The Score Predictor uses your latest credit score to predict the probable score. No credit report is requested from any credit bureau while using this tool. Thus, there is no impact whatsoever on your actual credit score when you use this tool.

Suggested Reads: Common Myths about Credit Score

It is recommended to check your predicted score every time you intend to take credit actions such as getting a new credit card or loan, paying off all dues, increasing or reducing credit card utilisation or a planned payment delay due to an emergency.

It will help you stay informed with the probable consequences beforehand and take smarter decisions in future.

Check Impact of your Actions on Credit Score using Score Predictor Check Now

Ans: Paisabazaar’s Score Predictor is a part of Credit Awareness campaign run to educate Indian consumers about using credit wisely. Thus, this tool is provided free of cost to all consumers who check credit score on Paisabazaar.

Ans: There is no limit on the number of times you use this tool to analyse how your credit score may change depending on your credit actions.

Ans: Credit+ service is a programme designed to help people improve their credit score. It is a paid subscription programme, whereas Score Predictor can be used by any user of Paisabazaar who has a valid credit score without paying any fee.

Ans: There can be instances where your credit score may not vary on certain actions speculated by you. However, you should diligently follow suggested actions to maintain a high credit score.

Ans: Yes, all your financial and personal details are completely safe and secure with Paisabazaar. We never share your personal or financial data with any entity without your approval.

Ans: Your latest credit score is utilised for predicting your credit score when you use this tool. No new requests are sent to any credit bureau while using this tool.

Ans: Score Predictor forecasts an indicative value depending on the AI algorithm. It provides a reliable prediction as per the inputs provided. However, in some cases, the actual results may vary from what is predicted by the tool.