Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

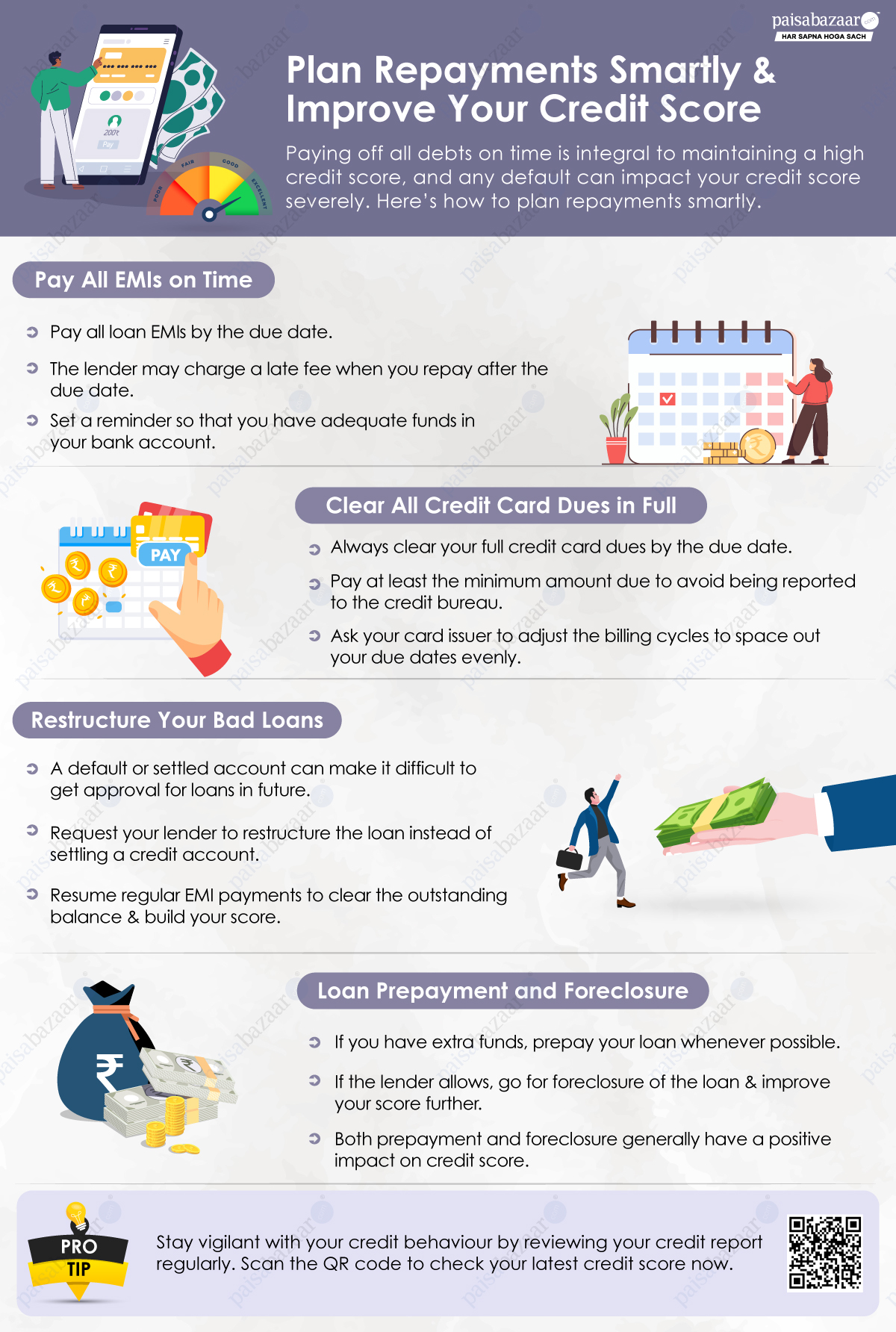

Paying off all debts on time is one of the most important factors in maintaining a high credit score, and even a single missed repayment or default can severely impact your credit score. Let us understand how you can plan your repayments smartly to improve your credit score and maintain high creditworthiness.

Also Read: How Long Does Negative Information Stay on CIBIL

Suggested Read: How to Build a Strong Credit Score with Credit Cards

Read in Detail: Why should you not Settle a Credit Account

Also Read: Best Ways to Improve Your Credit Score

To constantly monitor whether your actions are having a positive impact on your credit score, you should check your credit score and track your report regularly. You can do it for free at Paisabazaar. In case there are errors or you want assistance to improve your score, subscribe to Credit+ and start rebuilding your credit profile.