Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

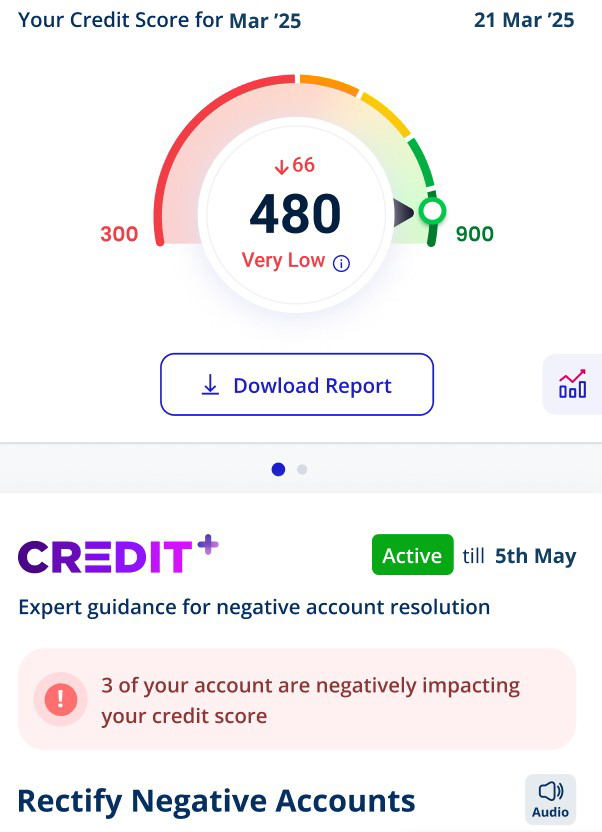

Credit score is one of the most important factors when considering your financial health. Your credit score depends on several factors such as timely repayments, credit utilisation ratio, new enquiries, etc.

A high credit score can help in getting credit easily whereas a low score can make it difficult to avail credit in future. A low credit score makes accessing credit a big challenge in times of need or while fulfilling important life goals like buying a house that entails taking a home loan necessary for most.

Improving your credit score beforehand would ensure you have high creditworthiness when you apply for a loan in future. It can be tricky at times but Paisabazaar’s credit improvement service, Credit+, can help you rebuild your fallen credit score in due course of time.

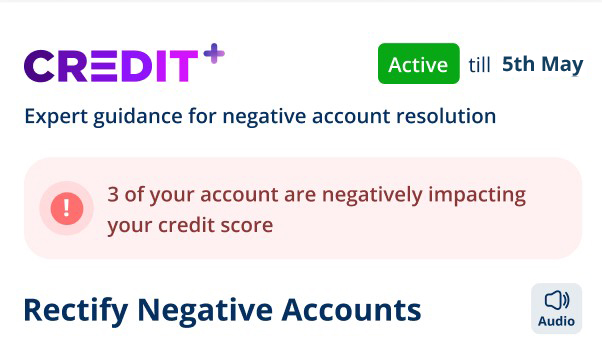

A primary reason for a low score is a ‘negative account’ that may appear due to non-payment of dues or some errors in your credit report. If you have a low credit score, you should focus on tracking and taking the right actions to build the score. Paisabazaar’s Credit+, the credit improvement service, includes personalized expert help that can assist you in building your credit health over time.

With the help of this credit advisory service, you can rebuild your score by improving your credit behaviour and be future-ready to avail credit whenever required. Not every case is similar, so the personalised guidance provided by credit experts at Paisabazaar can be very beneficial for those who want to rebuild their credit score after making certain mistakes in the past.

However, in some instances, you may have a low credit score even if you haven’t committed credit mistakes. Here, this low credit score could be because of errors in your credit report. To address this, you can take the assistance of Paisabazaar’s Credit+ service, where we guide you to correct errors in your report as well.

Credit+ service by Paisabazaar helps users detect negative accounts in their credit report and guides them on resolving them, that over time would build their creditworthiness.

This one-time subscription plan valid for 3 months is beneficial for those having a low credit score that has fallen due to an error in the credit report.

There can be certain cases where a user has errors in the report, but the credit score hasn’t fallen yet. Such errors have the potential to lower the credit score significantly in future. Proactive action, as guided under our Credit+ service, can be beneficial in addressing these.

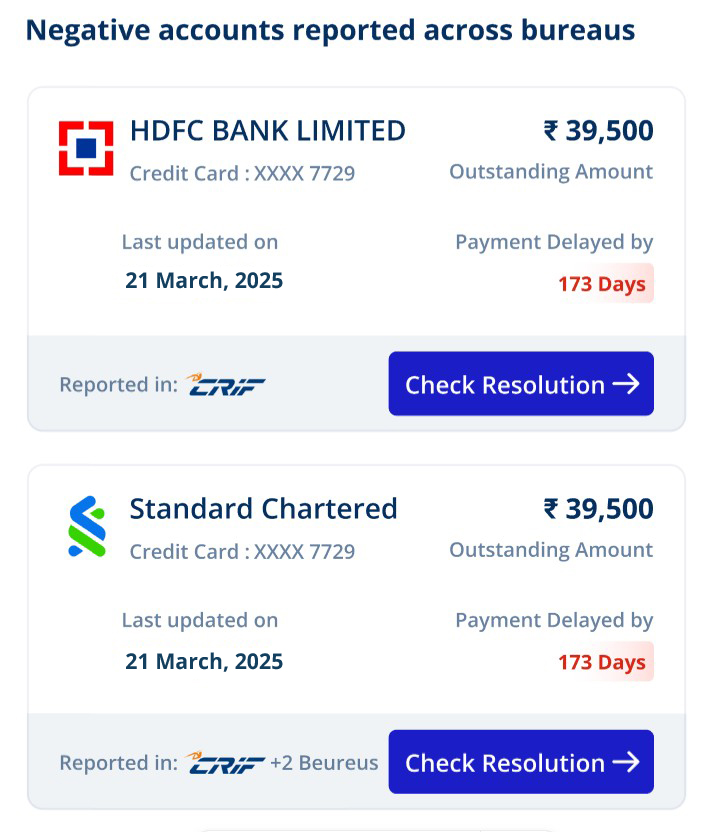

Negative accounts are those accounts in your credit report for which you have faced trouble repaying loan EMIs or credit card bills on time.

Lenders cannot figure out the borrower’s repayment intent, i.e., if a borrower has deliberately missed payments or the payment was missed unknowingly. Thus, both account types would be tagged as negative accounts.

These accounts have the potential to significantly impact your credit score and make it tougher to get loans or credit cards in future.

In addition to these errors, there can be situations where you want to pay the dues but can’t figure out how to do so.

One or more negative accounts in your credit report can have serious implications in future. Here’s how:

Lower Credit Score – Negative accounts indicate your irresponsible credit behaviour and thus a higher credit risk.

This leads to a significant drop in the credit score.

Reduced Creditworthiness – Lenders analyse your credit report to assess the risk of providing you with credit.

Negative accounts in your report reduce your creditworthiness, indicating the risk severity for the repayment. A higher risk makes it harder to get a loan or credit card approval.

Higher Cost of Credit – If there are less severe negative accounts in your report, some lenders might still approve your loan application but the loan terms in such cases are very strict and you may end up paying a high interest on the loan. It increases the overall cost of availing the credit.

Paisabazaar’s Credit+ rectification service caters to all issues related to negative accounts and helps in redressing them at the earliest.

Here, time is a very important factor. As soon as you find errors that have added negative accounts in your report, you can connect with the credit expert and rectify those errors.

It can normally take up to a month for the rectification of errors in your credit report if you follow the correct procedure, but resolution can take months, and your credit score would keep spiralling down in the meantime.

Credit+ Rectification service is available for a user having a low credit score and those who find some error in the credit report. Any/all errors in the credit report can be rectified with the help of credit experts after subscribing to the service.

If you are eligible for this service, you will find a subscription banner on your dashboard.

If your credit score is already high and there are very few chances of improvement, it shows no errors are present in your credit report and you may not find the Credit+ Rectification service on your dashboard. Your high credit score shows that you have handled your credit in a disciplined manner and would be eligible for most of the credit card and loan offers.

Credit advisory and Credit rectification are two components of the Credit+ program that cater to specific issues faced by people having a low credit score.

If your credit score is low because of your indiscipline credit behaviour, Paisabazaar’s Credit advisory service would guide you to take steps to improve your score over time. It may take anywhere from three months to more than a year to improve your score depending upon the severity of your case.

However, if the credit score has fallen due to an error in the credit report without the borrower having made a mistake, you should subscribe to the Credit Rectification Services.

Here, our credit experts would guide you to spot such errors and help resolve them at the earliest with both the lender and the credit bureau. In these cases, you can witness a steep increase in credit score as soon as the error is rectified.

Also Read: How to Improve your Credit Score

Subscribing for Credit+ Rectification Service is a very easy process. You can follow the steps mentioned below to avail this service:

Your subscription starts as soon as you make the payment and you can take the help of our credit expert for credit report rectification immediately.

As soon as you subscribe for the Credit+ Rectification service, a dedicated credit expert is assigned to you. The expert then helps you with the following:

You now have to take steps as per the guidance provided by the expert and resolve them accordingly.

Ans: You can start using the Credit+ rectification as soon as you subscribe to the service.

Ans: If your score is low and you do not know how to improve it even after going through the credit report, you should subscribe to the service and take expert guidance.

Ans: No, your credit score should start improving within (after) a month of taking suggested actions. However, the improvement depends on the severity of each case and the timeline may vary from one case to another.

Ans: Your subscription for Credit+ Rectification shall remain active for 3 months from the day of subscribing the service.

Ans: You can subscribe to the Credit+ Rectification service and take steps as guided by our credit expert to improve your credit score.

Ans: Non-payment of dues on time makes an account negative. Our credit expert will help you identify the correct way to make the repayment and prevent from making the account negative.

Ans: Credit+ Rectification service helps you identify negative accounts through our credit expert and take proper actions. In most cases, issues in the credit report gets resolved during the subscription period and the credit score witnesses a significant improvement.

However, if you do not follow the guidance diligently, you may end up having negative accounts in your report and you may have to subscribe again for resolving fresh negative accounts.