Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

When it comes to credit cards, managing your billing cycle smartly is as important as paying your bills on time. It not only helps you in tracking your expenses but also allows you to improve your cash flow while maximizing overall benefits.

By aligning your purchases according to your billing cycle and payment due date, you can make the most out of your credit card’s interest-free period. Also, as per the RBI guidelines, you can change your credit card billing cycle at least once, which gives you even more control over your payment schedule.

Here is how planning your big-ticket purchases according to your billing cycle can help you maximize savings.

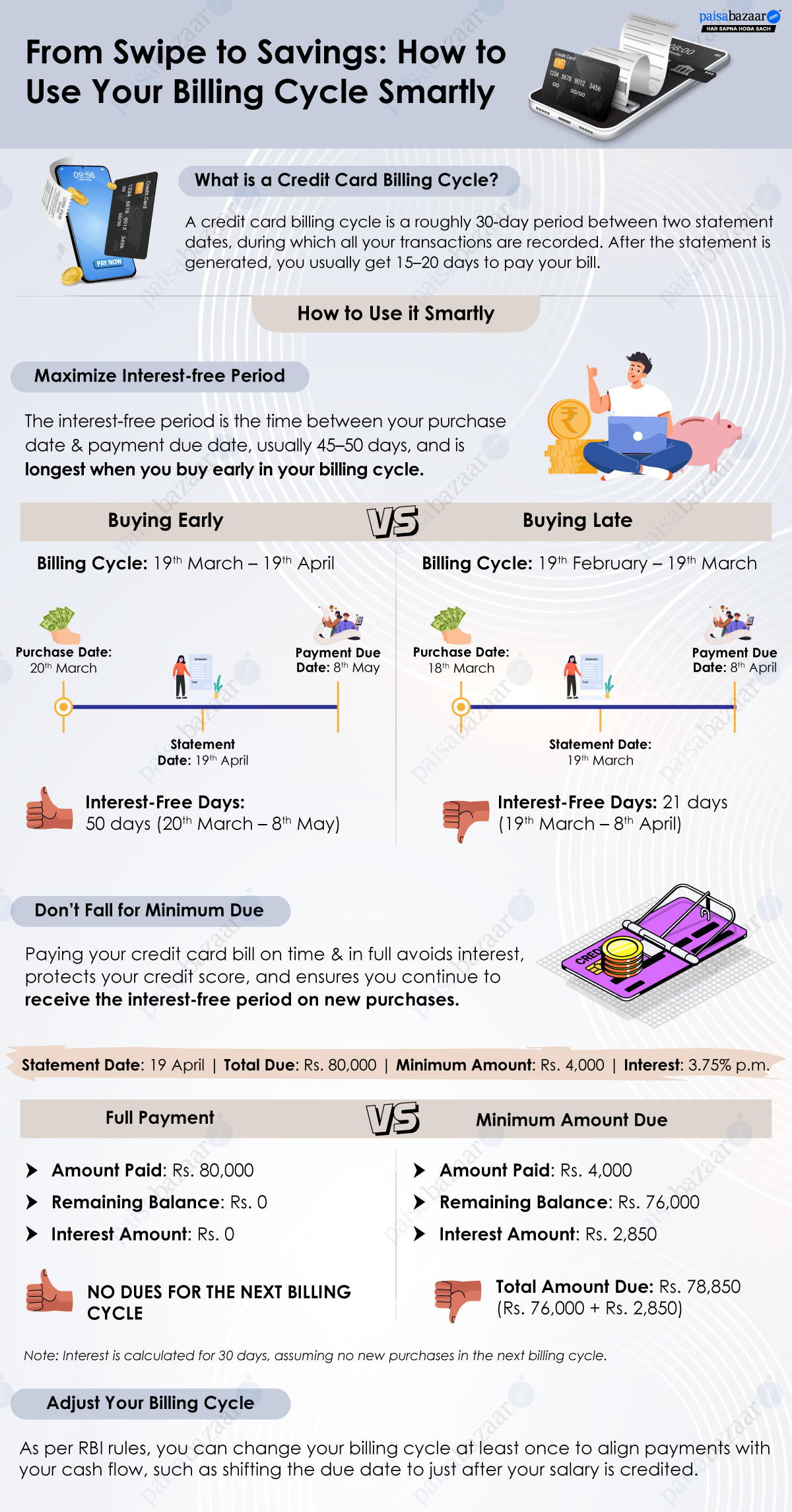

A credit card billing cycle is a time period between two statement generation dates, which is usually around 30 days. For instance, if your billing cycle is from 19th of the previous month to 19th of the current month, then all your transactions made during this period will reflect in your statement generated on 19th. The payments made after this date will be reflected in your statement generated on 19th of the next month. After your credit card statement is generated, you get a payment due date, which usually ranges from 15 to 20 days from the date of statement generation.

A credit card billing cycle starts on the first day of your payment period and ends on the last day of the billing period. During this period, all transactions, including purchases, cash withdrawals or advances and any other charges are reflected in your monthly statement.

At the end of your billing cycle, you receive a credit card statement with the total amount spent during the cycle, minimum amount due, payment due date and any carried-forward balance from the previous month. Once your statement is generated, you get around 15 to 20 days for the bill payment.

Here are a few tips that can help you understand and manage your credit card billing cycle smartly to maximize overall benefits:

The interest-free period is the time between your transaction date and the payment due date. This period typically ranges from 45 to 50 days, depending on your card and billing cycle. If you make a purchase at the start of your billing cycle, you will get the maximum interest-free period to make the bill payment.

For instance, if your credit card bill is generated on 19th of every month and your due date is 8th of the next month. So, if you make a purchase on 20th March, it will be billed in your April statement (generated on 19th April), and you’ll have until 8th May to pay it. This means you’ll get 50 days of interest-free credit period (from 20th March to 8th May).

On the other hand, if you make the same purchase on 18th March, it will appear in your March statement, and you will have only 21 days of interest-free period (from 19th March to 8th April).

As per the Reserve Bank of India (RBI) guidelines, you can change your credit card billing cycle at least once. This allows you to manage your cash flow by aligning your billing cycle to the time when it is easier for you to make payments.

For instance, if you are a salaried person, and your existing card’s billing cycle due date falls at the end of the month, you can change your cycle so that the bill is due at the beginning of the month, which would make it easier for you to manage your monthly cash flow. This way, you can easily manage your card’s bill by paying it at the start of the month when you receive your salary.

If you have multiple credit cards, using the cards smartly according to their billing cycle can help you maximize savings. Each card has its own billing cycle and due date. Therefore, by planning your purchases based on these dates, you can extend your interest-free period.

For instance, if you have two cards: the first one with a billing cycle from 1st May to 30th May with a due date on 20th June, and another one with a billing cycle from 15th May to 14th June with a due date on 4th July. If you want to make two big-ticket purchases in the same month, you can make the first one on the first card just after its cycle starts (on 2nd May) and the other one on the second card after its cycle starts (on 16th May). This way, you will get the maximum interest-free days for both purchases.

Paying your credit card bills timely is one of the major factors that can improve your financial health. Making no payment towards your credit card dues not only attracts high-interest charges, but it can also damage your credit score, as missed payments are recorded in your credit report’s ‘Days Past Due (DPD)’ section.

Moreover, many consumers think that paying only the minimum amount due is enough. However, when you pay the minimum due, interest is levied on the unpaid balance, and all the new purchases also become ineligible for the interest-free period and attract finance charges from the day of making the purchase. Thus, it is important to pay your bills on time and in full to maximize your credit card billing cycle benefits.

By planning your big-ticket purchases, utilizing the interest-free period, and aligning your billing cycle with your cash flow, you can make the most of your card’s benefits. Also, you should always pay your credit card bill on time and in full to avoid high interest charges. Whether you use a single card or multiple cards, understanding your credit card billing cycle can help you extend repayment timelines while managing your expenses smartly.