Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

हिंदी में पढ़े Fixed deposits and mutual funds are two of the popular investment choices. Both options provide investors with promising returns to help them realize their goals well within time. Where fixed deposits offer guaranteed returns at pre-fixed interest rates, mutual fund investments provide variable returns depending upon how the market performs. In this…

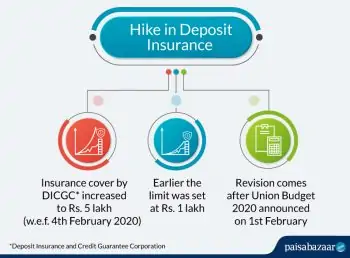

On the 1st of February 2020, Finance Minister Nirmala Sitharaman presented the Union Budget 2020 in the Parliament. In it, an increase in deposit insurance to Rs. 5 lakh was proposed which was earlier set at Rs. 1 lakh for the bank account holders. This revision in the insurance cover came into effect from the 4th of February, 2020. What is…

Fixed Deposits are one of the safest investment options and quite popular in our country among risk-averse investors. FDs are also called term deposits as they are booked for a fixed term which may range from as low as 7 days and can go up to 10 years. Also, fixed deposits provide guaranteed returns at…

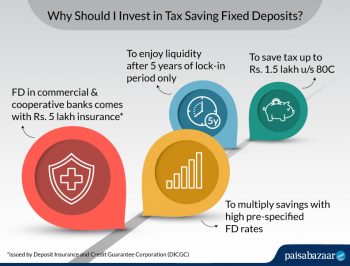

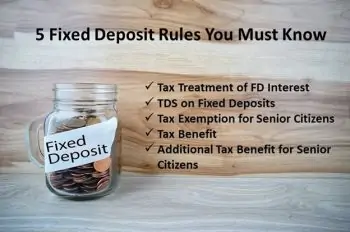

Fixed deposits also known as term deposits are one of the most popular investment instruments in India owing to a number of benefits which they offer. Besides providing for safety of capital and assured returns, fixed deposits also qualify for a tax deduction under Section 80C of the Income Tax Act. Thus, it is both…

For every individual, whether salaried or self-employed, saving money proves to be an essential part of one’s life. Saving money is easier said than done. Every individual aims to save a certain amount of money but end up spending it all. This could lead to several problems in the long run when you will be…

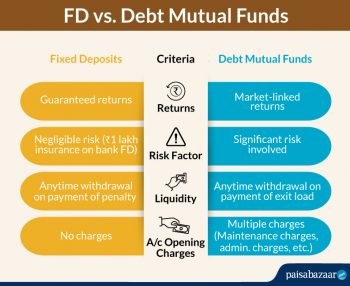

We know about FD, don’t we? But just so that we are on the same page fixed deposits are one of the safest and most consistent saving schemes that guarantee us a fixed percentage of the principal as the return over their tenure. Fixed deposits can be opened by Indian residents, Senior Citizens, and NRIs….