Customers can register themselves for Axis Bank Internet banking to avail various personal loans related services from the bank. The registration process involves the following steps

- Visit the official website of Axis Bank www.axis.bank.in

- Click on ‘Login’ and choose the ‘Register’ link listed under Internet Banking.

- Enter your ‘Login ID’. (Your Customer ID becomes your Login ID. It is mentioned in the welcome letter and cheque book.)

- Keep your Customer ID, account number, debit card and registered mobile number handy before you proceed.

- Enter your Customer ID, registered mobile number and account number and then click on ‘Proceed’.

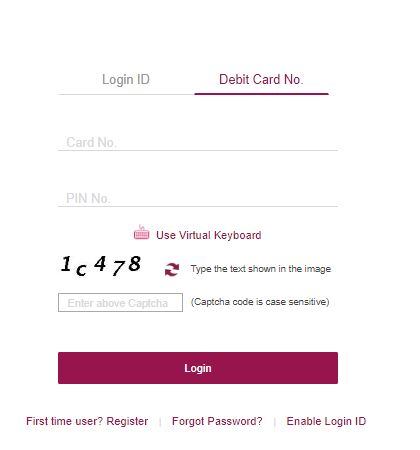

- Enter your 16 digit debit card number, the ATM PIN and expiry date. Under the card currency, choose Indian Rupee - INR option. Accept the terms and conditions and click on ‘Proceed’.

- Enter a login password of your choice keeping the rules in mind and re-enter it to confirm the password. You will receive an OTP on the registered mobile number. Enter the OTP and click on ‘Submit’.

- This completes the Axis Bank Internet Banking registration process. You can now log on to the Axis online banking portal using your login ID and password.

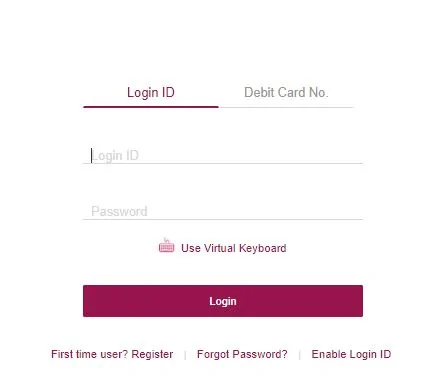

Enter your Login ID and Password and click on ‘Login’ to avail various personal loan related services like checking your loan status, repayment schedule, etc.

Enter your Login ID and Password and click on ‘Login’ to avail various personal loan related services like checking your loan status, repayment schedule, etc. Or

Or