Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Start Income Tax Filing Now

Let’s Get Started

The entered number doesn't seem to be correct

TDS or Tax Deducted at Source is a method of paying tax in India at the point of origin of income as per the Income Tax Act, 1961. The deductor (person, organization or institution) is required to withhold an amount equal to the tax amount from the total earnings payable to the receiver or deductee. It is the responsibility of the deductor to ensure that the tax is correctly deducted and then deposited with the concerned authorities within the stipulated timelines.

While it is commonly assumed that the TDS is applicable only on salary income, but it is also applicable in many other cases such as:

As income is taxable only at the end of the financial year, hence the government has instituted the concept of TDS, in order to ensure:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

TAN or Tax Deduction and Collection Account Number is a ten-digit alphanumeric number issued to individuals or organizations that are required to deduct or collect tax on payments made by them.

Many a times, people assume that PAN and TAN are similar documents and can be used interchangeably. However, TAN is to be obtained separately by people, organizations or institutions that are responsible to deduct tax, even if they have a PAN. The only exception is in the case of a buyer of an immovable property. In this case, the buyer or the deductor is not required to obtain TAN and can use PAN for remitting the TDS.

With the ever-increasing number of taxpayers in the country, digitalization is one of the most important pre-requisites for a speedy, accurate and stable ecosystem.

With effect from 1st January 2014, all corporate and government deductors and other assesses, who are subject to compulsory audit under Section 44AB, are required to use electronic transfer to make TDS payment. To avail of this facility the taxpayer is required to have a net-banking account with an authorized bank. The list is available on the NSDL- TIN website.

Online TDS payment or e-payment is a simple and user friendly process. It can be done by following the below-mentioned steps-

If you face any problem at the NSDL website, you can contact the TIN Call Centre at 020 – 27218080 or write to them at tininfo@nsdl.co.in.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

After depositing the TDS with the Income Tax Department, as per Section 203, the deductor is required to issue a TDS Certificate to the person on behalf of whom the tax payment was made.

The TDS Certificate or Form 16 / Form 16A (as applicable) should be issued on an annual or quarterly basis.

TDS return needs to be filed by the person, organization or institutions, who have deducted tax, on a quarterly basis. As per section 201(1A), interest for delay in the payment of TDS should be paid before filing the TDS return.

There are several forms, based on the nature of deduction:

The TDS returns need to be filed, on a quarterly basis and the due date for the same is 31st of the month after the end of the concerned quarter.

In addition to the interest clause applicable, there are additional provisions for penalty and prosecution proceedings as well.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Delay in filing of TDS returns for more than a year from the due date or submission with incorrect data such as TAN, Challan Number, TDS Amount etc. will attract a minimum penalty of ₹10,000 and not be more than ₹1,00,000.

Assessees can check the TDS payment status online through the online portal of Centralized Processing Cell. Here’s how to do it :

Assessees can check the TDS payment status online through the online portal of Centralized Processing Cell. Here’s how to do it :

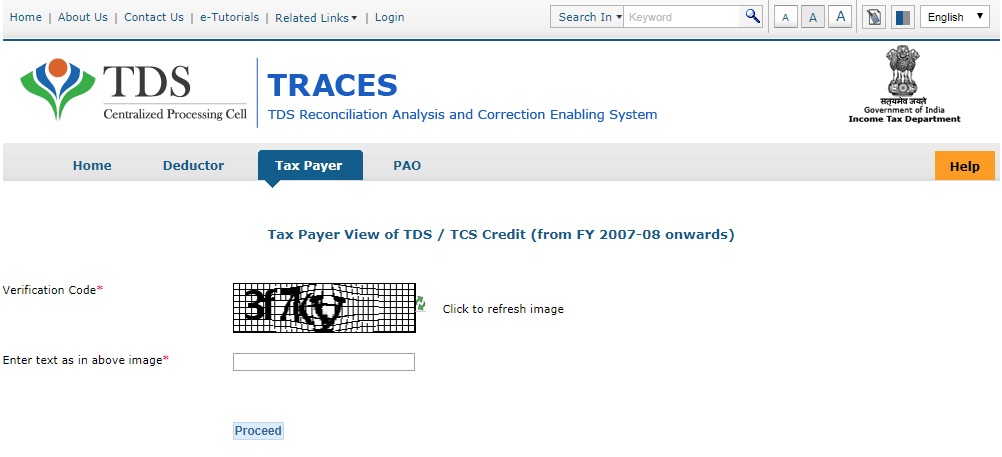

1) Visit TDS CPC website at https://www.tdscpc.gov.in/app/tapn/tdstcscredit.xhtml

2) Enter the captcha code and click on “Proceed”

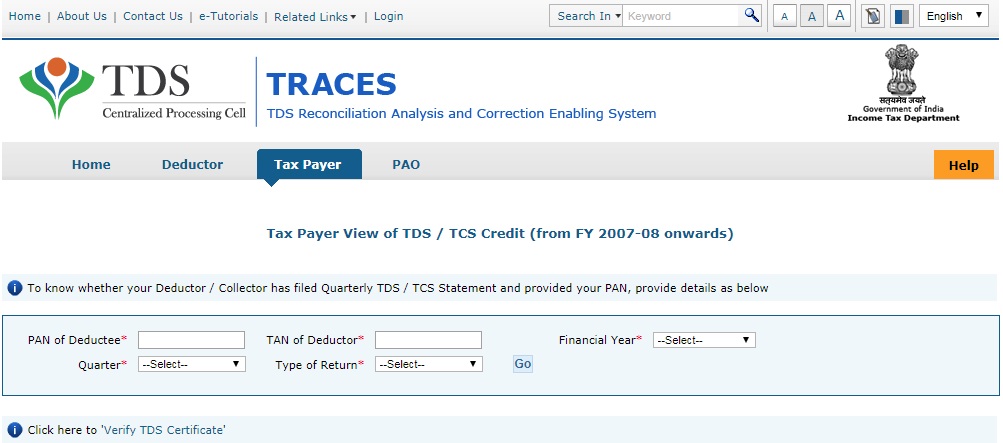

3) Enter details such as PAN of deductee, TAN of deductor, Financial Year, Quarter and Type of Return. Click on “Go” now.

4) TDS credit of the taxpayer is displayed on the screen

The due date for submitting TDS for every month is mentioned in the following table :

| Deduction Month | Quarter End Date | TDS Payment Due Date | Due Date for Filing Returns |

| April | 30th June | 7th May | 31st July |

| May | 7th June | ||

| June | 7th July | ||

| July | 30th September | 7th August | 31st October |

| August | 7th September | ||

| September | 7th October | ||

| October | 31st December | 7th November | 31st January |

| November | 7th December | ||

| December | 7th January | ||

| January | 31st March | 7th February | 31st May |

| February | 7th March | ||

| March | 7th April* |

*Deductors other than government entities can make payments till 30th April.