Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

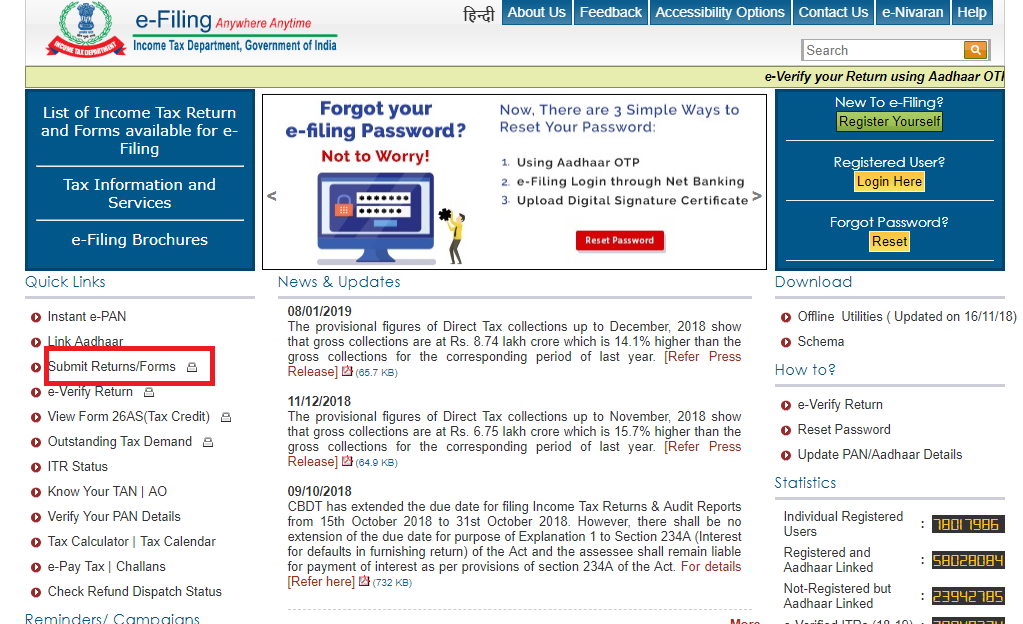

Under the Income Tax Act, 1961, non-profit entities such as charitable trusts, religious organizations, NGOs which are registered under Section 12A are eligible to claim full exemption from income tax. Hence, it is important for all such NGOs, trusts or organization to get registered under section 12A soon after incorporation.

Under existing rules, trusts, societies and other section 8 companies that are formed to provide benefits to the public such as Charitable Trusts, Religious Trusts, Welfare Societies, etc. are eligible for 12A registration. As of yet, the benefit of 12A registration is not applicable to private or family trusts.

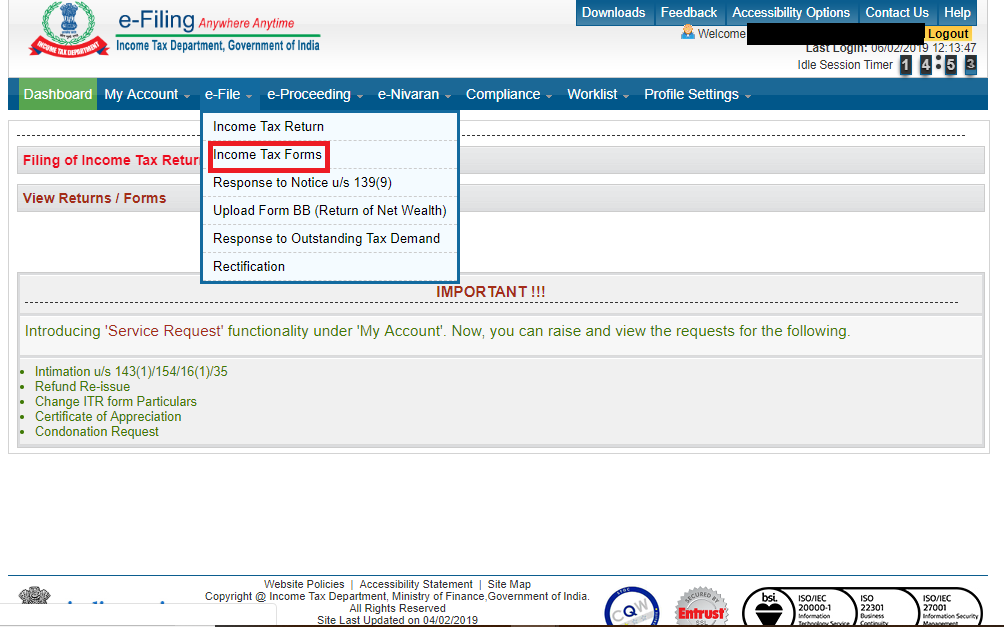

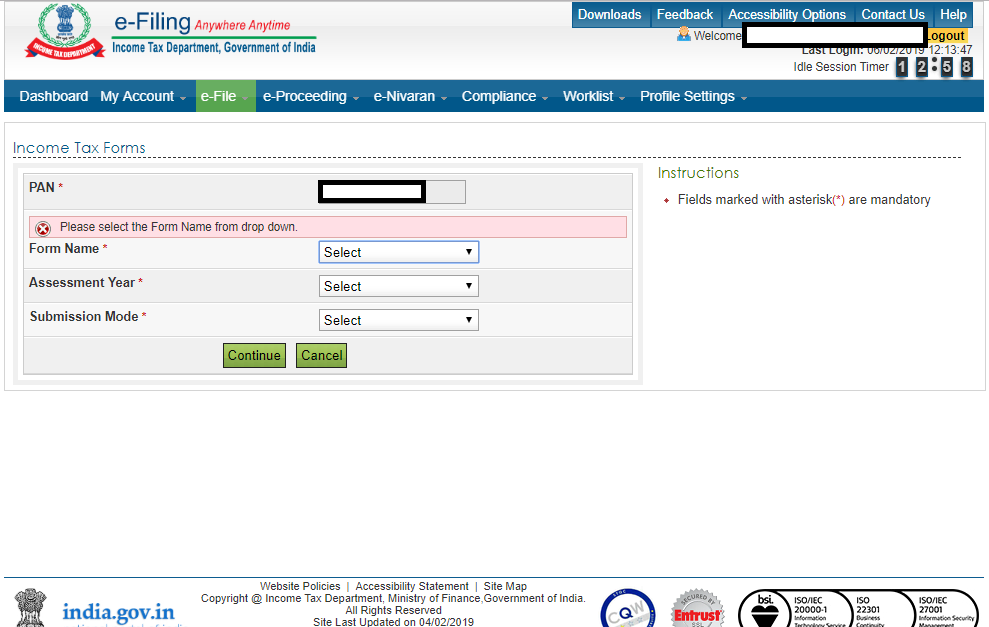

In order to obtain registration under Section 12A, the eligible organization must file Form 10A. Form 10A can be filed online if the applicant has digital signatures. If you are not required to own digital signature to file your income tax return online, you can file Form 10A electronically through electronic verification code. The application for Section 12A registration is officially filed with the jurisdictional Commissioner of Income Tax.

Apart from a completely filled out Form 10A, you must also submit certain key documents while filing for Section 12A registration. The following are key documents that should be furnished while filing Form 10A:

Note: It should be noted that submitting Form 10A to the Income Tax Commissioner does not guarantee that the organization will get registered under Section 12A. On receipt of a 12A application, the commissioner shall examine the case and may demand additional documents, if required. The registration will be granted only when the tax commissioner is satisfied with the supporting documents.