Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) was set up on 28th March, 2020 to deal with any kind of emergency, such as the economic and health distress posed by the COVID-19 outbreak. Individuals and organizations can contribute any amount to this fund in order to help the affected. It should be noted that the Income Tax Act has been accordingly modified so that contributions are eligible for tax benefits under Section 8G (donations). Read this article to understand the tax treatment of donations made to the PM CARES Fund in detail.

Section 80G of the Income Tax Act talks about the tax benefits that you can avail for your contribution towards certain funds and charitable institutions. The amount of claimable tax deduction depends on the type of organization you are donating to. While 100% tax deduction is allowed for contributions made towards some government funds, only 50% tax deduction can be claimed for monetary donations made to some NGOs.

Moreover, there is an upper limit for deduction under section 80G. This limit corresponds to 10% of your gross total income. In other words, you generally cannot claim tax deduction beyond this limit under this section.

However, special provisions have been announced for contributions made to the PM CARES Fund, which are as follows:

Hence, the entire amount you donate to the PM CARES Fund will be tax exempted u/s 80G of the Income Tax Act.

Read More: Section 80G of the Income Tax Act, 1961

Union Budget 2020-21 introduced a completely new alternative Income Tax Regime, where one can take the benefit of significantly reduced slab rates at the cost of major income tax exemptions and deductions. Hence you cannot claim tax benefit under Section 80G of the Income Tax Act under normal circumstances, if you have opted for the new regime.

However in the view of COVID-19 pandemic, the donations made to the PM CARES Fund till 30th June, 2020 will be eligible for tax deduction with respect to the income of FY 2019-20. Hence, both individuals and corporates who have opted for the new regime can claim tax deduction under Section 80G for their income of FY 2019-20 without compromising their eligibility to pay concessional tax for FY 2020-21.

Also Read: Deductions Allowed Under the New Income Tax Regime

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Individuals and organizations can contribute to the PM CARES Fund by following the below steps:

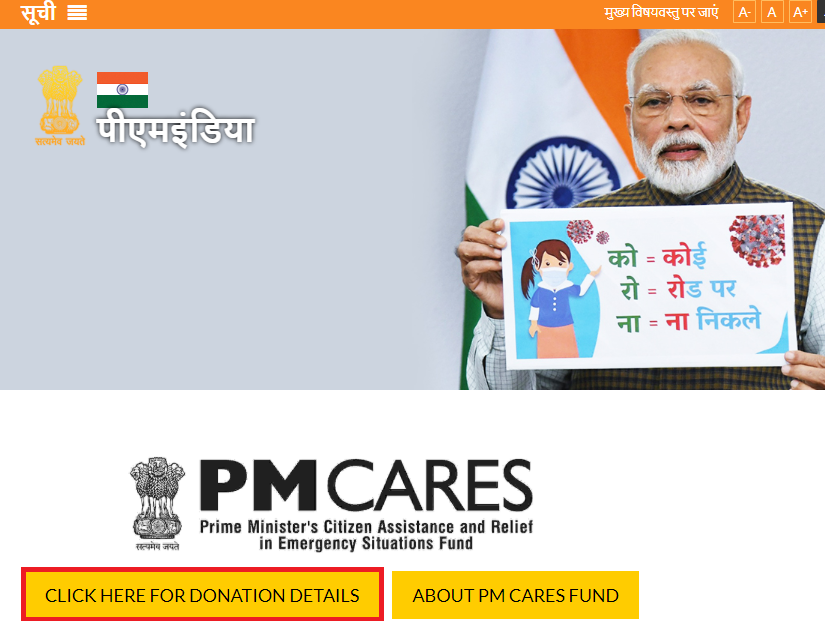

Step 1: Visit the PM CARES Fund website.

Step 2: Click on “Click Here For Donation Details”

Step 3: Click on “Click Here For Online Donation” to make an online donation.

Please note that following are the account details for making donations towards the PM CARES Fund:

Name of the Account: PM CARES

Account Number: 2121PM20202

IFSC Code: SBIN0000691

SWIFT Code: SBININBB104

Name of Bank & Branch: State Bank of India, New Delhi Main Branch

UPI ID: pmcares@sbi

You can use the following modes of payment to contribute towards the PM CARES Fund:

Your donation to the PM CARES Fund will be completely exempted from tax with no upper limited u/s 80G of the Income Tax Act. In FY 2019-20 this is also applicable for those, who have opted for the new regime in FY 2020-2021 (for contributions made till June 30th 2020)). This has been done to provide assistance for creating and upgrading health care and pharmaceutical facilities in this difficult time. Additionally, the donations will be used to financially assist the affected and grant payment wherever necessary to combat various emergency situations such as the current COVID19 crisis.