Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

600 or 750? What's your credit

score? Check for FREE.

Let’s Get Started

The entered number doesn't seem to be correct

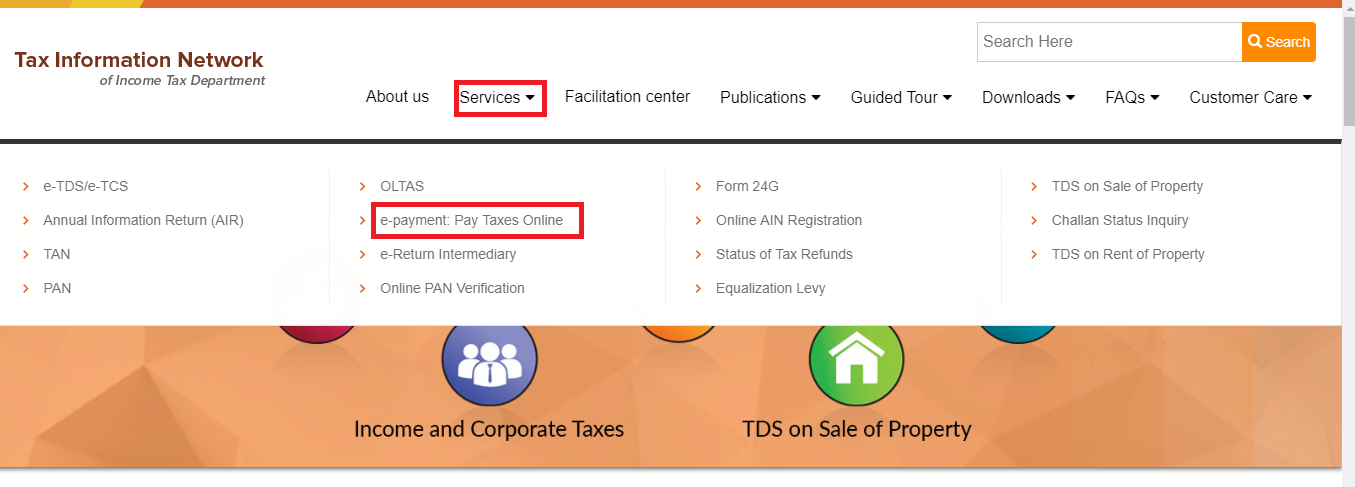

In case you are planning to file your returns during the current assessment year, you have to mandatory pay your income tax dues as per the applicable Income Tax Act, 1961 rules. Currently, you have the option of making your Income Tax payment via either the online route or the offline route. The following is a step by step guide for paying income tax online on the TIN website managed by the Income Tax Department.

| Points to be noted before making online tax payment |

|

Table of Contents :

In case you have still missed out saving a copy of the receipt, you can retrieve it by logging in to your net banking account.

Also Read: How to Pay Income Tax Online using UMANG App

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Many leading public and private sector banks in India are allowing their existing banking customers to pay their income tax dues online through their Internet Banking interface. Typically, this service can be accessed under the “Tax Services” menu after you have logged into your online banking account. The subsequent steps include selecting the correct payee type (individual/corporation) and challan in order to pay the due income tax. The following are some of the top banks for making online income tax payments through Internet Banking on the TIN website:

| State Bank of India | Punjab National Bank |

| Axis Bank | ICICI Bank |

| Union Bank of India | Bank of Baroda |

| HDFC Bank | Federal Bank |

| Canara Bank | Indian Overseas Bank and many other |

While the online income tax payment process is definitely more convenient and can be completed from the convenience of one’s home or office, offline payment of income tax dues is also possible. Under the existing system, offline payment of due income tax can be completed using the applicable challans through specific bank branches as notified by the Income Tax Department.

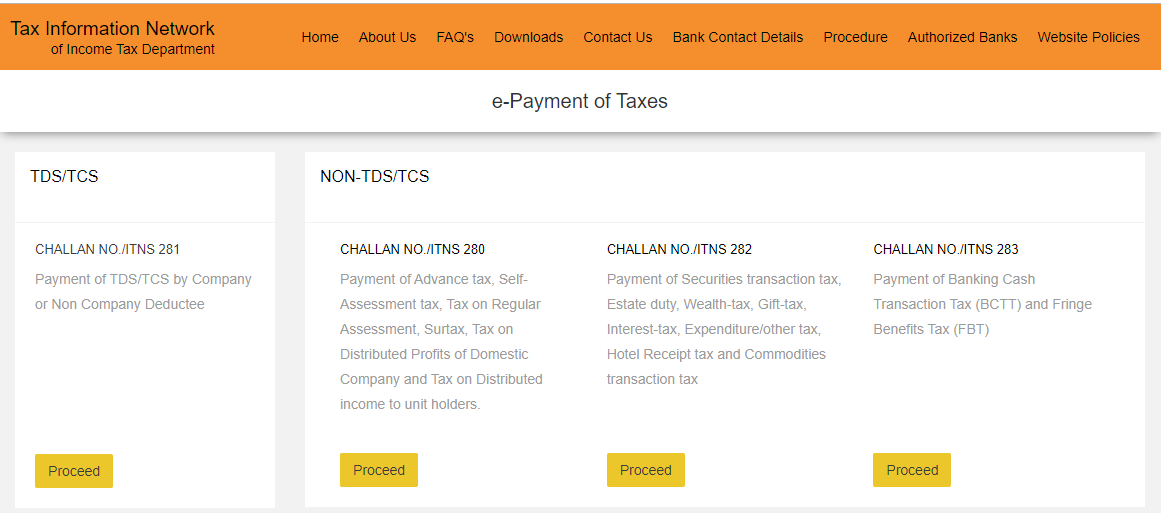

The following is a list of challans listed on the TIN website for payment of income tax and their applicability for making income tax payments online or offline.

| Challan Number | When to use |

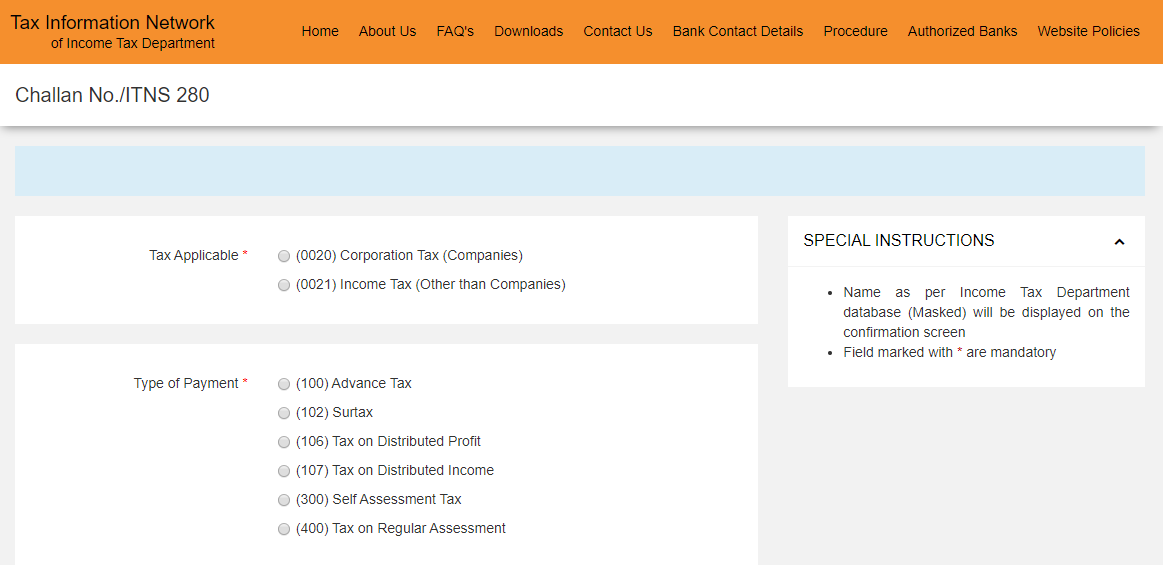

| INTS 280 (Challan 280) | For regular assessment tax, self-assessment tax, advance tax, etc. payment |

| INTS 281 (Challan 281) | For TCS/TDS payment by individual or company deductee. |

| INTS 282 (Challan 282) | For wealth tax, gift tax, securities transaction tax, estate duty, etc. payment |

| INTS 283 (Challan 283) | For Fringe Benefits Tax and Banking Cash Transaction Tax (BCTT) payment. |

| INTS 285 (Challan 285) | For payment of equalisation levy. |

| INTS 286 (Challan 286) | For payment of due income tax under Income Declaration Scheme, 2016. |

| INTS 287 (Challan 287) | For payment of tax under Pradhan Mantri Garib Kalyan Yojana, 2016 scheme. |

Always remember to furnish the details of the income tax paid by you in the income tax return filed later. By forgetting to do so, you will end up filing a return with a default because of which you can end up getting a notice from the I-T department.

The Government of India uses a part of your income in the form of income tax for the development of the country. There are three types of taxes collected from your income by the government. They are:

Tax Deducted at Source (TDS): According to the I-T laws, an employer, who provides an income to the employee, deducts a part of the salary before giving it to the employee and then pays it to the government. This is TDS. This move helps the government keep a check on tax evasion.

Advance Tax: When the estimation and payment of tax is done before the end of the financial year, it is called advance tax. This is also called ‘pay as you earn tax.’ This payment can be done in installments according to the due dates given by the government. One needs to pay advance tax if the tax liability is over Rs 10,000. However, for a salaried employee, this is not necessary as tax is deducted form his income every month. However, if you are a freelancer, or if you are running a business, or if you have incomes other than salary such as capital gains, you will be required to make payment of advance taxes. This can be done by making an income tax online payment.

|

Dates to pay Advance Tax |

|

| Dates | Payable advance tax |

| On or before 15th June | Up to 15% tax |

| On or before 15th September | Up to 45% of tax |

| On or before 15th December | Up to 75% of tax |

| On or before 15th March | Up to 100% of tax |

Self-assessment Tax: This tax is calculated by the taxpayer and is the balance tax paid by the taxpayer on the assessed income after taking the TDS and advance tax into account. One needs to clear all outstanding tax in order to file an income tax return. The self-assessment tax is usually subject to interest under section 234 B and 234 C.

Assessees who can pay their income tax online via the TIN website using various challans can be classified into two broad categories as follows:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The following are the key benefits of making income tax payments online:

Easy online verification of tax payments any time of the day