Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Start Income Tax Filing Now

Let’s Get Started

The entered number doesn't seem to be correct

Income Certificate is an official document issued by the state government certifying annual income details of the applicant/applicant’s family. The key information in this certificate includes details of the annual income of the family/individual from various sources as per available state government records for a specific financial year.

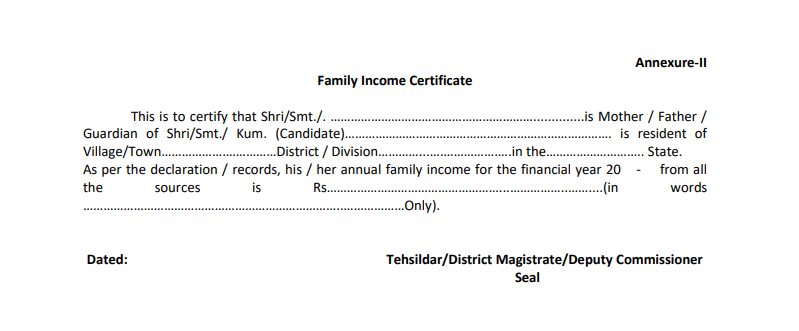

The following is a sample of an Income Certificate format. You can also download the income certificate format from the AICTE website.

Key Information in the Income Certificate Form

Key Information in the Income Certificate FormAs shown in the above sample, the key fields included in the income certificate form are as follows:

The details provided in this state government issued certificate are legally binding and may be used as income proof by the applicant (family/individual) when registering/applying for various Government-sponsored schemes and subsidies. Some of the common uses of the certificate are:

Income Certificate is issued by individual State Governments/Union Territories and each has its unique set of documentation requirements. Any individual who is resident of India and belongs to an economically weaker section of society and not required to pay income tax can apply for an income certificate with the applicable State Government/Union Territory.

The complete list of documents required for obtaining the certificate may vary slightly from one state to another. That said, few key documents are the same irrespective of the state in which the income certificate application is made. The following is a short list of key documents required for obtaining the certificate:

Additional documents such as expenditure proof may also need to be submitted depending on the individual requirement as provided by the state government/union territory.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

The validity of income certificate is based on the financial year mentioned in document. Thus the certificate needs to be updated every financial year in order to ensure validity. Also the old certificate may need to be provided as a key documentary proof required for issue of an updated income certificate.

Q- What is the validity of my income certificate?

Ans – The certificate is valid for only the financial year in which it was issued. So at most the validity of your income certificate is 1 year i.e. from the start of the fiscal on 1st April to its end on 31st March of the subsequent calendar year.

Q- Do I need Aadhaar card to apply for an income certificate?

Ans- No. Any government-issued identity/address proof (including Aadhaar) can be used as supporting documents when applying for this document. Some common examples of such government issued ID include PAN, Voter ID card, Ration Card, etc.

Q- I am a resident of Delhi. Can I get an income certificate in Haryana?

Ans – No. An income certificate is issued by the state government so it can only be obtained from the government of the state where you reside. Thus only a resident of Haryana can obtain an income certificate in Haryana. To ensure this, one of the documents needed to apply for an income certificate online or offline is a copy of a government-issued address proof with a local residential address.

Q- My income certificate application was rejected last time. Should I reapply?

Ans- The most common reasons for rejection of an income certificate application are – incorrectly filling out the application, non-submission of documents supporting the application request and ineligibility for availing income certificate. While you can definitely consider reapplying if the reason for rejection of your application is one of the first two, it would not be good idea to reapply if you are ineligible to get approval for an income certificate in the first place.

Q- I received my income certificate in 2017. Do I need to keep the old certificate to reapply?

Ans – No, it is not mandatory to submit the old certificate at the time of applying for a new one. However, it is necessary to hold on to old certificates for a period of 5 years after it has been issued in order to validate your eligibility for any and all schemes you using the certificate at a later date.

Q- Is an income certificate and agriculture income certificate the same thing?

Ans – No. This certificate includes details of annual income for all sources, while an agriculture income certificate only contains details of income obtained as a result of involvement in any and all agricultural activities.