Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Did you receive an Income Tax notice and are wondering how to respond to it? Or maybe you are wondering what an income tax notice is? Or perhaps you want to know when is an income tax notice is issued? Don’t worry we got you covered. Read on to find answers to the above questions and know what you should do after getting an IT notice.

Table of Contents :

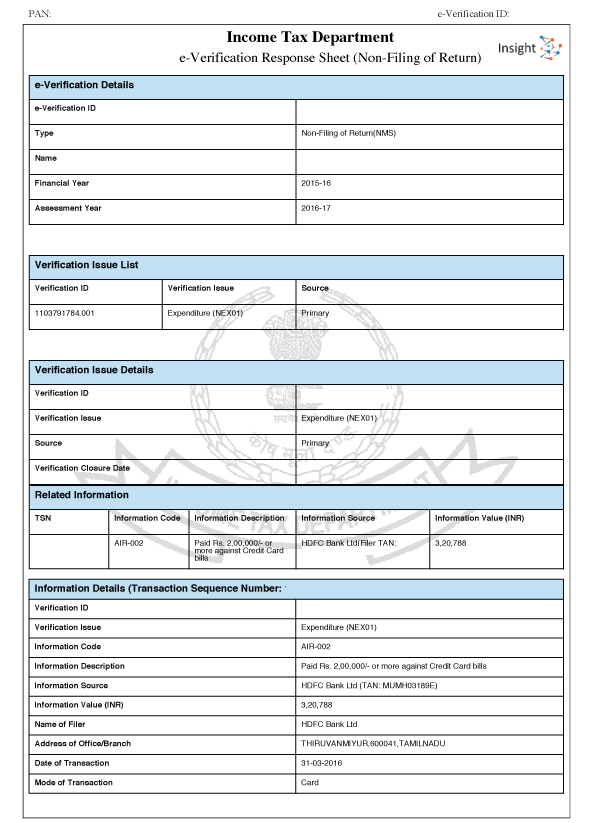

Following is a sample image of an online Income Tax Notice issued for ‘Non-Filing of Return’.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

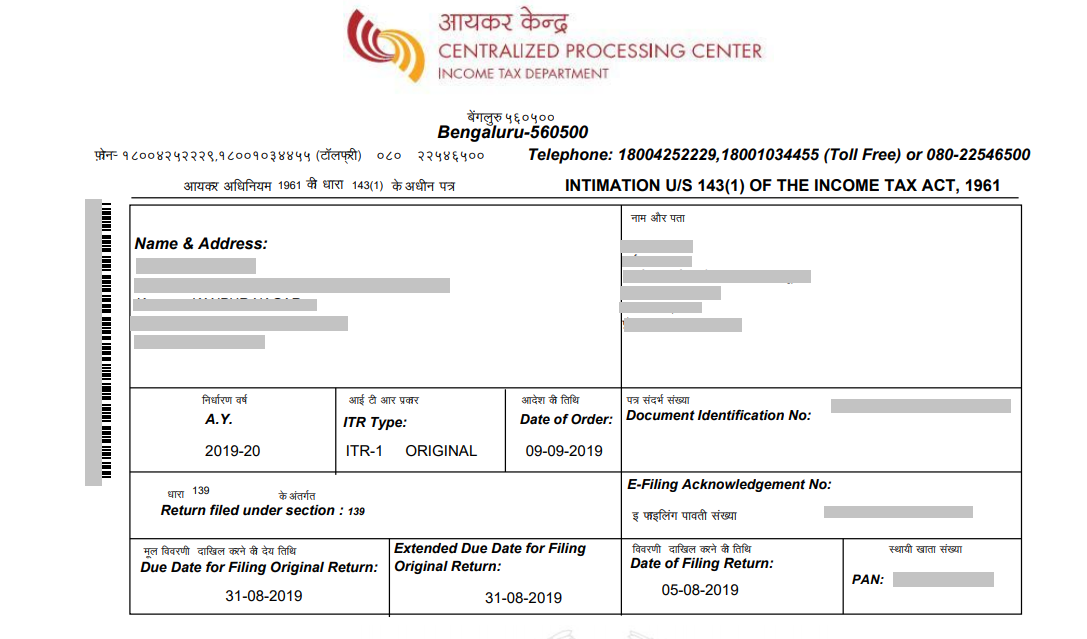

Following is an illustrative example of an income tax notice of ‘intimation sent under section 143(1) of the Income Tax Act’.

What is an Income Tax Notice

What is an Income Tax NoticeIncome tax notice is a legal document using which the Income Tax Department communicates with the taxpayers. It can be just an intimation or a demand for further information, tax payment, etc. Getting an income tax notice does not always indicate trouble for the receiver. It can also be issued to provide details regarding the refund any excess tax paid by you or to request submission of some additional documents. Thus, it is important to understand why an income tax notice has been issued in the first place.

Read more: Income Tax in India – Tax Guide, Types & ITR Filing

Income tax notices can be issued for various reasons under different sections of the Income Tax Act. Following is a short list of the major reasons you might receive an income tax notice:

An Income Tax Notice under 142(1) section is issued in the following cases:

Consequences

Missing the ITR filing deadline can lead to the following penalties:

| Late ITR filing fee as per Section 234F (for FY 2022-23) | ||

| ITR filing date | Total annual income (Rs.) | |

| Below 5 lakh | Above 5 lakh | |

| On or before due date (officially 31st July) | NIL | NIL |

| After due date 31st December 2023 | Rs. 1,000 | Rs. 5,000 |

| From 1st January to 31st March 2024 | Rs. 1,000 | Rs. 10,000 |

Read more about late ITR filing penalties

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Intimation under section 143(1) is issued in the following 3 cases:

This notice is sent by the Income Tax Department when the ITR filed by you is randomly picked for scrutiny to check for tax compliance. The department checks for the following:

This notice is issued within 6 months of completion of the assessment year to which the notice pertains. Further, applicable penalties can be instituted after the scrutiny.

This notice is issued when any income has escaped assessment. In other words, this notice is issued when according to the Assessing Officer you did not correctly disclose your income, and thus paid lower taxes. In this case, the Assessing Officer generally recomputes/reassesses the ITR. If any discrepancy is found after the reassessment, relevant penalties will be applicable.

This notice is issued when a tax refund payable to a taxpayer by the Income Tax Department is used to set off any previous tax dues. Hence, if you have pending tax liability as well as a tax refund, then you will not be credited the refund amount. Rather the refund shall be used to adjust the dues. Such an adjustment is made after a written intimation of the proposed action to the taxpayer under this section.

This notice is issued in case of a defective return. Under this section, the assessee has an opportunity to rectify the defect within 15 days from the date of intimation. If the assessee fails to rectify the defect within the specified time period, the filed return will be considered invalid. Hence, failing to rectify the defective return within 15 days of intimation will be treated as the same as not filing ITR at all.

Note: If the assessee rectifies the defect after the expiry of the said period of 15 days, but before the assessment is made, the Assessing Officer may condone the delay and treat the return as a valid return.

This notice is issued when the income is either concealed or likely to be concealed. It is to inform that the Assessing Officer has initiated an enquiry and may ask the assessee to produce the books of account and other related documents.

The Assessing Office under this section has the following powers:

Get FREE Credit Report from Multiple Credit Bureaus Check Now

An income tax notice under this section refers to the ‘Notice of Demand’. It is issued when the assessee has outstanding tax, interest, penalty, fine or any other outstanding sum payable to the Income Tax Department. Such an outstanding payment has to be made by the assessee within the specified time to avoid any penalties.

Stay calm and carefully verify the details. Understand the cause for the issuance of the notice and take the necessary steps. Please note that you should never ignore an IT notice. If you are not sure of handling the matter by yourself, take help from a chartered accountant or a tax expert.

Furthermore, take a note of the following points to avoid any legal consequences: